a. Dwayne Wade Company recently signed a lease for a new office building, for a lease period of 10 years. Under the lease agreement, a security deposit of $12,000 is made, with the deposit to be returned at the expiration of the lease, with interest compounded at 5% per year. What amount will the company receive at the time the lease expires?

a. Dwayne Wade Company recently signed a lease for a new office building, for a lease period of 10 years. Under the lease agreement, a security deposit of $12,000 is made, with the deposit to be returned at the expiration of the lease, with interest compounded at 5% per year. What amount will the company receive at the time the lease expires?

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 50P

Related questions

Concept explainers

Mortgages

A mortgage is a formal agreement in which a bank or other financial institution lends cash at interest in return for assuming the title to the debtor's property, on the condition that the obligation is paid in full.

Mortgage

The term "mortgage" is a type of loan that a borrower takes to maintain his house or any form of assets and he agrees to return the amount in a particular period of time to the lender usually in a series of regular equally monthly, quarterly, or half-yearly payments.

Question

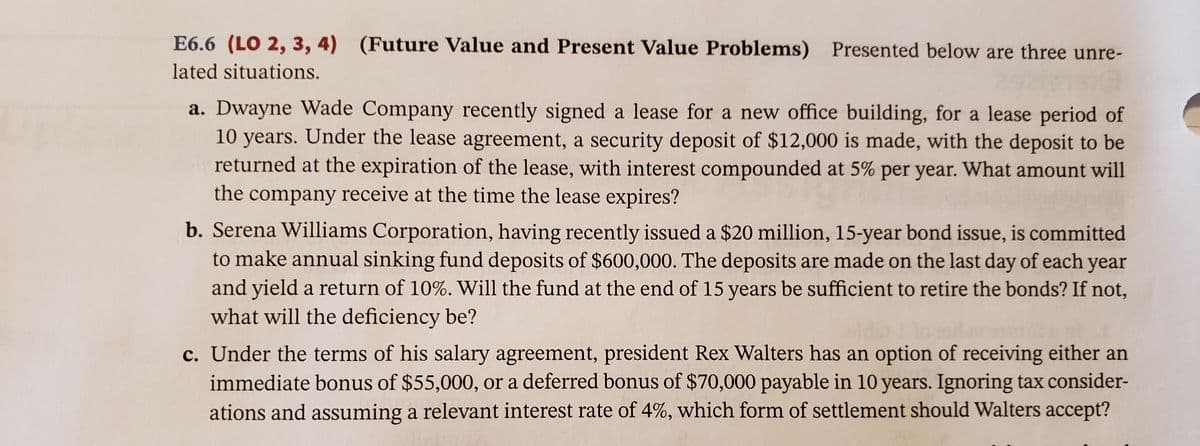

Transcribed Image Text:E6.6 (LO 2, 3, 4) (Future Value and Present Value Problems) Presented below are three unre-

lated situations.

a. Dwayne Wade Company recently signed a lease for a new office building, for a lease period of

10 years. Under the lease agreement, a security deposit of $12,000 is made, with the deposit to be

returned at the expiration of the lease, with interest compounded at 5% per year. What amount will

the company receive at the time the lease expires?

b. Serena Williams Corporation, having recently issued a $20 million, 15-year bond issue, is committed

to make annual sinking fund deposits of $600,000. The deposits are made on the last day of each year

and yield a return of 10%. Will the fund at the end of 15 years be sufficient to retire the bonds? If not,

what will the deficiency be?

c. Under the terms of his salary agreement, president Rex Walters has an option of receiving either an

immediate bonus of $55,000, or a deferred bonus of $70,000 payable in 10 years. Ignoring tax consider-

ations and assuming a relevant interest rate of 4%, which form of settlement should Walters accept?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT