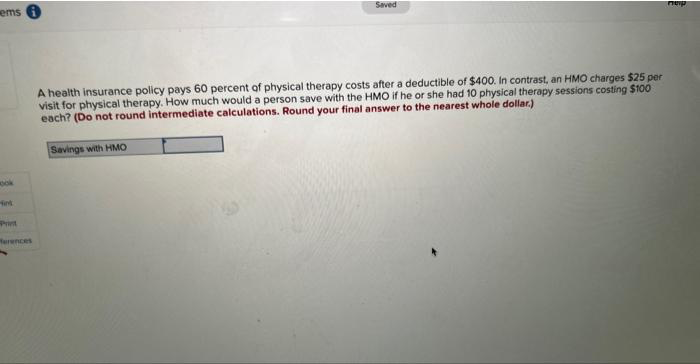

A health insurance policy pays 60 percent of physical therapy costs after a deductible of $400. In contrast, an HMO charges $25 per visit for physical therapy. How much would a person save with the HMO if he or she had 10 physical therapy sessions costing $100 each? (Do not round intermediate calculations. Round your final answer to the nearest whole dollar) Savings with HMO

Q: How long will it take to build up a fund of $10,000 by saving $300 at the beginning of every six…

A: An annuity is a financial product that provides a stream of income payments at fixed intervals,…

Q: Suppose you are considering two possible investment opportunities: a 12-year Treasury bond and a…

A: Different risk components of a bond have different risk premia. The information has been provided on…

Q: A car is purchased for $25,500. After each year, the resale value decreases by 30%. What will the…

A: Information Provided: Purchase price = $25,500 Decrease in value each year = 30% Period = 5 years…

Q: How can organizations meet the special needs of different groups (e.g., work and family issues)…

A: Favoritism refers to offering special treatment to a few employees that are close to higher…

Q: Bird Wing Bedding can lease an asset for 4 years with payments of $22,000 due at the beginning of…

A: The cost of leasing refers to the total expense incurred by a company or individual when leasing an…

Q: A perceptive engineer started saving for her retirement 15 years ago by deligently saving Php 18 000…

A: Using the concepts of time value of money, we can solve for this question. Time value of money…

Q: A company has two investment opportunities. Alternative 1 (Alt. 1) pays $8,000 (inflow) two years…

A: A financial tenet known as the time value of money holds that a dollar's value today is greater than…

Q: Question 5 On the basis of the data provided at question 3, what is your expected NPV if you invest…

A: In question 5 , on the basis of data provided in the question 3, expected NPV if you invest $150 mi…

Q: Your company has just successfully completed some R&D work that leads you to expect that its…

A: We will first have to find the dividends for the years 1, 2 and 3. Then use the dividend at year 3…

Q: After paying premiums for 24 years, Chad forgot to pay his 25th year annual premium due on January…

A: Insurance policy: A contract between an insurance company and a policyholder that provides financial…

Q: What is the delta hedge (number of options) for call options with a strike of $71.85 required to…

A: Delta is the ratio of the change in the price of an option to the change in the price of the…

Q: How can a Company Show Positive Net Income but go Bankrupt? What does Working Capital Mean? Why do…

A: Kindly find the answers to you question below :

Q: Financial institution risk management participation. Please provide instances and hypotheticals in…

A: Financial institution risk management is an essential function that helps banks, insurance…

Q: 7. Abenah invests $15000 and gets an interest at a rate of 3.5%, compounded biweekly. a) Write an…

A: Data given: P=$ 15000 Rate=3.5% (compounded biweekly) Biweekly=52/2 =26

Q: 1. Calculate the standard deviation of both service providers and interpret which share carries the…

A: To calculate the standard deviation of the two service providers, we need to calculate the variance…

Q: Which of the following statements is correct? A firm has a greater likelihood of needing an…

A: The following statement is correct

Q: Bond J has a coupon rate of 4.2 percent. Bond K has a coupon rate of 14.2 percent. Both bonds have…

A: Bond J Compound = semiannually = 2 Coupon rate = 4.2 / 2 = 2.1% Time = t = 10 * 2 = 20 semiannually…

Q: The current price of a stock is $80.24. If dividends are expected to be $1.00 per share for the next…

A: The price of stock refers to the price at which the securities can be bought or sold in the stock…

Q: EVALUATING RISK AND RETURN Bartman Industries's and Reynolds Inc.'s stock prices and dividends,…

A: Any stock's return indicates the yield earned from the investment in a stock over a period of time.…

Q: What is the effective cost of this loan if you pay it off at the end of year 2?

A: The effective cost of an Adjustable Rate Mortgage (ARM) if it is paid off at the end of year 2. An…

Q: Part I: Define the following terms (35-40 words) Q1. USPAP Q2. Transaction Price

A: The question asks for definitions of two terms: USPAP and transaction price. USPAP is a set of…

Q: Compare the alternatives below using present worth analysis at MARR 10% per year and a 3-year study…

A: It is a problem that requires the application of the net present value method to compare two…

Q: Company A sells a machine to Company B on September 1 for $27,000. The down payment to be paid by…

A: A loan is an agreement between a lender and a borrower where the lender provides the borrower with a…

Q: Construction industry stakeholders can manipulate unit price contracts to unbalance the bid. Explain…

A: Unit price contracts are a type of construction contract where the owner agrees to pay the…

Q: You buy furniture for 5400. You pay 300 down the remainder is financed in 36 100 monthly payments.…

A: Furniture price = 5400 Down payment = 300 Number of payment = nper = 36 Monthly payment = pmt = 100

Q: You own $107,000 worth of Smart Money stock. One year from now, you will receive a dividend of $2.95…

A: A share price refers to the stock price of a particular company. Investors invest in a particular…

Q: Share Price $ 20.00 EPS $ 3.00 Shares outstanding (million) 10 Book Value $ 25.00 If the company…

A: A share repurchase, also known as a stock buyback, is a process in which a company buys back its own…

Q: DDY Ltd currently does not pay a dividend to its shareholders but equity analysts expect that the…

A: Share price refers to the amount which is used for trading the shares between the buyers and sellers…

Q: Treasury bills are currently paying 7 percent and the inflation rate is 3.8 percent. What is the…

A: Approximate real rate of return = Nominal rate-Inflation rate Exact real rate of return = (1+Nominal…

Q: A 10-year maturity bond with par value $1,000 makes semiannual coupon payments at a coupon rate of…

A: All the characteristics of a bond are known. The bond equivalent yield and the effective annual…

Q: What are the total finance charges over that four-year period

A: The finance charges are the interest payments made over the period of time of loan payments and…

Q: An investor holds 700,000 shares in Didi & Co. and is considering buying some put options to hedge…

A: a) To calculate the value of the put options, we can use the Black-Scholes formula: Put option value…

Q: A ten-year, zero-coupon bond with a yield to maturity of 6.9% has a face value of $5,000. An…

A: Given: YTM of zero coupon bond = 6.9% Face value = $5,000 Years to maturity, n = 10 years The…

Q: The following data is provided for a PPP project. Benefits Disbenefits To the People $115,000 per…

A: This problem will use the conventional benefit-cost ratio method to solve it. If the value of the…

Q: Bond J has a coupon rate of 4.6 percent. Bond K has a coupon rate of 14.6 percent. Both bonds have…

A: Bonds are debt instruments that a company issues to raise capital from investors. It pays back the…

Q: Consider a stock with current price S0 = 29 per share. A european call option on this stock that…

A: A call option gives the right but not the obligation to buy at the strike price. In this question,…

Q: How much will the coupon payments be of a 20 -year $500 bond with a 10% coupon rate and…

A: A coupon bond is a type of debt security that pays periodic interest payments (known as coupon…

Q: mes (28) and Nadine (27) is a young married couple, with 2 children, ages 4 and 2 years old. Both…

A: The young couple James and Nadine , with two children , ages 4 and 2 Years old . Both are working…

Q: Find the interest on a loan of $3300 at 7% if I borrow on April 7 and repay on June 2 using the…

A: Exact Time measures 365 days in a yearOrdinary Time measures 360 days in a yearBanker's rule…

Q: A company provided the following information: ROA= 15% Financial Leverage Ratio 1.8 What is the…

A: Given: Return on assets (ROA) = 15% Financial leverage ratio = 1.8

Q: Sarah the Company Secretary of Beta Plc, The company is a non-listed public company. She seeks your…

A: Companies issue shares to the general public to raise funds to support business expansionary…

Q: Calculate the Price-to-Revenue transaction price is $550,000,000 660.500 0.200 Ratio for the…

A: Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Discuss how ross's condition be made better off without harming rosa

A: Introduction: Ross’s condition can be improved without harming Rosa if the appropriate steps are…

Q: On April 1, Hilda made a $3410 deposit to open a savings account paying 3.5 % compounded daily. She…

A: Interest earned refers to the amount to be earned on the deposited amount over a period of time by…

Q: You and your spouse are in good health and have reasonably secure jobs. Each of you makes about…

A: DINK refers to double income, no kids category of insured. In this time of insurance category, both…

Q: You pay a visit to your local payday loan company and you need to borrow £1000 for 1 week. They…

A: weekly Amount borrowed = £1000 Finance charge rate = 10% Number of week in a year = n = 52.1429

Q: An investment of x dollar is made at the end of each year for three years, at an interest rate of 9%…

A: Future value of an annuity is the value of a series of equal payments made at regular intervals,…

Q: A bank has DA = 2.4 years and DL= 0.9 years. The bank has total equity of $82 million and total…

A: Equity refers to the share of ownership of the assets of the company after paying off all the…

Q: The margin on an adjustable-rate mortgage is 2.5% and the rate cap is 5% over the life of the loan.…

A: An adjustable-rate mortgage is a loan in which the interest rate on the loan keeps on fluctuating.…

Q: salvage provide the following expected forecasts: Sales $5,000,000 Variable expenses $3,000,000…

A: The NPV of a project refers to the profitability of the project after considering the PV of cash…

Do

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Health insurance policy pays 65% of physical therapy cost after deductible of $200. In contrast HMO charges $15 per visit. How much person save with HMO if she had 10 Physical therapy s$50 each?You have a policy with a $1,000 deductible, 80/20 co-insurance, and a $7,500 maximum OOP. You become ill and are hospitalized for two days. The total cost for your treatment is $26,000. Answer the following questions. How much will you pay of the deductible? How much will you pay in co-insurance? What is the total OOP you will pay for this hospital visit? During the same policy year, you have an additional medical expense of $3,500. How much will you pay? What is your total OOP for the year-to-date? Later in the same policy year, you have a $5,000 charge for tests required after your previous hospital stay. How much will you payC.J Watson of Clemson, SC, recently had a surgery. His total bill for the surgery, which was his only health care expense for the year, came to $12,890. His health insurance plan has a $500 annual deductible and an 80/20 coinsurance provision (meaning CJ will only pay 20% of the costs). The coinsurance cap for CJ is $2,000. How much of the bill will CJ pay?

- An insurance company has a simplified method for determining the annual premium for a term life insurance policy. A flat annual fee of $150 is charged for all policies plus $2.50 for each thousand dollars of the amount of the policy.For example, a $20,000 policy would cost $150 for the fixed fee plus $50, which corresponds to the face value of the policy. If p equals the annual premium in dollars and x equals the face value of the policy (stated in thousands of dollars), determine the function which can be used to compute annual premiums.Break-A-Leg Insurance Company sells a $500,000 insurance policy to thespians for self-inflicted lower-body extremity injury. The premium for the policy is $150 per year. If the probability that an actor actually breaks their leg and is paid $500,000 is 0.0001, compute the expected value the insurance company should expect to receive per policy sold. The insurance company should expect to receive how much money?Latesha Moore has a choice at work between a traditional health insurance plan that pays 80 percent of the cost of doctor visits after a $250 deductible and an HMO that charges a $55 co-payment per visit plus a $1919 monthly premium deduction from her paycheck. Latesha anticipates seeing a doctor once a month for her high blood pressure. The cost of each office visit is $6060. She normally sees the doctor an average of three times a year for other health concerns. Comment on the difference in costs between the two health-care plans and the advantages and disadvantages of each. Question content area bottom Part 1 Latesha would pay an annual out-of-pocket cost with the traditional plan of

- Michael Howitt of Berkley, Michigan, recently had his gallbladder removed. His total bill for this surgery, which was his only health care expense for the year, came to $13,810. His health insurance plan has a $450 annual deductible and an 80/20 coinsurance provision. The cap on Michael's coinsurance share is $1,910. Round your answers to the nearest dollar. a. How much of the bill will Michael pay? b. How much of the bill will be paid by Michaels insurance?Calculate the amount that the pharmacy bills to the insurance company under the formula of AWP plus 2% plus $6 dispensing fee per prescription if the pharmacy fills 50 prescriptions in 1 month for the same drug and each of the prescriptions contain 30 tablets of the same drug which has AWP $300.A health insurance policy costs $275/month and pays $100,000 for a major illness. The probability that an individual will use their benefits in a given month is .25% for a major illness and 12% for a doctor's visit costing an average of $100. If the company has 40,000,000 policyholders, what is the expected net profit for the company each month?

- Prydain Pharmaceuticals is reviewing its employee healthcare program. Currently, the company pays a fixed fee of$300 per month for each employee, regardless of the number or dollar amount of medical claims filed. Anotherhealth-care provider has offered to charge the company$100 per month per employee and $30 per claim filed. Athird insurer charges $200 per month per employee and$10 per claim filed. Which health-care program should Prydain join? How would the average number of claimsfiled per employee per month affect your decision?Consider the following scenario: Bill has an income of $50,000 and has a probability of remaining healthy of 70%. If he is not healthy, Bill has the following projected medical costs that would be paid 100% by insurance: Medications = $400 Medical Office Visits = $1,600 What is the actuarially fair premium Bill should pay?A couch sells for $1020. Instead of paying the total amount at the time of purchase, the same couch can be bought by paying $400 down and $60 a month for 12 months. How much is saved by paying the total amount at the time of purchase? A