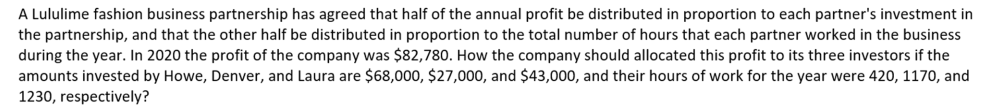

A Lululime fashion business partnership has agreed that half of the annual profit be distributed in proportion to each partner's investment in the partnership, and that the other half be distributed in proportion to the total number of hours that each partner worked in the business during the year. In 2020 the profit of the company was $82,780. How the company should allocated this profit to its three investors if the amounts invested by Howe, Denver, and Laura are $68,000, $27,000, and $43,000, and their hours of work for the year were 420, 1170, and 1230, respectively?

A Lululime fashion business partnership has agreed that half of the annual profit be distributed in proportion to each partner's investment in the partnership, and that the other half be distributed in proportion to the total number of hours that each partner worked in the business during the year. In 2020 the profit of the company was $82,780. How the company should allocated this profit to its three investors if the amounts invested by Howe, Denver, and Laura are $68,000, $27,000, and $43,000, and their hours of work for the year were 420, 1170, and 1230, respectively?

Chapter14: Choice Of Business Entity—operations And Distributions

Section: Chapter Questions

Problem 47P

Related questions

Question

Transcribed Image Text:A Lululime fashion business partnership has agreed that half of the annual profit be distributed in proportion to each partner's investment in

the partnership, and that the other half be distributed in proportion to the total number of hours that each partner worked in the business

during the year. In 2020 the profit of the company was $82,780. How the company should allocated this profit to its three investors if the

amounts invested by Howe, Denver, and Laura are $68,000, $27,000, and $43,000, and their hours of work for the year were 420, 1170, and

1230, respectively?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT