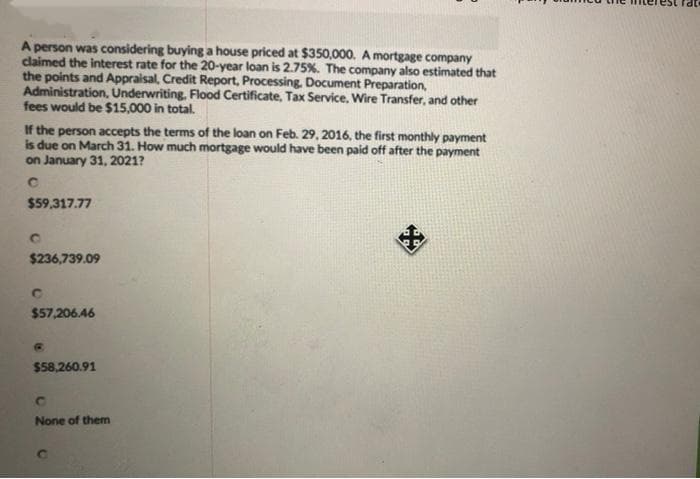

A person was considering buying a house priced at $350,000. A mortgage company claimed the interest rate for the 20-year loan is 2.75%. The company also estimated that the points and Appraisal, Credit Report, Processing, Document Preparation, Administration, Underwriting, Flood Certificate, Tax Service, Wire Transfer, and other fees would be $15,000 in total. If the person accepts the terms of the loan on Feb. 29, 2016, the first monthly payment is due on March 31. How much mortgage would have been paid off after the payment on January 31, 2021? C

A person was considering buying a house priced at $350,000. A mortgage company claimed the interest rate for the 20-year loan is 2.75%. The company also estimated that the points and Appraisal, Credit Report, Processing, Document Preparation, Administration, Underwriting, Flood Certificate, Tax Service, Wire Transfer, and other fees would be $15,000 in total. If the person accepts the terms of the loan on Feb. 29, 2016, the first monthly payment is due on March 31. How much mortgage would have been paid off after the payment on January 31, 2021? C

Chapter5: Introduction To Business Expenses

Section: Chapter Questions

Problem 61P

Related questions

Question

Question 7

Full explain this question very fast solution sent me step by step

Transcribed Image Text:A person was considering buying a house priced at $350,000. A mortgage company

claimed the interest rate for the 20-year loan is 2.75%. The company also estimated that

the points and Appraisal, Credit Report, Processing, Document Preparation,

Administration, Underwriting, Flood Certificate, Tax Service, Wire Transfer, and other

fees would be $15,000 in total.

If the person accepts the terms of the loan on Feb. 29, 2016, the first monthly payment

is due on March 31. How much mortgage would have been paid off after the payment

on January 31, 2021?

с

$59,317.77

$236,739.09

C

$57,206.46

$58,260.91

с

None of them

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning