a. Calculate Keystone's return on stockholders' equity. Round your answer to two decimal places. % b. Industry average ratios are Net profit margin 8.5% Total asset turnover 2.1 times Equity multiplier 1.2 times Compare Keystone's net profit margin, total asset turnover, and equity multiplier to these averages. Round your answers to two decimal places.

a. Calculate Keystone's return on stockholders' equity. Round your answer to two decimal places. % b. Industry average ratios are Net profit margin 8.5% Total asset turnover 2.1 times Equity multiplier 1.2 times Compare Keystone's net profit margin, total asset turnover, and equity multiplier to these averages. Round your answers to two decimal places.

Chapter3: Evaluation Of Financial Performance

Section: Chapter Questions

Problem 13P

Related questions

Question

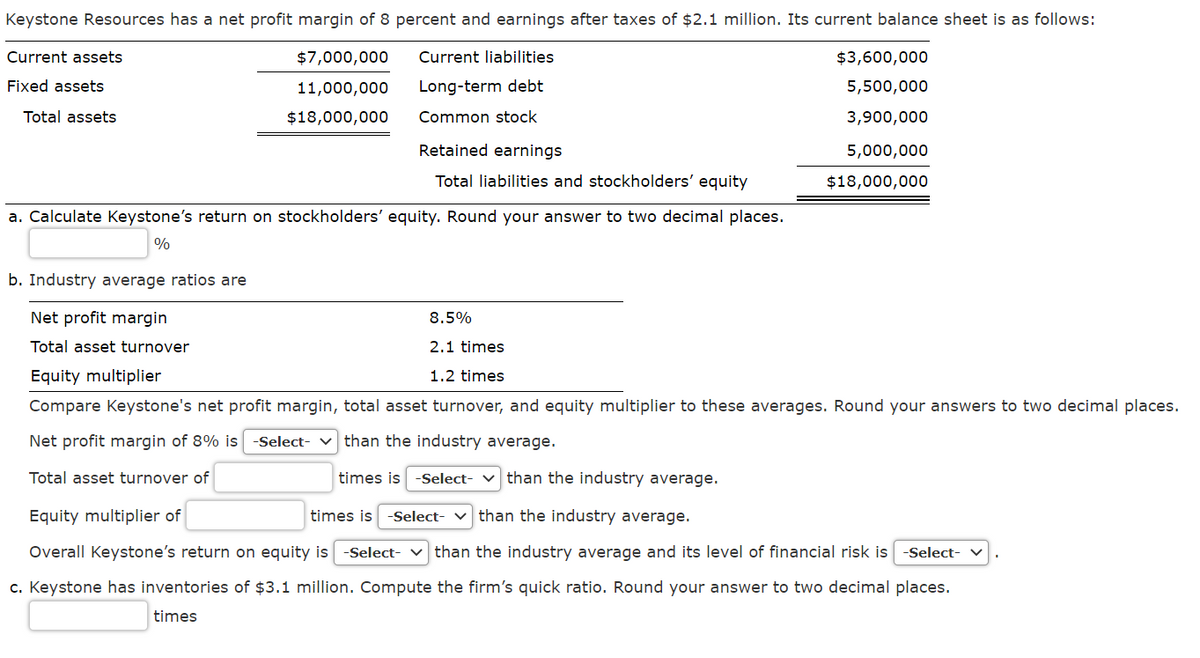

Transcribed Image Text:Keystone Resources has a net profit margin of 8 percent and earnings after taxes of $2.1 million. Its current balance sheet is as follows:

Current assets

$7,000,000

Current liabilities

$3,600,000

Fixed assets

11,000,000

Long-term debt

5,500,000

Total assets

$18,000,000

Common stock

3,900,000

Retained earnings

5,000,000

Total liabilities and stockholders' equity

$18,000,000

a. Calculate Keystone's return on stockholders' equity. Round your answer to two decimal places.

%

b. Industry average ratios are

Net profit margin

8.5%

Total asset turnover

2.1 times

Equity multiplier

1.2 times

Compare Keystone's net profit margin, total asset turnover, and

multiplier to these averages. Round your answers to two decimal places.

Net profit margin of 8% is

-Select- v than the industry average.

Total asset turnover of

times is -Select- v than the industry average.

Equity multiplier of

times is -Select- v than the industry average.

Overall Keystone's return on equity is

Select- v than the industry average and its level of financial risk is

-Select-

c. Keystone has inventories of $3.1 million. Compute the firm's quick ratio. Round your answer to two decimal places.

times

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning