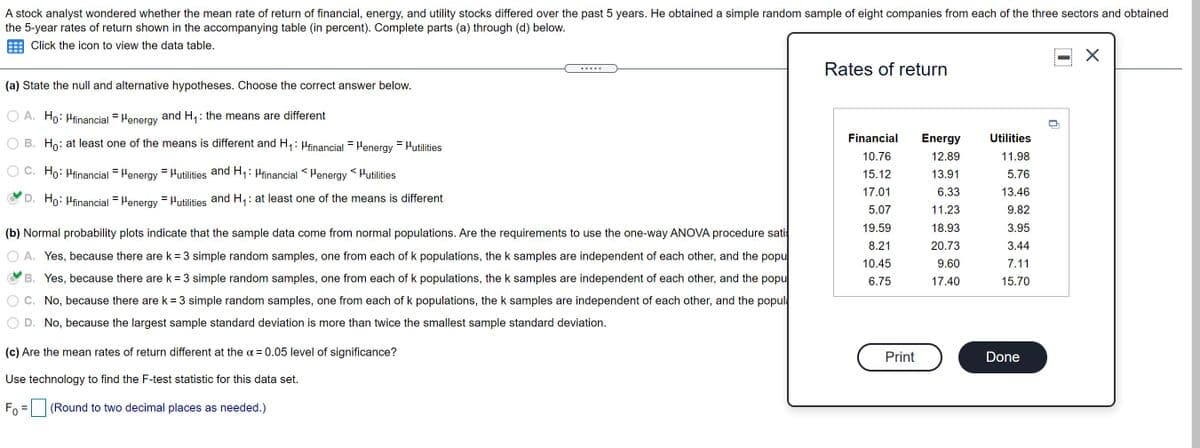

A stock analyst wondered whether the mean rate of return of financial, energy, and utility stocks differed over the past 5 years. He obtained a simple random sample of eight companies from each of the three sectors and obtained the 5-year rates of return shown in the accompanying table (in percent). Complete parts (a) through (d) below. E Click the icon to view the data table. Rates of return (a) State the null and alternative hypotheses. Choose the correct answer below. A. Ho: Hinancial Henergy and H,: the means are different O B. Ho: at least one of the means is different and H,: Henancial = Henergy = Hutilities Financial Energy Utilities 10.76 15.12 12.89 11.98 C. Ho: Hinancial = Henergy = Hutilities and H, : Hinancial Honergy * Hutilities 13.91 5.76 17.01 6.33 13.46 D. Ho: Hanancial = Henergy Hutilties and H,: at least one of the means is different O 5.07 11.23 9.82 (b) Normal probability plots indicate that the sample data come from normal populations. Are the requirements to use the one-way ANOVA procedure sati 19.59 18.93 3.95 8.21 20.73 3.44 O A. Yes, because there are k= 3 simple random samples, one from each of k populations, the k samples are independent of each other, and the popu 10.45 9.60 7.11 B. Yes, because there are k= 3 simple random samples, one from each of k populations, the k samples are independent of each other, and the popu 6.75 17.40 15.70 No, because there are k =3 simple random samples, one from each of k populations, the k samples are independent of each other, and the popul O D. No, because the largest sample standard deviation is more than twice the smallest sample standard deviation. Oc. (c) Are the mean rates of return different at the a = 0.05 level of significance? Print Done Use technology to find the F-test statistic for this data set. Fo = (Round to two decimal places as needed.)

A stock analyst wondered whether the mean rate of return of financial, energy, and utility stocks differed over the past 5 years. He obtained a simple random sample of eight companies from each of the three sectors and obtained the 5-year rates of return shown in the accompanying table (in percent). Complete parts (a) through (d) below. E Click the icon to view the data table. Rates of return (a) State the null and alternative hypotheses. Choose the correct answer below. A. Ho: Hinancial Henergy and H,: the means are different O B. Ho: at least one of the means is different and H,: Henancial = Henergy = Hutilities Financial Energy Utilities 10.76 15.12 12.89 11.98 C. Ho: Hinancial = Henergy = Hutilities and H, : Hinancial Honergy * Hutilities 13.91 5.76 17.01 6.33 13.46 D. Ho: Hanancial = Henergy Hutilties and H,: at least one of the means is different O 5.07 11.23 9.82 (b) Normal probability plots indicate that the sample data come from normal populations. Are the requirements to use the one-way ANOVA procedure sati 19.59 18.93 3.95 8.21 20.73 3.44 O A. Yes, because there are k= 3 simple random samples, one from each of k populations, the k samples are independent of each other, and the popu 10.45 9.60 7.11 B. Yes, because there are k= 3 simple random samples, one from each of k populations, the k samples are independent of each other, and the popu 6.75 17.40 15.70 No, because there are k =3 simple random samples, one from each of k populations, the k samples are independent of each other, and the popul O D. No, because the largest sample standard deviation is more than twice the smallest sample standard deviation. Oc. (c) Are the mean rates of return different at the a = 0.05 level of significance? Print Done Use technology to find the F-test statistic for this data set. Fo = (Round to two decimal places as needed.)

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.4: Distributions Of Data

Problem 19PFA

Related questions

Question

Help finding:

- Are the mean rates of return different at the

α=0.05level of significance?

- what is the F0

- What is the P value

- is there enough evidence to reject the null hypothesis.

- Draw boxplots of the three sectors to support the results obtained in part (c).

Transcribed Image Text:A stock analyst wondered whether the mean rate of return of financial, energy, and utility stocks differed over the past 5 years. He obtained a simple random sample of eight companies from each of the three sectors and obtained

the 5-year rates of return shown in the accompanying table (in percent). Complete parts (a) through (d) below.

Click the icon to view the data table.

Rates of return

.....

(a) State the null and alternative hypotheses. Choose the correct answer below.

O A. Ho: Hfinancial = Heneray and H,: the means are different

B. Ho: at least one of the means is different and H,: Hfinancial = Henergy = Hutilities

Financial

Energy

Utilities

10.76

12.89

11.98

Ho: Hfinancial = Henergy = Hutilities and H: Hfinancial <Henergy <Hutilities

15.12

13.91

5.76

17.01

6.33

13.46

D. Ho: Hfinancial = Heneray = Hutilities and H: at least one of the means is different

5.07

11.23

9.82

19.59

18.93

3.95

(b) Normal probability plots indicate that the sample data come from normal populations. Are the requirements to use the one-way ANOVA procedure sati

8.21

20.73

3.44

A. Yes, because there are k = 3 simple random samples, one from each of k populations, the k samples are independent of each other, and the popu

10.45

9.60

7.11

B. Yes, because there are k 3 simple random samples, one from each of k populations, the k samples are independent of each other, and the popu

6.75

17.40

15.70

C. No, because there are k = 3 simple random samples, one from each of k populations, thek samples are independent of each other, and the popul

D. No, because the largest sample standard deviation is more than twice the smallest sample standard deviation.

(c) Are the mean rates of return different at the a = 0.05 level of significance?

Print

Done

Use technology to find the F-test statistic for this data set.

Fo = (Round to two decimal places as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill