A Player O (1488) Example: Interest Capit x Grades for Preston Porter: ACC X Answered: Exercise 12-9Durin X + s.ucf.edu/courses/1336012/assignments/6285656 Other Current Attempt in Progress On July 31, 2020, Carla Vista Company paid $2,700,000 to acquire all of the common stock of Conchita Incorporated, which became a division (a reporting unit) of Carla Vista. Conchita reported the following balance sheet at the time of the acquisition. Current assets $730,000 Current liabilities $570,000 Noncurrent assets ort 2,400,000 Long-term liabilities 470,000 Total assets $3,130,000 Stockholders' equity 2,090,000 ces Total liabilities and stockholders' equity $3,130,000 It was determined at the date of the purchase that the fair value of the identifiable net assets of Conchita was $2,455,000. Over the next 6 months of operations, the newly purchased division experienced operating losses. In addition, it now appears that it will generate substantial losses for the foreseeable future. At December 31, 2020, Conchita reports the following balance sheet information. Current assets $410,000 Noncurrent assets (including goodwill recognized in purchase) 2,060,000 Current liabilities (700,000 ) Long-term liabilities (500,000 ) Net assets $1,270,000 Finally, it is determined that the fair value of the Conchita Division is $1,850,000. Your answer is correct. Compute the amount of goodwill recognized, if any, on July 31, 2020. (If answer is zero, do not leave answer field blank. Enter O for the amount.) MacBook Pro DII F12 F11 F10 F9 F8 F7 F6 F3 F2 F5 F4 #3 & del 80 4. 3 2 { Y н MI + |/ A Player (1488) Example: Interest Capit X Grades for Preston Porter: AC Answered: Exercise 12-9During X X urses.ucf.edu/courses/1336012/assignments/6285656 Other Book Your answer is incorrect. Assume that fair value of the Conchita Division is $1,224,000 instead of $1,850,000. Determine the impairment loss, if any, to be recorded on December 31, 2020. (If answer is zero, do not leave answer field blank. Enter O for the amount.) $ The impairment loss -199000 eTextbook and Media List of Accpunts Your answer is partially correct. Prepare the journal entry to record the impairment loss, if any, and indicate where the loss would be reported in the income statement. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Credit Debit Account Titles and Explanation 199000 Loss on Impairment 199000 Goodwill Income From Continuing Operations This loss will be reported in income as a separate line item before the subtotal MacBook Pro F12 F11 DII F10 888 F7 F5 F4 F3 & 23 E 11 н G в C 00 S.

A Player O (1488) Example: Interest Capit x Grades for Preston Porter: ACC X Answered: Exercise 12-9Durin X + s.ucf.edu/courses/1336012/assignments/6285656 Other Current Attempt in Progress On July 31, 2020, Carla Vista Company paid $2,700,000 to acquire all of the common stock of Conchita Incorporated, which became a division (a reporting unit) of Carla Vista. Conchita reported the following balance sheet at the time of the acquisition. Current assets $730,000 Current liabilities $570,000 Noncurrent assets ort 2,400,000 Long-term liabilities 470,000 Total assets $3,130,000 Stockholders' equity 2,090,000 ces Total liabilities and stockholders' equity $3,130,000 It was determined at the date of the purchase that the fair value of the identifiable net assets of Conchita was $2,455,000. Over the next 6 months of operations, the newly purchased division experienced operating losses. In addition, it now appears that it will generate substantial losses for the foreseeable future. At December 31, 2020, Conchita reports the following balance sheet information. Current assets $410,000 Noncurrent assets (including goodwill recognized in purchase) 2,060,000 Current liabilities (700,000 ) Long-term liabilities (500,000 ) Net assets $1,270,000 Finally, it is determined that the fair value of the Conchita Division is $1,850,000. Your answer is correct. Compute the amount of goodwill recognized, if any, on July 31, 2020. (If answer is zero, do not leave answer field blank. Enter O for the amount.) MacBook Pro DII F12 F11 F10 F9 F8 F7 F6 F3 F2 F5 F4 #3 & del 80 4. 3 2 { Y н MI + |/ A Player (1488) Example: Interest Capit X Grades for Preston Porter: AC Answered: Exercise 12-9During X X urses.ucf.edu/courses/1336012/assignments/6285656 Other Book Your answer is incorrect. Assume that fair value of the Conchita Division is $1,224,000 instead of $1,850,000. Determine the impairment loss, if any, to be recorded on December 31, 2020. (If answer is zero, do not leave answer field blank. Enter O for the amount.) $ The impairment loss -199000 eTextbook and Media List of Accpunts Your answer is partially correct. Prepare the journal entry to record the impairment loss, if any, and indicate where the loss would be reported in the income statement. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Credit Debit Account Titles and Explanation 199000 Loss on Impairment 199000 Goodwill Income From Continuing Operations This loss will be reported in income as a separate line item before the subtotal MacBook Pro F12 F11 DII F10 888 F7 F5 F4 F3 & 23 E 11 н G в C 00 S.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 21P

Related questions

Question

100%

Transcribed Image Text:A Player

O (1488) Example: Interest Capit x

Grades for Preston Porter: ACC X

Answered: Exercise 12-9Durin X +

s.ucf.edu/courses/1336012/assignments/6285656

Other

Current Attempt in Progress

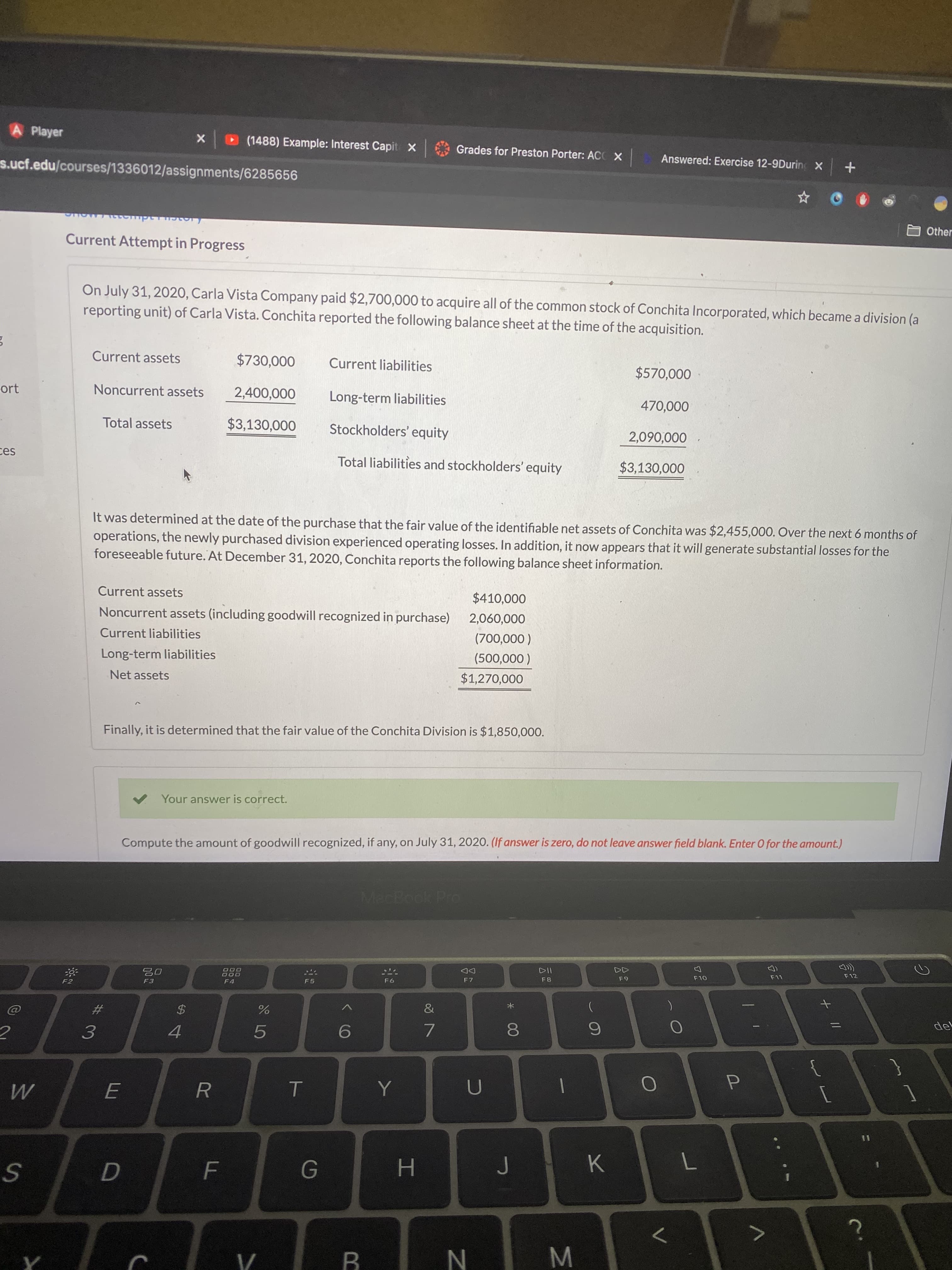

On July 31, 2020, Carla Vista Company paid $2,700,000 to acquire all of the common stock of Conchita Incorporated, which became a division (a

reporting unit) of Carla Vista. Conchita reported the following balance sheet at the time of the acquisition.

Current assets

$730,000

Current liabilities

$570,000

Noncurrent assets

ort

2,400,000

Long-term liabilities

470,000

Total assets

$3,130,000

Stockholders' equity

2,090,000

ces

Total liabilities and stockholders' equity

$3,130,000

It was determined at the date of the purchase that the fair value of the identifiable net assets of Conchita was $2,455,000. Over the next 6 months of

operations, the newly purchased division experienced operating losses. In addition, it now appears that it will generate substantial losses for the

foreseeable future. At December 31, 2020, Conchita reports the following balance sheet information.

Current assets

$410,000

Noncurrent assets (including goodwill recognized in purchase)

2,060,000

Current liabilities

(700,000 )

Long-term liabilities

(500,000 )

Net assets

$1,270,000

Finally, it is determined that the fair value of the Conchita Division is $1,850,000.

Your answer is correct.

Compute the amount of goodwill recognized, if any, on July 31, 2020. (If answer is zero, do not leave answer field blank. Enter O for the amount.)

MacBook Pro

DII

F12

F11

F10

F9

F8

F7

F6

F3

F2

F5

F4

#3

&

del

80

4.

3

2

{

Y

н

MI

+ |/

Transcribed Image Text:A Player

(1488) Example: Interest Capit X

Grades for Preston Porter: AC

Answered: Exercise 12-9During X

X

urses.ucf.edu/courses/1336012/assignments/6285656

Other Book

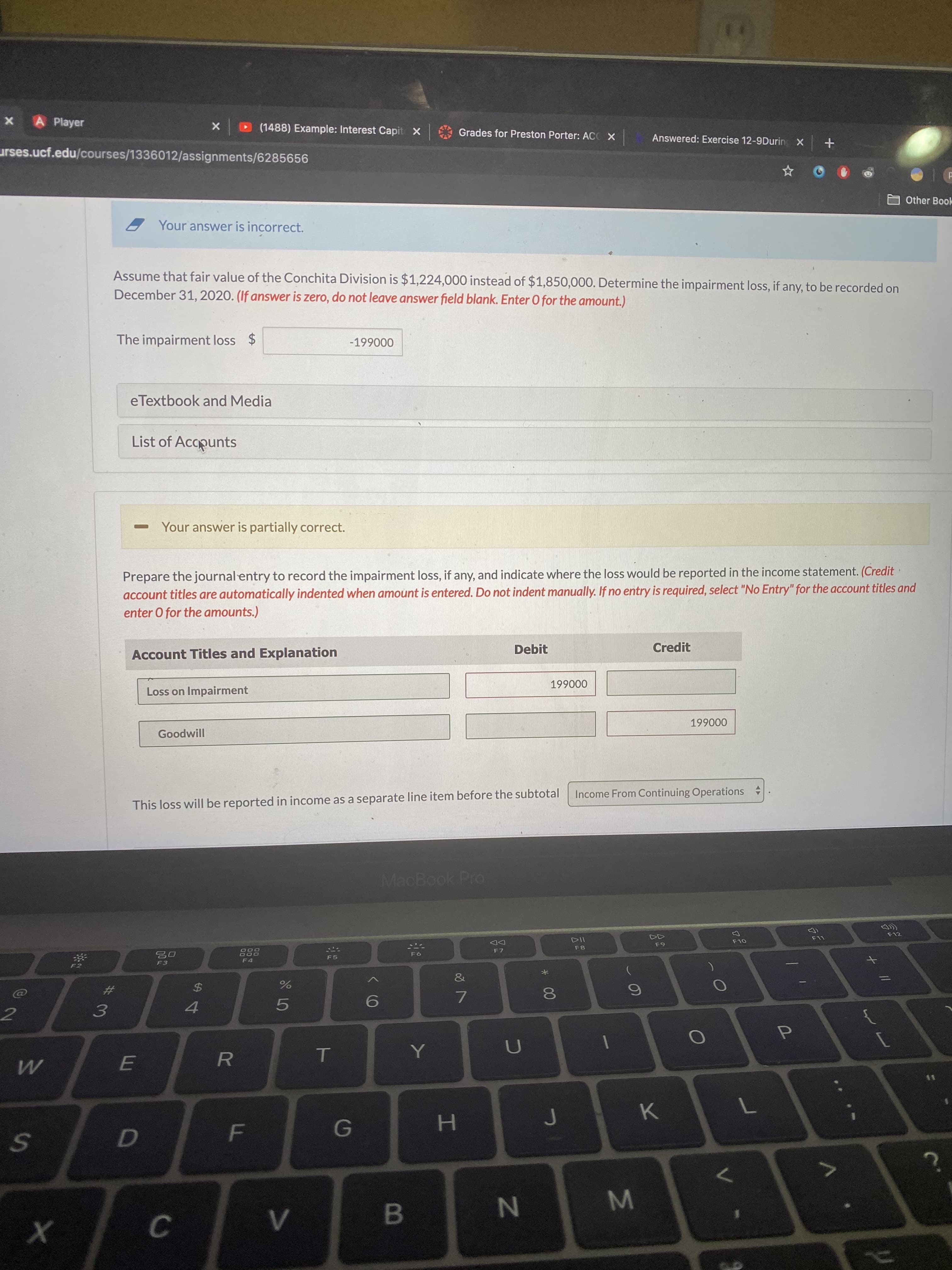

Your answer is incorrect.

Assume that fair value of the Conchita Division is $1,224,000 instead of $1,850,000. Determine the impairment loss, if any, to be recorded on

December 31, 2020. (If answer is zero, do not leave answer field blank. Enter O for the amount.)

$

The impairment loss

-199000

eTextbook and Media

List of Accpunts

Your answer is partially correct.

Prepare the journal entry to record the impairment loss, if any, and indicate where the loss would be reported in the income statement. (Credit

account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and

enter O for the amounts.)

Credit

Debit

Account Titles and Explanation

199000

Loss on Impairment

199000

Goodwill

Income From Continuing Operations

This loss will be reported in income as a separate line item before the subtotal

MacBook Pro

F12

F11

DII

F10

888

F7

F5

F4

F3

&

23

E

11

н

G

в

C

00

S.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning