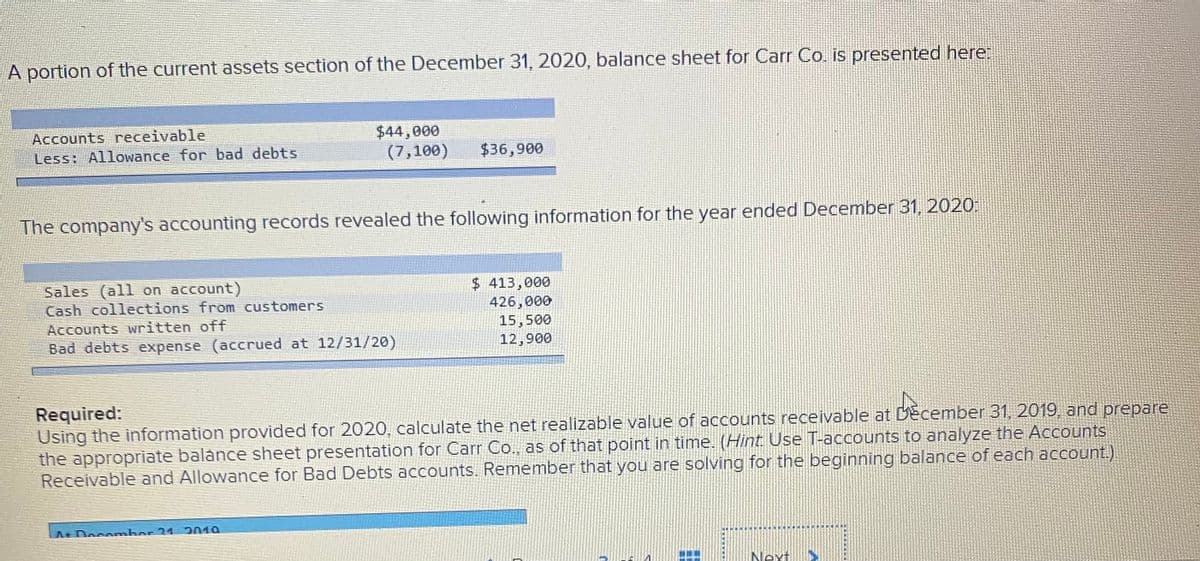

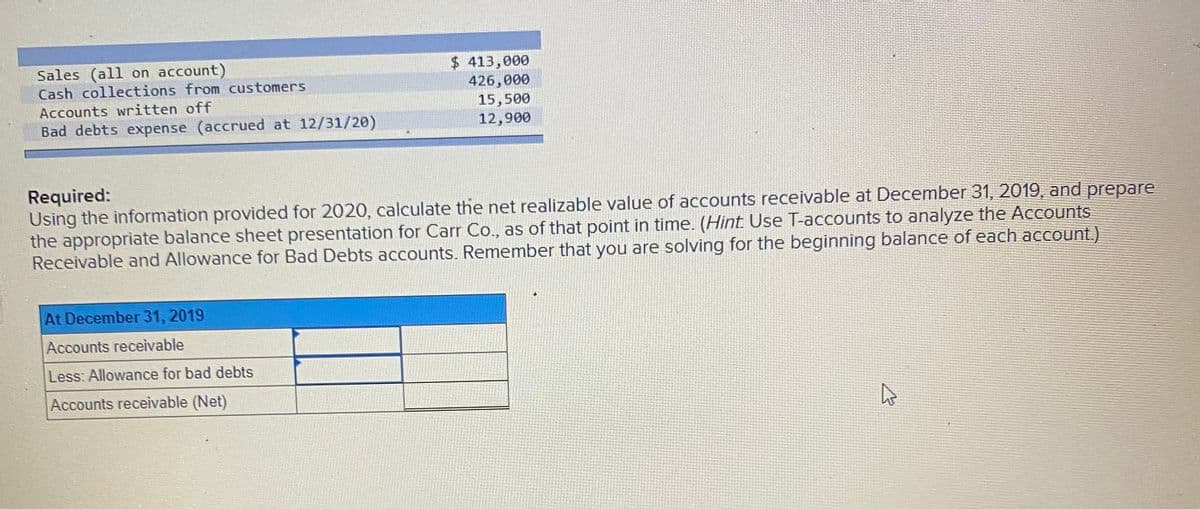

A portion of the current assets section of the December 31, 2020, balance sheet for Carr Co. is presented here: Accounts receivable $44,000 (7,100) Less: Allowance for bad debts $36,900 The company's accounting records revealed the following information for the year ended December 31, 2020: Sales (all on account) Cash collections from customers Accounts written off Bad debts expense (accrued at 12/31/20) $ 413,000 426,000 15,500 12,900 Required: Using the information provided for 2020, calculate the net realizable value of accounts receivable at DEcember 31, 2019, and prepare the appropriate balance sheet presentation for Carr Co., as of that point in time. (Hint. Use T-accounts to analyze the Accounts Receivable and Allowance for Bad Debts accounts. Remember that you are solving for the beginning balance of each account.)

hello, I need help please

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 6 images

The following is a portion of the current asset section of the balance sheets of HiROE Co., at December 31, 2020 and 2019:

| 12/31/20 | 12/31/19 | |

| Accounts receivable, less allowance for uncollectible accounts of $23,000 and $11,000, respectively |

$457,000 | $359,000 |

e-2. What factors might have caused the change in this ratio?

-

Credit was extended to proportionately more slow-paying or high credit-risk customers during 2020.

Credit was extended to proportionately more slow-paying or high credit-risk customers during 2020. -

Credit was extended to proportionately more slow-paying or lower credit-risk customers during 2020.

Credit was extended to proportionately more slow-paying or lower credit-risk customers during 2020. -

Credit was extended to proportionately more slow-paying or high credit-risk customers during 2019.

Credit was extended to proportionately more slow-paying or high credit-risk customers during 2019. -

Credit was extended to proportionately more slow-paying or lower credit-risk customers during 2019.

Credit was extended to proportionately more slow-paying or lower credit-risk customers during 2019. -

Proportionately fewer bad accounts were actually written off during 2020.

Proportionately fewer bad accounts were actually written off during 2020. -

Proportionately fewer bad accounts were actually written off during 2019.

Proportionately fewer bad accounts were