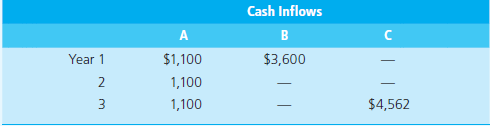

A firm has the following investment alternatives (refer to image): Each investment costs $3,000; investments B and C are mutually exclusive, and the firm’s cost of capital is 8 percent. a.) What is the net present value of each investment? b.) According to the net present values, which investment(s) should the firm make? Why? c.) What is the internal rate of return on each investment?

A firm has the following investment alternatives (refer to image): Each investment costs $3,000; investments B and C are mutually exclusive, and the firm’s cost of capital is 8 percent. a.) What is the net present value of each investment? b.) According to the net present values, which investment(s) should the firm make? Why? c.) What is the internal rate of return on each investment?

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter13: Statement Of Cash Flows

Section: Chapter Questions

Problem 13.3APR

Related questions

Question

100%

A firm has the following investment alternatives (refer to image):

Each investment costs $3,000; investments B and C are mutually exclusive, and the firm’s cost of capital is 8 percent.

a.) What is the

b.) According to the net present values, which investment(s) should the firm make? Why?

c.) What is the

Transcribed Image Text:Cash Inflows

A

B

Year 1

$1,100

$3,600

2

1,100

3

1,100

$4,562

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning