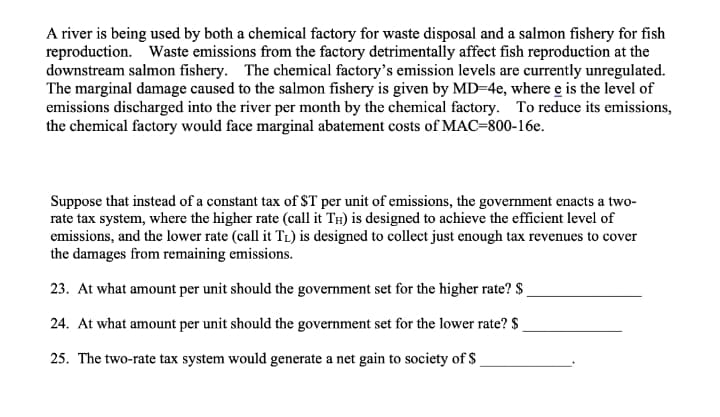

A river is being used by both a chemical factory for waste disposal and a salmon fishery for fish reproduction. Waste emissions from the factory detrimentally affect fish reproduction at the downstream salmon fishery. The chemical factory's emission levels are currently unregulated. The marginal damage caused to the salmon fishery is given by MD=4e, where e is the level of emissions discharged into the river per month by the chemical factory. To reduce its emissions, the chemical factory would face marginal abatement costs of MAC-800-16e. Suppose that instead of a constant tax of ST per unit of emissions, the government enacts a two- rate tax system, where the higher rate (call it TH) is designed to achieve the efficient level of emissions, and the lower rate (call it TL) is designed to collect just enough tax revenues to cover the damages from remaining emissions. 23. At what amount per unit should the government set for the higher rate? S 24. At what amount per unit should the government set for the lower rate? $ 25. The two-rate tax system would generate a net gain to society of $

A river is being used by both a chemical factory for waste disposal and a salmon fishery for fish reproduction. Waste emissions from the factory detrimentally affect fish reproduction at the downstream salmon fishery. The chemical factory's emission levels are currently unregulated. The marginal damage caused to the salmon fishery is given by MD=4e, where e is the level of emissions discharged into the river per month by the chemical factory. To reduce its emissions, the chemical factory would face marginal abatement costs of MAC-800-16e. Suppose that instead of a constant tax of ST per unit of emissions, the government enacts a two- rate tax system, where the higher rate (call it TH) is designed to achieve the efficient level of emissions, and the lower rate (call it TL) is designed to collect just enough tax revenues to cover the damages from remaining emissions. 23. At what amount per unit should the government set for the higher rate? S 24. At what amount per unit should the government set for the lower rate? $ 25. The two-rate tax system would generate a net gain to society of $

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter16: Government Regulation

Section: Chapter Questions

Problem 7E

Related questions

Question

Transcribed Image Text:A river is being used by both a chemical factory for waste disposal and a salmon fishery for fish

reproduction. Waste emissions from the factory detrimentally affect fish reproduction at the

downstream salmon fishery. The chemical factory's emission levels are currently unregulated.

The marginal damage caused to the salmon fishery is given by MD=4e, where e is the level of

emissions discharged into the river per month by the chemical factory. To reduce its emissions,

the chemical factory would face marginal abatement costs of MAC=800-16e.

Suppose that instead of a constant tax of $T per unit of emissions, the government enacts a two-

rate tax system, where the higher rate (call it TH) is designed to achieve the efficient level of

emissions, and the lower rate (call it T1) is designed to collect just enough tax revenues to cover

the damages from remaining emissions.

23. At what amount per unit should the government set for the higher rate? $

24. At what amount per unit should the government set for the lower rate? $

25. The two-rate tax system would generate a net gain to society of $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning