А В C Unlevered Firm Levered Firm 10,000 3,200 6,800 2,312 4,488 3,200 1 2 EBIT 10,000 3 Interest 4 Taxable Income 10,000 3,400 6,600 5 Tax (tax rate: 34%) 6 Net Income 7 CFFA 0

Q: 6. The market value of Company T's equity is $15.0 million, and the market value of its risk-free…

A: Weighted average cost of capital(WACC) is the firm's overall cost of capital taking into…

Q: The market value of Stan Company's equity is P15 million, and the market value of its risk free debt…

A:

Q: Alderson Research has the capital structure given here. If Alderson’s tax rate is 30%, what is its…

A: bond preferred stock common stock book value $1000 $400 $600 market value $1000 $300 $1700…

Q: Theresa’s belongs to Harvester, which has expected earnings before interest and tax (EBIT) of…

A: The question is related to Capital Structure. MM Approach corporate taxes:- MM later recognizes the…

Q: Consider the case of two firms, ABC which is an unlevered firm and XYZ which is a levered firm. The…

A: (i) Calculation of cost of capital of each firm: *cost of capital is the firms overall cost of…

Q: Hanson Ltd had a market value of $400m and had no debt The company has decided to issue $100m worth…

A: Answer:- Value of firm definition:- The worth of the company, also called as value of firm. It is…

Q: Theresa’s belongs to Harvester, which has expected earnings before interest and tax (EBIT) of…

A: The question is related to Capital Structure. MM Proposition :- When taxes are applicable to…

Q: Consider two hypothetical firms: Firm U, which uses no debt financing, and Firm L, which uses…

A: A firm that uses both debt and equity to raise the funds for the business operations is term as the…

Q: The market value of Lays Corporation's equity is 50 million $ and the market value of its debt is 27…

A: Cost of equity = Risk free rate + (Market rate of return - risk free rate) * Beta Weight of equity…

Q: lsen Outfitters Inc. believes that its optimal capital structure consists of 55% common equity and…

A: 1. Optimal capital structure: Common equity=55% Debt =45% 2.Tax rate =40…

Q: Gaucho Services starts life with all-equity financing and a cost of equity of 14%. Suppose it…

A: Given: Cost of equity = 14% Debt = 45% Equity = 55% Cost of debt = 9.5% Tax rate = 40%

Q: An unlevered firm has a value of $500 million. An otherwise identical butlevered firm has $50…

A: Introduction: A corporation utilizes debt in its capital structure is known as levered firm and a…

Q: Firms A and B are identical except for their capital structure: A is fully equity financed, while B…

A: Frist we need to calculate the value of ungeared firm(firm A). In prefect capital market line where…

Q: Gaucho Services starts life with all-equity financing and a cost of equity of 14%. Suppose it…

A: Debt = 45% Equity = 55% rD =9.5% Tax = 40% Cost of Equity = 14%

Q: Assume that a company borrows at a cost of 0.08. Its tax rate is 0.35. What is the minimum after-tax…

A: Cost of Capital is the rate that a company is expected to pay on average on all the security holders…

Q: Mentone Global Corporation (MGC) is attempting to evaluate two alternative capital structures - X…

A: WACC: It refers to the sum of the average weighted cost of each security in the capital structure.…

Q: and $750,000,000 of debt, then what is the after-tax weighted aver Mining if it is subject to a 35…

A: Cost of equity and cost of debt is given we have to weight of both and calculate weighted average…

Q: The company requires P1,000,000 for its proposed plan. The following financial alternatives are…

A: Data given: i) Plan I: 100% Equity Capital (Face Value P100)ii) Plan III: 50% Equity Capital (Face…

Q: XYZ Ltd. Decides to use two financial plans and they need Rs. 50000 for investment. Plan A Plan B…

A: A financial plan is a record that contains an individual's present financial condition, long-term…

Q: Kohwe Corporation plans to issue equity to raise $50.7 million to finance a new investment. After…

A: Therefore, the NPV is $85.06 million.

Q: Assume the following data for U&P Company: Debt (D) = $100 million; Equity (E) = $300 million; rD =…

A: Debt (D) = $100 million Equity (E) = $300 million Total capital = $400 million (i.e. $100 million +…

Q: Your company is financed 20% with riskless debt with a yield of 6% and 80% with equity with a cost…

A: Debt ratio = 20% Debt yield = 6% Equity ratio = 80% Cost of equity = 14%

Q: 1. Pfd Company has debt with a yield to maturity of 7.8%, a cost of equity of 14.2%, and a cost of…

A: The weighted average cost of capital (WACC) is the computation of the company's cost of capital. The…

Q: Take It All Away has a cost of equity of 10.75 percent, a pretax cost of debt of 5.41 percent, and a…

A: Weighted Average Cost of Capital(WACC) is calculated by considering the proportionate capital…

Q: Compute the market value of a levered corporation and its cost of capital knowing that the debt…

A: in this we have to calculate cost equity and cost of capital and than find out value of firm.

Q: Kay Corp is comparing 2 different capital structure. Plan I would in 7,000 shares of stocks and…

A: Plan 1 capital structure 7000 shares Debt RM 160,000 Plan II capital structure 5000 shares Debt RM…

Q: f company’s debt-to-equity ratio is 0.25, what is the weighted average cost of capital for the…

A: WACC =(Cost of equity * Weight of equity) + (Cost of debt * Weight of debt)

Q: Banana Airways. has an expected EBIT of $1,515,000 in perpetuity and tax rate of 25%. The Banana's…

A:

Q: Bulldogs Inc. is considering whether to pursue a restricted or relaxed current asset investment…

A: Return on equity is the net income earned by the amount invested in the net assets of the company.…

Q: Take It All Away has a cost of equity of 10.45 percent, a pretax cost of debt of 5.21 percent, and a…

A: WACC =(cost of debt * market value weight of debt)+ (cost of equity * market value weight of equity)

Q: Ivanhoe Resources Company has a WACC of 12.0 percent, and it is subject to a 40 percent marginal tax…

A:

Q: The ABCCompany has a cost of equity of 21.2 percent, a pre-tax cost of debt of 5.2percent, and a tax…

A: WACC: It is the company’s total cost of capital which is computed by giving weights to the sources…

Q: You have been tasked with the responsibility of calculating the WACC for Meeks Investments Limited…

A: WACC is the avg. cost to the company for financing through different sources. It can be calculated…

Q: interest and taxes should be 10% of total sales, and the federal-plus-state tax rate is 25%. a. What…

A: Information Provided: Expected sales = $3 million Fixed assets = $2 million Debt-to assets = 50%…

Q: Firms A and B are identical except for their capital structure: A is fully equity financed, while B…

A: Firm A is fully equity fincanced, Firm B has 50m debt with 5% interest rate. Cost of capital of Firm…

Q: Consider two hypothetical firms: Firm U, which uses no debt financing, and Firm L, which uses…

A:

Q: Company X has debt and equity as source of funds..Company X has market value of debt as $ 150000 and…

A: WACC is weighted average cost of capital including cost of equity and after tax cost of debt.So you…

Q: vered with firm value at $640,000. maze is currently deciding whether including debt in its capital…

A: Cost of equity can be find out from the net income and value of equity.

Q: The company requires P1,000,000 for its proposed plan. The following financial alternatives are…

A: Given, Plan 1 has 100% equity capital Plan III has 50% equity capital and 50% preference capital

Q: Pfd Company has debt with a yield to maturity of 6.3%, a cost of equity of 15.1%, and a cost of…

A: The weighted average cost of capital computes the weighted cost of sourcing funds from different…

Q: Company A unlevered value is $100 million. The tax rate is 30%. The debt cost of capital is 3% and…

A:

Q: Bulldogs Inc. is considering whether to pursue a restricted or relaxed current asset investment…

A: EBIT = P 40000 Interest rate = 10% Fixed assets = P 200000 Sales = P 500000

What is the

Assume that cost of debt = 8%; unlevered cost of capital = 10%; systematic risk of the asset is 1.5. Assume a 50% debt to equity ratio.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- 1. BATO Corp has the following data for the year ended December 31, 2021: PH USA Gross Income: P6,000,000.00 $50,000.00 Deductions: P4,000,000.00 $20,000.00 Dollar Rate P45:$1 Determine income tax due assuming the company is a domestic corporation with company assets amounting to more than P100M. Group of answer choices P837,500.00 P800,000.00 P492,500.00 P3,350,000.00 2. LENI Lugawan Corp has the following data for the year ended December 31, 2021: PH USA Gross Income: P6,000,000.00 $50,000.00 Deductions: P4,000,000.00 $20,000.00 Dollar Rate P45:$1 Determine income tax due assuming the company is a resident corporation. Group of answer choices P600,000.00 P1,500,000.00 P500,000.00 3. YORMS Corp has the following data for the year ended December 31, 2021:…Item 2 The tax rates for a particular year are shown below: Taxable Income Tax Rate $0 – 50,000 15 % 50,001 – 75,000 25 % 75,001 – 100,000 34 % 100,001 – 335,000 39 % What is the average tax rate for a firm with taxable income of $129,513?For income tax purposes, what is the amount of gross income given the following amounts? Gross sales 4,000,000.00 Sales discounts, returns and allowances 100,000.00 Cost of sales 1,500,000.00 Itemized deductions 800,000.00 Given the amount, how much is the minimum corporate income tax? Group of answer choices P78,000.00 P34,000.00 P32,000.00 P48,000.00

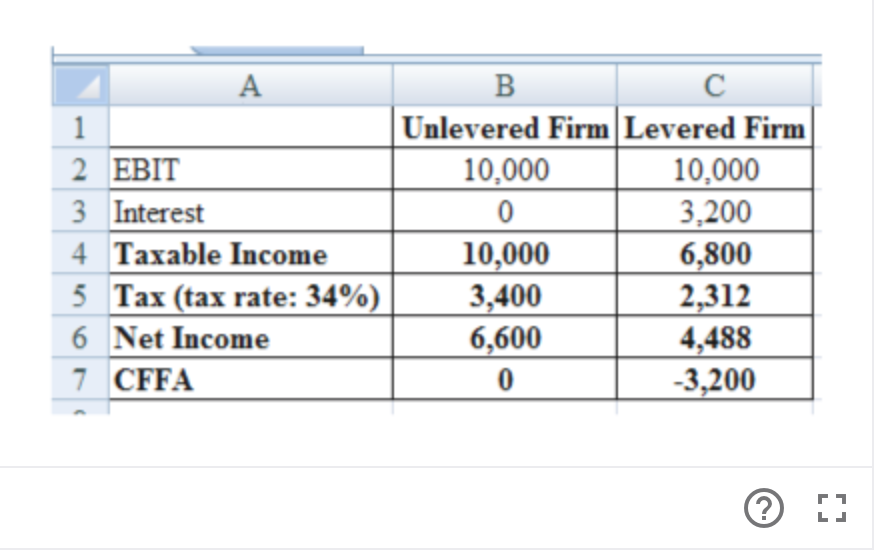

- Red Velvet Corporation, a domestic corporation has the following data. 2021 2022 Gross Income 3,500,000.00 2,400,000.00 Taxable Income 125,000.00 500,000.00 The income tax payable for 2021 is 31,250 40,000 35,000 37,500Button Company has the following two temporary differences between its income tax expense and income taxes payable. 00202000) 00202100) 00202200) Pretax financial income $840,000) $910,000) $945,000) Excess depreciation expense on tax return (30,000) (40,000) (10,000) Excess warranty expense in financial income 0020,000) 0010,000) 0008,000) Taxable income $830,000) $880,000) $943,000) The income tax rate for all years is 20%. Instructions a. Assuming there were no temporary differences prior to 2020, prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2020, 2021, and 2022. b. Indicate how deferred taxes will be reported on the 2022 balance sheet. Button's product warranty is for 12 months. c. Prepare the income tax expense section of the income statement for 2022, beginning with the line “Pretax financial income.”Fill in the blanks: Unlevered firm Levered firm EBIT 10,000 10,000 Interest 0 3,200 Taxable income Tax (tax rate: 34%) Net income CFFA What is the taxable income, tax, net income, and CFFA for the unlevered and levered firms?

- 54. In relation to transaction #1, How much is the capital gains tax due, if any? A. PO C. P300,000 B. P360,000. D. P450,000If Your Taxable Income Is Up to $19,050 $19,050 $77,400 $77,400 $165,000 $165,000 $315,000 $315,000 - $400,000 $400,000 - $600,000 Over $600,000 2018 Individual Tax Rates Single Individuals If Your Taxable Income Is Up to $9,525 $9,525 $38,700 $38,700 $82,500 $82,500 $157,500 $157,500 $200,000 $200,000 $500,000 Over $500,000 Standard deduction for individual: $12,000 You Pay This Amount on the Base of the Bracket $ $0 952.50 4,453.50 14,089.50 32,089.50 45,689.50 150,689.50 Married Couples Filing Joint Returns Plus This Percentage on the Excess over the Base (Marginal Rate) 10.0% 12.0 22.0 24.0 32.0 35.0 37.0 You Pay This Amount on the Base of the Bracket Plus This Percentage on the Excess over the Base (Marginal Rate) 10.0% 12.0 22.0 24.0 32.0 35.0 37.0 $0 1,905.00 8,907.00 28,179.00 64,179.00 91,379.00 161,379.00 Average Tax Rate at Top of Bracket 10.0% 11.5 17.1 20.4 22.8 30.1 37.0 Average Tax Rate at Top of Bracket 10.0% 11.5 17.1 20.4 22.8 26.9 37.0 Standard deduction for married…ABC Corporation has the following information for the taxable year 2022: Quarter RCIT MCIT CWT 1st P200,000 P160,000 P40,000 2nd 240,000 500,000 60,000 3Rd 500,000 150,000 80,000 4th 300,000 200,000 70,000 MCIT carry-over from prior year amounts to P60,000 and excess tax credits from prior year amounts to P20,000. How much was the income tax payable for the first quarter? How much was the income tax payable for the third quarter? How much was the annual income tax payable?

- 1. A VAT-registered business makes a sale of P10,000, inclusive of VAT. The VAT on the sale can be computed asa. P10,000 x 12%b. P10,000 12%.c. P10,000 x 12%/112%d. P10,000 -12%/112%2. A Non-VAT registered business makes total sales of P110.000 during a taxable period.The percentage tax can be computed asa. P110,000 x 3%.b. P110,000 3%.c. P110,000 x 3%/103%d. P110,000 3%/103%3. A VAT-registered business makes a sale of P34,500, inclusive of VAT. The amount of sale that was reported in the statement of comprehensive income can be computed asa. P34,500 x 112%.b. P34,500 112%.c. P34,500 x 12%/112%d. P34,500 12%/112%4. A VAT-registered business has total sales of P62,720 and total purchases of P25,088, both inclusive of VAT. How much is the net VAT payable to the BIR?a. 1,882 b. 4,032 c. 4,516 d. 5,2245. A Non-VAT business has total sales of P200,720. How much is the sales tax payable to the BIR?a. 2,007b. 4,015c. 4,516d. 6,022Compute the taxable income. A. ZeroB. P4,000,000C. P5,000,000D. P29,000,000ver But not over Tax is: Of amount over: $0 $50,000 15% $0 $50,000 $75,000 $7,500 + 25% $50,000 $75,000 $ 100,000 $13,750 + 34% $75,000 $100,000 $335,000 $22,250 + 39% $100,000 $335,000 $10,000,000 $ 113,900+ 34% $335,000 $10,000,000 $15,000,000 $3,400,000 + 35% $10,000,000 $15,000,000 $18, 333, 333 $ 5,150,000 + 38% $15,000,000 $18,333,333 35% $0 Refer to the table above: A firm has $12, 000, 000 in taxable income. What is the firm's average tax rate?