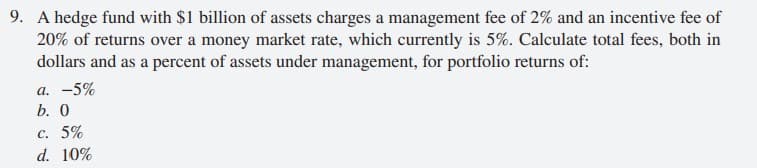

A hedge fund with $1 billion of assets charges a management fee of 2% and an incentive fee of 20% of returns over a money market rate, which currently is 5%. Calculate total fees, both in dollars and as a percent of assets under management, for portfolio returns of: a. −5% b. 0 c. 5% d. 10%

Q: The composition of the Fingroup Fund portfolio is as follows: Stock Shares Price A 200000 $35…

A: With the given information, we can determine the net asset value as follows:

Q: The composition of the Fingroup Fund portfolio is as follows: Stocks Shares Price 200,000 Php 35 B…

A: The Net Asset Value is the amount which a unit holder would received if the mutual fund is…

Q: Your Company, manager of the Gigantic Mutual Fund, knows that her fund currently is well diversified…

A: As per CAPM, Expected Return = Risk free rate +(beta * CAPM risk premium) Expected Return = (8%) +…

Q: Consider an open-end mutual fund with 2 million shares outstanding, liabilities of $5 million, and…

A: Net Asset Value= Market Value of Assets - Liabilities

Q: onsider a no-load mutual fund with $457 million in assets and 12 million shares at the start of the…

A: …

Q: You have $16,000 to invest in a mutual fund with an NAV = $45. You choose a fund with a 4 percent…

A: Rate of return is the annual income generated from the investment expressed in percentage terms.

Q: What is the market Risk Premium? a. 3% b. 7% c. 10% d. 13% Option 2

A: Market Risk Premium refers to the additional return earned above the risk free rate by the market…

Q: City Street Fund has a portfolio of $450 million and liabilities of $10 million.a. If 44 million…

A: Part (a): Answer: Net asset value is $10

Q: Consider a no-load mutual fund with $457 million in assets and 12 million shares at the start of the…

A: The question is based on the concept of mutual fund

Q: Assume a fund has securities worth ₱140 million, liabilities of ₱5 million, 10 million shares…

A:

Q: Portfolio Required Return Suppose you manage a $4.4 million fund that consists of four stocks with…

A: Stock investment Beta A 500000 1.5 B 650000 -0.5 C 1100000 1.25 D 2150000 0.75…

Q: Your Company, manager of the Gigantic Mutual Fund, knows that her fund currently is well diversified…

A: The capital asset pricing model is a technique that is used to evaluate the expected return of…

Q: You have $15,000 to invest in a mutual fund. You choose a fund with a 3.5 percent front load, a 1.75…

A: The net annual rate of return is providing information that with the security investment, what…

Q: A hedge fund with $1 billion of assets charges a management fee of 2% and an incentive fee of 20% of…

A: Given information in question Fund value = $1 billion Management fee…

Q: )The twenty-first century closed-end fund has GHS350 million in securities, GHS8 million in…

A: Net Asset Value: It is the total sum of total assets less total liabilities divided by total…

Q: A mutual fund company has cash resources of birr 200 million for investment in a diversified…

A: Linear programming (LP) model is a mathematical modelling technique used to help decision makers in…

Q: Assume that you are the portfolio manager of the SF Fund, a $3 million hedge fund that contains the…

A: Return for individual stock can be calculated with the help of below formula,

Q: Calculate the required rate of return for the Wagner Assets Management Group, which holds 4 stocks.…

A: The question is based on the concept of portfolio return by use of capital asset pricing model.…

Q: The quoted rate of the short-term government security is 5% and a 2% premium is added to rate to…

A: Risk free rate = 5% Risk premium = 2% Other information STOCK INVESTMENT BETA ABC 500,000 1…

Q: The Closed Fund is a closed-end investment company with a portfolio currently worth $200 million. It…

A: Part (a): Answer: Net asset value is $39.4

Q: PORTFOLIO REQUIRED RETURN Suppose you are the money manager of a $4.82 million investment fund. The…

A: Portfolios are the group or combination of investments of an investor that are grouped together in…

Q: Assume a hedge fund has a fee structure of 4 plus 25%. What return is the hedge fund required to…

A: Hedge funds are also known as actively managed funds that use various no-traditional and risky…

Q: Consider a mutual fund with $250 million in assets at the start of the year and 10 million shares…

A: Net asset value (NAV) is a method that helps to evaluate the value of a company. It also provides…

Q: A hedge fund with $25 million of assets under management has a standard 2/20 fee structure and earns…

A: Hedge fund can be defined as the investment fund that requires pooled investment and trades in…

Q: A fund manager is holding the following stocks: Stock Amount Invested Beta 1 $300 million 1.2…

A: Note: We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

Q: A hedge fund charges a management fee of 3 percent and an incentive fee of 25 percent for all…

A: Hedge funds are actively managed investment pools whose managers employ a variety of tactics, such…

Q: Portfolio Required Return Suppose you manage a $4.71 million fund that consists of four stocks with…

A: Portfolio required return helps in calculating the anticipated profit and losses from portfolio of…

Q: If his portfolio currently has a sensitivity to the first factor of bi1= -0.5, what is its…

A: CAPM: CAPM stands for Capital Asset Pricing Model. Expected return of the stock can be calculated…

Q: Samantha is the money manager of a R4 000 000 investment fund. The fund consists of four shares with…

A: Given, Market required return (Rm)= 14% Risk-free rate (Rf) = 6% CAPM: The capital asset pricing…

Q: The Swadhinota open end mutual fund is being sold for Tk.47.85 per share. The fund includes Tk.540…

A: Fund NAV = (Securities & Assets Owned by funds - Fund Liabilities) / Number of shares…

Q: What is the net asset value at the start and end of the year? What is the rate of return for an…

A: Accounting rate of return compares average profit with average investment and express profit as a…

Q: Required: A hedge fund with $1.6 billion of assets charges a management fee of 3% and an incentive…

A:

Q: 1)The twenty-first century closed-end fund has GHS350 million in securities, GHS8 million in…

A: “Since you have asked multiple questions, we will solve the one question for you. If you want any…

Q: f the market's required rate of return is 11% and the risk-free rate is 5%, what is the fund's…

A: Portfolio Beta is a measure of the overall systematic risk of a portfolio of investments. It equals…

Q: The Stone Harbor Fund is a closed-end investment company with a portfolio currently worth $1…

A: Net Asset Value is defined as the value of the assets of entity and minus the liabilities value,…

Q: Consider a no - load mutual fund with $ 500 million in assets , 50 million in debt , and 12 million…

A: Solution detail at the start of the year asset $500 million Solution Step (1) Debt $50 million Share…

Q: Portfolio Required Return Suppose you manage a $6 million fund that consists of four stocks with…

A: The Capital Asset Pricing Model (CAPM) refers to the model which tells us how the financial markets…

Q: You create a portfolio consisting of $23000 invested in a mutual fund with beta of 1.3, $25000…

A: Expected Return = Risk risk rate + beta of portfolio * market risk premium Beta of portfolio =…

Q: A portfolio manager is holding the following investments: Stock Amount Invested Beta X RM10 million…

A: Risk free rate = 5% Market Risk Premium = 5.5% Beta of X = 1.4 Beta of Y = 1.0 Beta of Z = 0.8

Q: You are the investment manager for Global Assets Investments Company's mutual fund and you have…

A: Solution: (i). You pay cash for the stock : No. of the shares that we will able to buy =…

Q: sofie Inc. has an investment fund amounting to P4,500,000. The portfolio consists of three stocks…

A: Answer) Calculation of Portfolio’s Required rate of return Portfolio’s required rate of return =…

Q: Assuming risk free rate to be 2% p.a while market return is expected to be 8% return with a Standard…

A:

Hello, can you show how this shoould be made

A hedge fund with $1 billion of assets charges a management fee of 2% and an incentive fee of

20% of returns over a

dollars and as a percent of assets under management, for portfolio returns of:

a. −5%

b. 0

c. 5%

d. 10%

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 3 images

- A hedge fund with $1 billion of assets charges a management fee of 2% and an incentive fee of 20% of returns over a money market rate, which currently is 5%. Calculate total fees, both in dollars and as a percent of assets under management, for portfolio returns of:a. −5%b. 0c. 5%d. 10%Harlequin Capital is a hedge fund with $250 million of initial capital. Harlequin charges a 2% management fee based on assets under management at year end, and a 20% incentive fee based on returns in excess of an 8% hurdle rate. In its first year, Harlequin appreciates 16%. Assume management fees are calculated using end-of-period valuation. Calculate the investor’s net return assuming the performance fee is calculated net of the management fee.A hedge fund charges a management fee of 3 percent and an incentive fee of 25 percent for all returns over a benchmark return of 4%. The risk-free rate is 2% and the standard deviation of the funds continuously compounded returns has been 23%. The current net asset value is $55 per share. What is the value of all fees expressed as a percent at the start of the investment period?

- ABC CAPITAL is a hedge fund with $300 million of initial investment capital. They charge a 2 percent management fee based on assets under management at year- end and a 20 percent incentive fee. In its first year, ABC Capital has a 80 percent return. Assume management fees are calculated using end-of-period valuation. 1. What are the fees earned by ABC if the incentive and management fees are calculated independently? What is an investor’s effective return given this fee Structure? 2. What are the fees earned by ABC assuming that the incentive fee is calculated based on return net of the management fee? What is an investor’s net return given this fee structure? 3. If the fee structure specifies a hurdle rate of 5 percent and the incentive fee is based on returns in excess of the hurdle rate, what are the fees earned by ABC assuming the performance fee is calculated net of the management fee? What is an investor’s net return given this fee structure? 4. In the second year, the fund…Citadel LLC is one of largest hedge fund firms in the United States. Citadel now holds $360 billion in its hedge fund account. Citadel charges a 2% management fee based on assets under management at year end, and a 20% incentive fee. In its first year, Citadel appreciates 19.20%. Calculate the investor’s net return. Assume that management fees are calculated using end-of-period valuation, the performance fee is calculated net of the management fee, and no hurdle rate on its performance. A. 13.45% B. 17.25% C. 21.25% D. 24.65%ABC CAPITAL is a hedge fund with $300 million of initial investment capital. They charge a 2 percent management fee based on assets under management and a 20 percent incentive fee. In its first year, ABC Capital has a 20 percent return. Assume management fees are calculated using beginning-of-period valuation. 1. What are the fees earned by ABC if the incentive and management fees are calculated independently? What is an investor’s effective return given this fee Structure? 2. What are the fees earned by ABC assuming that the incentive fee is calculated based on return net of the management fee? What is an investor’s net return given this fee structure? 3. If the fee structure specifies a hurdle rate of 5 percent and the incentive fee is based on returns in excess of the hurdle rate, what are the fees earned by ABC assuming the performance fee is calculated net of the management fee? What is an investor’s net return given this fee structure? 4. In the second year, the fund value…

- The quoted rate of the short-term government security is 5% and a 2% premium is added to rate to reflect the market return. What is the required rate of return of the portfolio? (In percentage, put percentage sign) Blue Co. has an investment fund consist of three stocks as follows: STOCK INVESTMENT BETA ABC 500,000 1 DEF 1,250,000 0.8 XYZ 750,000 1.5Bulldogs Inc. has an investment fund amounting to P4,500,000. The portfolio consists of three stocks within the retail industry. P1,350,000 is invested in HLCM, 45% in MWIDE and the remaining in PHN. HLCM and PHN has a beta of 1.50 and 2, respectively. The average return on the market is 9.50% and it is 5% greater than the risk-free rate. The portfolio beta of investment held by Bulldogs Inc. is 2.What is the beta of stock MWIDE? a. 2.55 b. 2.33 c. 3.22 d. 3.55A mutual fund company has cash resources of birr 200 million for investment in a diversified portfolio. Table below shows the opportunity available, their estimated yields, risk factors and term period of details. Annual yield (%) Risk Factor Time period ( years) Bank deposit 9.5 0.02 6 treasury notes 8.5 0.01 4 corporate deposits 12.0 0.08 3 blue chip stocks 15.0 0.25 5 speculative stocks 32.5 0.45 3 real estates 35.0 0.04 10 Formulate the L.P. model to find the optimal portfolio that will maximize return, considering the following policy guidelines: i) All funds available may be invested ii) Weighted average period of at least 5 years should be the planning horizon iii) Weighted average risk factor must not exceed 0.20 iv) Investment in real estate and speculative stocks together must not be more than 25% of the money invested

- sofie Inc. has an investment fund amounting to P4,500,000. The portfolio consists of three stocks within the retail industry. P1,350,000 is invested in HLCM, 45% in MWIDE and the remaining in PHN. HLCM and PHN has a beta of 1.50 and 2, respectively. The average return on the market is 9.50% and it is 5% greater than the risk-free rate. The portfolio beta of investment held by Bulldogs Inc. is 2.What is the portfolio’s required rate of return?Calculate the required rate of return for the Wagner Assets Management Group, which holds 4 stocks. The market's required rate of return is 17.0%, the risk-free rate is 7.0%, and the Fund's assets are as follows: Stock Investment Beta A $200,000 1.50 B 300,000 −0.50 C 500,000 1.25 D 1,000,000 0.75 Select the correct answerYou create a portfolio consisting of $23000 invested in a mutual fund with beta of 1.3, $25000 invested in Treasury Securities (assume risk-free), and $12000 invested in an index fund tracking the market. According to surveys, the expected market risk premium is 6.6%, risk free rate is 1.3%. What is the expected return of this portfolio according to CAPM? Answer in percent, rounded to one decimal place.