А В C Unlevered Firm Levered Firm 10,000 3,200 6,800 2,312 4,488 3,200 1 2 EBIT 10,000 3 Interest 4 Taxable Income 10,000 3,400 6,600 5 Tax (tax rate: 34%) 6 Net Income 7 CFFA 0

Q: Optional deduction is computed as a.net income less net expenses b.gross sales multiply to 40%

A: The answer is option b. gross sales multiply to 40%

Q: 36. ABC Industries has the following acount balances: Retained eamings Revenue Operating Expenses…

A: Cost Accounting: It is the process of collecting, recording, analyzing the cost, summarizing cost,…

Q: Richard eami $42,250 perycao. what i8 hi8 annual Income tax-2

A: Income tax is the tax that is paid by the individuals and the businesses to the government on the…

Q: 1. BATO Corp has the following data for the year ended December 31, 2021:…

A: As per our protocol we provide solutions to only one question but as you have asked multiple…

Q: DICK Corp has the following data for the year ended December 31, 2021:…

A: Government Owned and Controlled Corporation (GOCC) According to Philippines taxation rules…

Q: Simple Accounting - Property Tax. Market Value Tax Policy Rate Property Tax $1,370,980.00 50.75%…

A: Property Tax = Property Tax is the tax imposed on property by the authority.

Q: P5 Pre-tax profit Items not recognized at year-end were as follows: Prepaid insurance Accrued wages…

A: Pretax profit =5000000 Prepaid insurance =250000 Accrued wages =200000 Rent revenue collected in…

Q: Payday Gross earnings 1/1/2022 1/4/2022 $ 20,564 S 1/11/2022 $ 20,564 S 1/18/2022 $ 200,564…

A: Year to Date in Payroll The Calculation of Year to Date in payroll which was incurred the total…

Q: this company. 1. Pretax financial income for 2021 is $100,000. 2. The tax rate enacted for…

A: PLEASE GIVE A LIKE, your response matters Part 1 Pre-tax financial income $ 100,000…

Q: (LO. 6) Beckett Corporation has nexus with States A and B. Apportionable income for the year totals…

A: Tax liability: When a person or an entity earns an income, then that income is taxed on the basis…

Q: Oakdale Fashions, Inc. had $245.000 in 2018 taxable income. Using the tax schedule in Table 2.3 to…

A: Average tax rate = (Total Taxes / Total Taxable Income) * 100 Marginal Tax rate = Amount of…

Q: 2021 P3,600.0 P3,000 3.060.0 2022 Sales 2.550 Operating costs (excluding depreciation and…

A: NOWC stands for Net operating working capital refers to the difference among the current assets (CA)…

Q: 20X8 20X9 tax accounting income (financial statements) ple income (tax return) ne tax rate $510,000…

A: The answer is stated below:

Q: Assume that cost of debt = 8%; unlevered cost of capital = 10%; systematic risk of the asset is 1.5.…

A: Value of unlevered firm can be calculated using,EBIT = 10000Tax = 34%kUL=10% (unlevered cost of…

Q: Status Single DATA TABLE Total Tax Payments $ 8,342…

A: Tax Refunds includes the amounts which are additionally paid to the government,. This is computed by…

Q: Identify the below missing figures (A,B,C,D,E). Annual Income TAX RATE P250,000 and below 0%…

A: Here given the details of tax structure which are applicable for Philippines taxation. There are…

Q: X is a percentage tax business. X issued a VAT-invoice for goods sold in the amount of P12,400…

A: VAT Payable = VAT Collected from Sale of Goods - VAT Paid on Goods Purchased

Q: of sales it ncome, net of 20% final tax P 900, 000 400, 000 P 500, 000 16, 000 12, 000 ncome from…

A: A tax deduction is declared by the taxable assessee for which the tax is being determined and he…

Q: Assume that the personal tax rate on interest income is 15% and the personal tax rate on dividends…

A: Here, Personal Tax on Interest Income is 15% Personal Tax rate on Dividends is 10% EBIT is 5 Euros…

Q: Q No. 05: a): Moon Star (Pvt) Ltd. which is an active tax payer company, provides (05) following…

A: Given, Tax rate on income from house property and business = 29%

Q: Q1 Q2 Q3 ues 20,000 25,000 18,000 ions 16.000 30.000 23. 000

A: Tax refers to the amount which is imposed by the taxation authorities on the entities or individuals…

Q: Return to q Given the folllowing tax structure: Taxpayer Mae Pedro Salary $ 40,500 $ 53,000 Total…

A: Vertical equity tax structure requires taxpayers to pay more tax if they earned a higher income. The…

Q: Taxable income Marginal tax rate 0-12.000 € 0% 12.001-30.000€ 29% 30.001-75.000 € 39% άνω 75.000 €…

A: on the taxable income the tax recharge by the government on the basis of income . generally as the…

Q: Profit after tax A) 1,75 c) 0,35 = $27894 sharer issued = 10 Ordinary Market price per ordinary…

A: Profit After tax is $27,894 Ordinary shares issued are 10,000 Market price per ordinary share is…

Q: The Company provided the following financial information: Assets 7,250,800.00…

A: time interest earned ratio measures company position with respect to payment of its interest expense…

Q: TAX PAYER DOMESTIC CORPO RATIO Inside the Plalippines 7,550, 000 4,100,000 1550,000 outside Bus mess…

A: Assumption :- We are assuming taxation year 2021.…

Q: Assets 7,250,800.00 Tax rate 35% BEP 14% ROA 4%

A: Time Interest Earned (TIE) is one type of solvency ratio, It measures a company's ability to pay off…

Q: Withholding Tax Payable 203 (15) (31) 150.00 150.00 SSS &Medicare Payable 204 (31) 375.00 Patrick,…

A: T- Accounts Balance: Accounts Title Debit Credit Withholding tax payable 300 Patrick,…

Q: A C corporation earns $9.10 per share before taxes. The corporate tax rate is 39%, the personal tax…

A: Earning before share = $9.10 Corporate Tax rate = 39% Personal tax rate on dividend = 15% Personal…

Q: Instruction: Complete the following table. Gross Compensation Tax Income Таx Table Tax Due 1.…

A: Tax: Tax is a financial charge imposed by the county's government on the income of the person, and…

Q: A firm is a sole proprietorship that has taxable income of $94,200. The additional tax that will be…

A: given that, taxable income = $94200 from the above, we can see that, the taxable income of $94200…

Q: 0,000 30,000 Total Tax $ 7,972 40,000

A: Taxable Income required for Target tax is 55561.36 Below is the detailed solution Tax rate (%) 10 12…

Q: X is a percentage tax business. X issued a VAT-invoice for goods sold in the amount of P12,400…

A: VAT ouput from Sale of Goods = (Total sales / (1 + VAT rate) x VAT rate = (P12400 / 1.12) x 12% =…

Q: Marvel Corporation (a C-corporation) has the following operating profit for 2019 through 2021. Year…

A: Net operating loss is a situation when the deductions exceed the income. For example, deductions…

Q: Business income 50,000 100,000 400,000 300,000 30,000 Professional fees Compensation income 200,000…

A: Residence Status of Philippines tax payment It is difficult in part to make the judgement of the…

Q: Samuel Corp. provides the following information: EBIT = $386.50 Tax (TC ) = 21% Debt = $700 RU =…

A: EBIT = $386.50Tax (TC ) = 21%Debt = $700RU = 10%

Q: The following table pertains to C. J. Company: Year Taxable Income Tax Rate 2020 ($1,000,000) 25%…

A: The question is based on the concept to set off of loss with forward year profit for calculation of…

Q: 1 - X Iron and Steel Industry and Trade Joint Stock Company of 2018 year corporate tax amount is…

A: A company will report all its assets and liabilities in the balance sheet. When income tax is…

Q: Inc., a domestic corporation. How much final tax m Vodka, Inc.? a. PO 05ginu2 to 19hl b. P11,111AL…

A: Dividend Received Deduction is a kind of deduction in the taxation that is received by a corporation…

Q: revenues in its 20x4 financial statements, of which P12,000 will 6. Scott Corp. received cash of…

A: Answer: Given Revenue reported in 20X4 = P 20000 Not taxed until 20X5= P 12000 Tax rate for 20X4=…

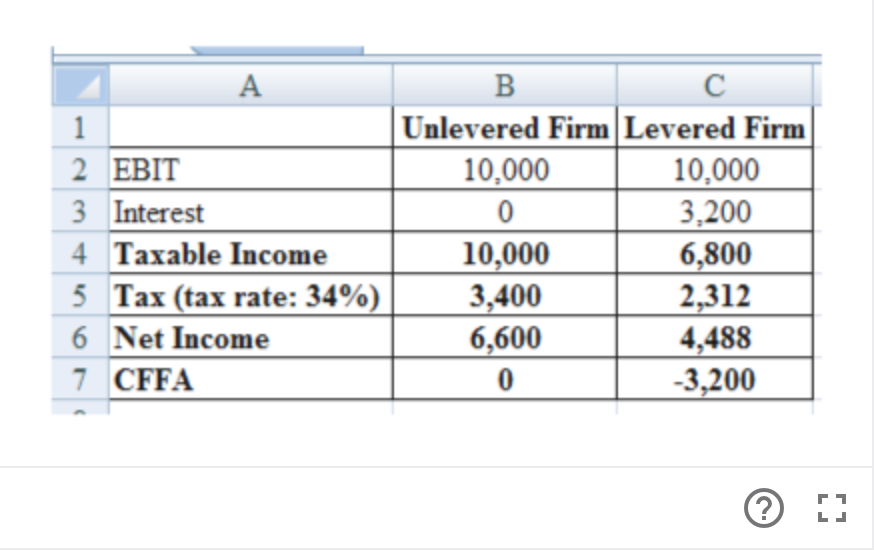

Q: Fill in the blanks: Unlevered firm…

A: Calculation of Taxable Income, Tax, Net Income, and CFFA for the Unlevered and Levered Firms:Excel…

What is the size of debt for each firm?

Assume that cost of debt = 8%; unlevered cost of capital = 10%; systematic risk of the asset is 1.5

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

- 1. BATO Corp has the following data for the year ended December 31, 2021: PH USA Gross Income: P6,000,000.00 $50,000.00 Deductions: P4,000,000.00 $20,000.00 Dollar Rate P45:$1 Determine income tax due assuming the company is a domestic corporation with company assets amounting to more than P100M. Group of answer choices P837,500.00 P800,000.00 P492,500.00 P3,350,000.00 2. LENI Lugawan Corp has the following data for the year ended December 31, 2021: PH USA Gross Income: P6,000,000.00 $50,000.00 Deductions: P4,000,000.00 $20,000.00 Dollar Rate P45:$1 Determine income tax due assuming the company is a resident corporation. Group of answer choices P600,000.00 P1,500,000.00 P500,000.00 3. YORMS Corp has the following data for the year ended December 31, 2021:…Item 2 The tax rates for a particular year are shown below: Taxable Income Tax Rate $0 – 50,000 15 % 50,001 – 75,000 25 % 75,001 – 100,000 34 % 100,001 – 335,000 39 % What is the average tax rate for a firm with taxable income of $129,513?For income tax purposes, what is the amount of gross income given the following amounts? Gross sales 4,000,000.00 Sales discounts, returns and allowances 100,000.00 Cost of sales 1,500,000.00 Itemized deductions 800,000.00 Given the amount, how much is the minimum corporate income tax? Group of answer choices P78,000.00 P34,000.00 P32,000.00 P48,000.00

- Red Velvet Corporation, a domestic corporation has the following data. 2021 2022 Gross Income 3,500,000.00 2,400,000.00 Taxable Income 125,000.00 500,000.00 The income tax payable for 2021 is 31,250 40,000 35,000 37,500Button Company has the following two temporary differences between its income tax expense and income taxes payable. 00202000) 00202100) 00202200) Pretax financial income $840,000) $910,000) $945,000) Excess depreciation expense on tax return (30,000) (40,000) (10,000) Excess warranty expense in financial income 0020,000) 0010,000) 0008,000) Taxable income $830,000) $880,000) $943,000) The income tax rate for all years is 20%. Instructions a. Assuming there were no temporary differences prior to 2020, prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2020, 2021, and 2022. b. Indicate how deferred taxes will be reported on the 2022 balance sheet. Button's product warranty is for 12 months. c. Prepare the income tax expense section of the income statement for 2022, beginning with the line “Pretax financial income.”Fill in the blanks: Unlevered firm Levered firm EBIT 10,000 10,000 Interest 0 3,200 Taxable income Tax (tax rate: 34%) Net income CFFA What is the taxable income, tax, net income, and CFFA for the unlevered and levered firms?

- 54. In relation to transaction #1, How much is the capital gains tax due, if any? A. PO C. P300,000 B. P360,000. D. P450,000If Your Taxable Income Is Up to $19,050 $19,050 $77,400 $77,400 $165,000 $165,000 $315,000 $315,000 - $400,000 $400,000 - $600,000 Over $600,000 2018 Individual Tax Rates Single Individuals If Your Taxable Income Is Up to $9,525 $9,525 $38,700 $38,700 $82,500 $82,500 $157,500 $157,500 $200,000 $200,000 $500,000 Over $500,000 Standard deduction for individual: $12,000 You Pay This Amount on the Base of the Bracket $ $0 952.50 4,453.50 14,089.50 32,089.50 45,689.50 150,689.50 Married Couples Filing Joint Returns Plus This Percentage on the Excess over the Base (Marginal Rate) 10.0% 12.0 22.0 24.0 32.0 35.0 37.0 You Pay This Amount on the Base of the Bracket Plus This Percentage on the Excess over the Base (Marginal Rate) 10.0% 12.0 22.0 24.0 32.0 35.0 37.0 $0 1,905.00 8,907.00 28,179.00 64,179.00 91,379.00 161,379.00 Average Tax Rate at Top of Bracket 10.0% 11.5 17.1 20.4 22.8 30.1 37.0 Average Tax Rate at Top of Bracket 10.0% 11.5 17.1 20.4 22.8 26.9 37.0 Standard deduction for married…ABC Corporation has the following information for the taxable year 2022: Quarter RCIT MCIT CWT 1st P200,000 P160,000 P40,000 2nd 240,000 500,000 60,000 3Rd 500,000 150,000 80,000 4th 300,000 200,000 70,000 MCIT carry-over from prior year amounts to P60,000 and excess tax credits from prior year amounts to P20,000. How much was the income tax payable for the first quarter? How much was the income tax payable for the third quarter? How much was the annual income tax payable?

- 1. A VAT-registered business makes a sale of P10,000, inclusive of VAT. The VAT on the sale can be computed asa. P10,000 x 12%b. P10,000 12%.c. P10,000 x 12%/112%d. P10,000 -12%/112%2. A Non-VAT registered business makes total sales of P110.000 during a taxable period.The percentage tax can be computed asa. P110,000 x 3%.b. P110,000 3%.c. P110,000 x 3%/103%d. P110,000 3%/103%3. A VAT-registered business makes a sale of P34,500, inclusive of VAT. The amount of sale that was reported in the statement of comprehensive income can be computed asa. P34,500 x 112%.b. P34,500 112%.c. P34,500 x 12%/112%d. P34,500 12%/112%4. A VAT-registered business has total sales of P62,720 and total purchases of P25,088, both inclusive of VAT. How much is the net VAT payable to the BIR?a. 1,882 b. 4,032 c. 4,516 d. 5,2245. A Non-VAT business has total sales of P200,720. How much is the sales tax payable to the BIR?a. 2,007b. 4,015c. 4,516d. 6,022Compute the taxable income. A. ZeroB. P4,000,000C. P5,000,000D. P29,000,000ver But not over Tax is: Of amount over: $0 $50,000 15% $0 $50,000 $75,000 $7,500 + 25% $50,000 $75,000 $ 100,000 $13,750 + 34% $75,000 $100,000 $335,000 $22,250 + 39% $100,000 $335,000 $10,000,000 $ 113,900+ 34% $335,000 $10,000,000 $15,000,000 $3,400,000 + 35% $10,000,000 $15,000,000 $18, 333, 333 $ 5,150,000 + 38% $15,000,000 $18,333,333 35% $0 Refer to the table above: A firm has $12, 000, 000 in taxable income. What is the firm's average tax rate?