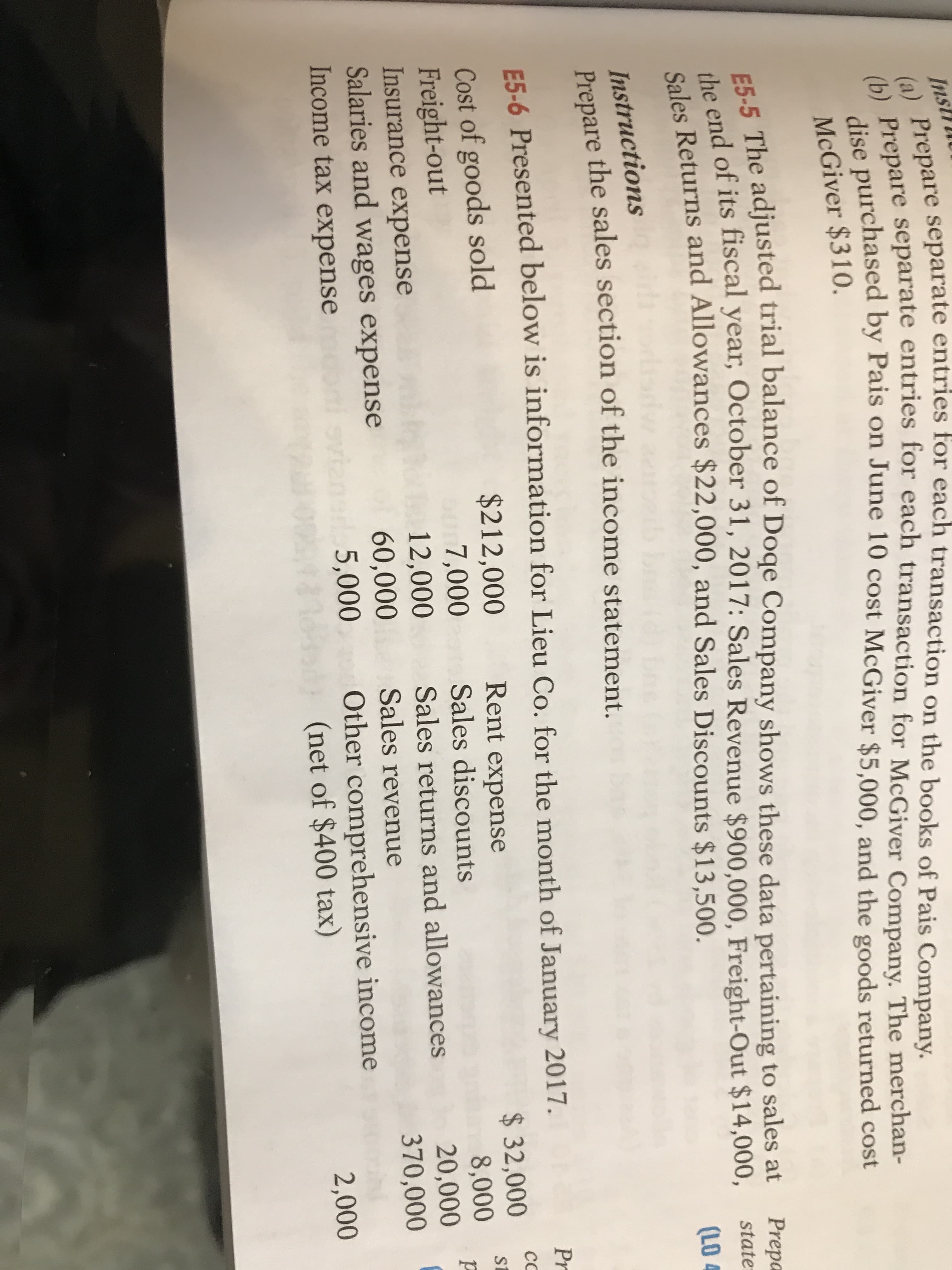

(a) Prepare separate entries for each transaction on the books of Pais Company. dise purchased by Pais on June 10 cost McGiver $5,000, and the goods returned cost Insti McGiver $310. E5-5 The adjusted trial balance of Doqe Company shows these data pertaining to sales at the end of its fiscal year, October 31, 2017: Sales Revenue $900,000, Freight-Out $14,000, Sales Returns and Allowances $22,000, and Sales Discounts $13,500. Prepa state (LO 4 Instructions Prepare the sales section of the income statement. E5-6 Presented below is information for Lieu Co. for the month of January 2017. Pr Cost of goods sold Freight-out Insurance expense Salaries and wages expense $212,000 7,000 12,000 60,000 5,000 Rent expense $ 32,000 St 8,000 20,000 370,000 Sales discounts Sales returns and allowances Sales revenue Other comprehensive income (net of $400 tax) Income tax expense i svta 2,000 252 5 Merchandising Operations and the Multiple-Step Income Statement Instructions Frepare an income statement using the format presented in Illustration 5-11. (b) Prepare a comprehensive income statement. (c) Calculate the profit margin and the gross profit rate. pute missing amounts and late profitability ratios. ), AP E5-7 Financial information is presented here for two companies. Yoste Noone Company Company $90,000 Sales revenue Sales returns and allowances Net sales $ 5,000 100,000 ? 84,000 58,000 Cost of goods sold Gross profit Operating expenses Net income ? 40,000 14,380 17,000

(a) Prepare separate entries for each transaction on the books of Pais Company. dise purchased by Pais on June 10 cost McGiver $5,000, and the goods returned cost Insti McGiver $310. E5-5 The adjusted trial balance of Doqe Company shows these data pertaining to sales at the end of its fiscal year, October 31, 2017: Sales Revenue $900,000, Freight-Out $14,000, Sales Returns and Allowances $22,000, and Sales Discounts $13,500. Prepa state (LO 4 Instructions Prepare the sales section of the income statement. E5-6 Presented below is information for Lieu Co. for the month of January 2017. Pr Cost of goods sold Freight-out Insurance expense Salaries and wages expense $212,000 7,000 12,000 60,000 5,000 Rent expense $ 32,000 St 8,000 20,000 370,000 Sales discounts Sales returns and allowances Sales revenue Other comprehensive income (net of $400 tax) Income tax expense i svta 2,000 252 5 Merchandising Operations and the Multiple-Step Income Statement Instructions Frepare an income statement using the format presented in Illustration 5-11. (b) Prepare a comprehensive income statement. (c) Calculate the profit margin and the gross profit rate. pute missing amounts and late profitability ratios. ), AP E5-7 Financial information is presented here for two companies. Yoste Noone Company Company $90,000 Sales revenue Sales returns and allowances Net sales $ 5,000 100,000 ? 84,000 58,000 Cost of goods sold Gross profit Operating expenses Net income ? 40,000 14,380 17,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 2E: Cost of Goods Sold and Income Statement Schuch Company presents you with the following account...

Related questions

Question

E5-6

two picture. It's on two pages

Transcribed Image Text:(a) Prepare separate entries for each transaction on the books of Pais Company.

dise purchased by Pais on June 10 cost McGiver $5,000, and the goods returned cost

Insti

McGiver $310.

E5-5 The adjusted trial balance of Doqe Company shows these data pertaining to sales at

the end of its fiscal year, October 31, 2017: Sales Revenue $900,000, Freight-Out $14,000,

Sales Returns and Allowances $22,000, and Sales Discounts $13,500.

Prepa

state

(LO 4

Instructions

Prepare the sales section of the income statement.

E5-6 Presented below is information for Lieu Co. for the month of January 2017.

Pr

Cost of goods sold

Freight-out

Insurance expense

Salaries and wages expense

$212,000

7,000

12,000

60,000

5,000

Rent expense

$ 32,000

St

8,000

20,000

370,000

Sales discounts

Sales returns and allowances

Sales revenue

Other comprehensive income

(net of $400 tax)

Income tax expense

i svta

2,000

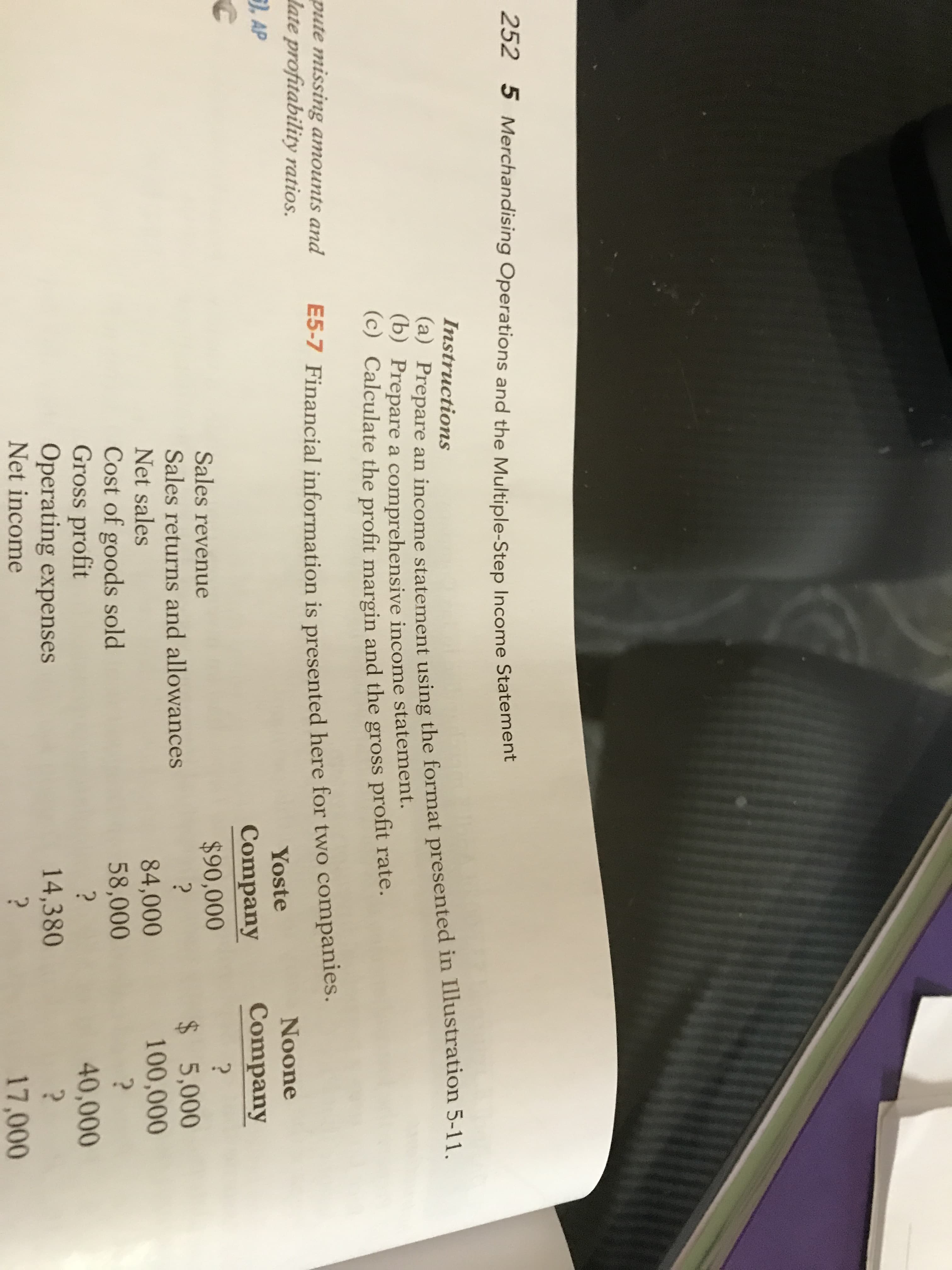

Transcribed Image Text:252 5 Merchandising Operations and the Multiple-Step Income Statement

Instructions

Frepare an income statement using the format presented in Illustration 5-11.

(b) Prepare a comprehensive income statement.

(c) Calculate the profit margin and the gross profit rate.

pute missing amounts and

late profitability ratios.

), AP

E5-7 Financial information is presented here for two companies.

Yoste

Noone

Company

Company

$90,000

Sales revenue

Sales returns and allowances

Net sales

$ 5,000

100,000

?

84,000

58,000

Cost of goods sold

Gross profit

Operating expenses

Net income

?

40,000

14,380

17,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning