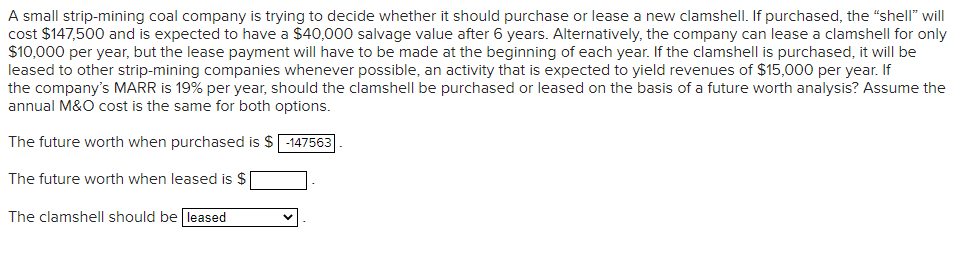

A small strip-mining coal company is trying to decide whether it should purchase or lease a new clamshell. If purchased, the "shelI" will cost $147,500 and is expected to have a $40,000 salvage value after 6 years. Alternatively, the company can lease a clamshell for only $10,000 per year, but the lease payment will have to be made at the beginning of each year. If the clamshell is purchased, it will be leased to other strip-mining companies whenever possible, an activity that is expected to yield revenues of $15,000 per year. If the company's MARR is 19% per year, should the clamshell be purchased or leased on the basis of a future worth analysis? Assume the annual M&O cost is the same for both options. The future worth when purchased is $ -147563 The future worth when leased is $ The clamshell should be leased

A small strip-mining coal company is trying to decide whether it should purchase or lease a new clamshell. If purchased, the "shelI" will cost $147,500 and is expected to have a $40,000 salvage value after 6 years. Alternatively, the company can lease a clamshell for only $10,000 per year, but the lease payment will have to be made at the beginning of each year. If the clamshell is purchased, it will be leased to other strip-mining companies whenever possible, an activity that is expected to yield revenues of $15,000 per year. If the company's MARR is 19% per year, should the clamshell be purchased or leased on the basis of a future worth analysis? Assume the annual M&O cost is the same for both options. The future worth when purchased is $ -147563 The future worth when leased is $ The clamshell should be leased

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 2P

Related questions

Question

Transcribed Image Text:A small strip-mining coal company is trying to decide whether it should purchase or lease a new clamshell. If purchased, the "shell" will

cost $147,500 and is expected to have a $40,000 salvage value after 6 years. Alternatively, the company can lease a clamshell for only

$10,000 per year, but the lease payment will have to be made at the beginning of each year. If the clamshell is purchased, it will be

leased to other strip-mining companies whenever possible, an activity that is expected to yield revenues of $15,000 per year. If

the company's MARR is 19% per year, should the clamshell be purchased or leased on the basis of a future worth analysis? Assume the

annual M&O cost is the same for both options.

The future worth when purchased is $ -147563

The future worth when leased is $

The clamshell should be leased

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning