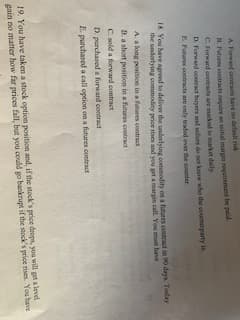

A Forwand contracts have no defalt risk B Futures contracts roquire an initial margin requirement be paid. c Forward contracts are markod to market daily- D. Forward contract buyers and sellers do not know who the counterparty iS E. Fuures contracts are caly traded over the counter 18. You have agreed to deliver the underlying conmmodity on a futures contract in 90 days. Today the underlying commodity peice rises and you get a margin call. You must have A. a long position in a fatures contract B. a short position in a futures contract C. sold a forward contract D. purchased a forward contract E purchased a call option on a futures contract 19. You have taken a stock option position and, if the stock's price drops, you will get a level gain no matter how far prices fall, but you could go bankrupt if the stock's price rises. You have

A Forwand contracts have no defalt risk B Futures contracts roquire an initial margin requirement be paid. c Forward contracts are markod to market daily- D. Forward contract buyers and sellers do not know who the counterparty iS E. Fuures contracts are caly traded over the counter 18. You have agreed to deliver the underlying conmmodity on a futures contract in 90 days. Today the underlying commodity peice rises and you get a margin call. You must have A. a long position in a fatures contract B. a short position in a futures contract C. sold a forward contract D. purchased a forward contract E purchased a call option on a futures contract 19. You have taken a stock option position and, if the stock's price drops, you will get a level gain no matter how far prices fall, but you could go bankrupt if the stock's price rises. You have

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

Transcribed Image Text:A Forwand contracts have no defalt risk

B Futures contracts roquire an initial margin requirement be paid.

c Forward contracts are markod to market daily-

D. Forward contract buyers and sellers do not know who the counterparty iS

E. Fuures contracts are caly traded over the counter

18. You have agreed to deliver the underlying conmmodity on a futures contract in 90 days. Today

the underlying commodity peice rises and you get a margin call. You must have

A. a long position in a fatures contract

B. a short position in a futures contract

C. sold a forward contract

D. purchased a forward contract

E purchased a call option on a futures contract

19. You have taken a stock option position and, if the stock's price drops, you will get a level

gain no matter how far prices fall, but you could go bankrupt if the stock's price rises. You have

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education