A v2.cengagenow.com Inbox (229) - ilopezau@my.chemeketa.edu. Google Docs Mind Tap - Cengage Learning CengageNOWv2 | Online teaching and learnin. Calculator Print Item eBook Show Me How Job Costs At the end of August, Ellis Company had completed Jobs 40 and 42. Job 40 is for 1,000 units, and Job 42 is for 500 units. The following data relate to these two jobs: On August 4, raw materials were requisitioned for production as follows: 300 units for Job 40 at $16 per unit and 1,400 units for Job 42 at $18 per unit. During August, Ellis Company accumulated 700 hours of direct labor costs on Job 40 and 400 hours on Job 42. The total direct labor was incurred at a rate of $12 per direct labor hour for Job 40 and $10 per direct labor hour for Job 42. The predetermined factory overhead rate is $10.00 per direct labor hour. a. Determine the balance on the job cost sheets for Jobs 40 and 42 at the end of August. Job 40 Job 42 b. Determine the cost per unit for Jobs 40 and 42 at the end of August. If required, round your answers to the nearest cent. Job 40 $1 Job 42

A v2.cengagenow.com Inbox (229) - ilopezau@my.chemeketa.edu. Google Docs Mind Tap - Cengage Learning CengageNOWv2 | Online teaching and learnin. Calculator Print Item eBook Show Me How Job Costs At the end of August, Ellis Company had completed Jobs 40 and 42. Job 40 is for 1,000 units, and Job 42 is for 500 units. The following data relate to these two jobs: On August 4, raw materials were requisitioned for production as follows: 300 units for Job 40 at $16 per unit and 1,400 units for Job 42 at $18 per unit. During August, Ellis Company accumulated 700 hours of direct labor costs on Job 40 and 400 hours on Job 42. The total direct labor was incurred at a rate of $12 per direct labor hour for Job 40 and $10 per direct labor hour for Job 42. The predetermined factory overhead rate is $10.00 per direct labor hour. a. Determine the balance on the job cost sheets for Jobs 40 and 42 at the end of August. Job 40 Job 42 b. Determine the cost per unit for Jobs 40 and 42 at the end of August. If required, round your answers to the nearest cent. Job 40 $1 Job 42

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter2: Basic Managerial Accounting Concepts

Section: Chapter Questions

Problem 28BEB

Related questions

Question

Transcribed Image Text:A v2.cengagenow.com

Inbox (229) - ilopezau@my.chemeketa.edu.

Google Docs

Mind Tap - Cengage Learning

CengageNOWv2 | Online teaching and learnin.

Calculator

Print Item

eBook

Show Me How

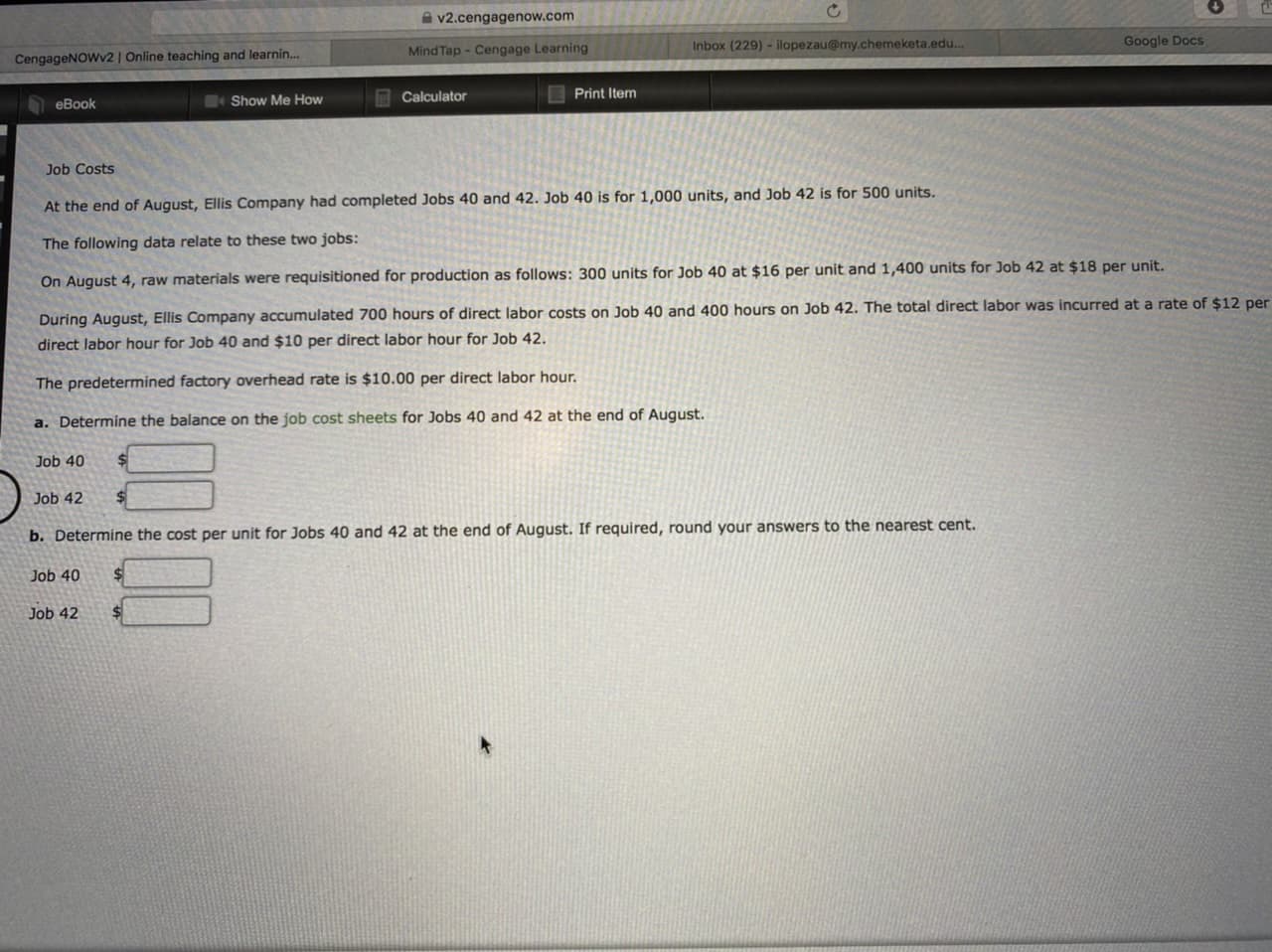

Job Costs

At the end of August, Ellis Company had completed Jobs 40 and 42. Job 40 is for 1,000 units, and Job 42 is for 500 units.

The following data relate to these two jobs:

On August 4, raw materials were requisitioned for production as follows: 300 units for Job 40 at $16 per unit and 1,400 units for Job 42 at $18 per unit.

During August, Ellis Company accumulated 700 hours of direct labor costs on Job 40 and 400 hours on Job 42. The total direct labor was incurred at a rate of $12 per

direct labor hour for Job 40 and $10 per direct labor hour for Job 42.

The predetermined factory overhead rate is $10.00 per direct labor hour.

a. Determine the balance on the job cost sheets for Jobs 40 and 42 at the end of August.

Job 40

Job 42

b. Determine the cost per unit for Jobs 40 and 42 at the end of August. If required, round your answers to the nearest cent.

Job 40

$1

Job 42

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning