a. Materials and labor for servicing machine tools b. Rework costs $1,100,000 90,000 c. Expediting costs caused by work delays d. Materials-handling costs e. Materials-procurement and inspection costs f. Preventive maintenance of equipment g. Breakdown maintenance of equipment 65,000 80,000 45,000 55,000 75,000 Classify each cost as value-added, non-value-added, or in the gray area between. For any cost classified in the gray area, assume 60% is value-added and 40% is non-value-added. How much of the total of all seven costs is value-added and how much is non-value-added? 1. Required 2. 3. Magill is considering the following changes: (a) introducing quality-improvement programs whose net effect will be to reduce rework and expediting costs by 40% and materials and labor costs for servicing machine tools by 5%; (b) working with suppliers to reduce materials-procurement and inspection costs by 20% and materials-handling costs by 30%; and (c) increasing preventive-maintenance costs by 70% to reduce breakdown-maintenance costs by 50%. Calculate the effect of programs (a), (b), and (c) on value-added costs, non-value-added costs, and total costs. Comment briefly.

a. Materials and labor for servicing machine tools b. Rework costs $1,100,000 90,000 c. Expediting costs caused by work delays d. Materials-handling costs e. Materials-procurement and inspection costs f. Preventive maintenance of equipment g. Breakdown maintenance of equipment 65,000 80,000 45,000 55,000 75,000 Classify each cost as value-added, non-value-added, or in the gray area between. For any cost classified in the gray area, assume 60% is value-added and 40% is non-value-added. How much of the total of all seven costs is value-added and how much is non-value-added? 1. Required 2. 3. Magill is considering the following changes: (a) introducing quality-improvement programs whose net effect will be to reduce rework and expediting costs by 40% and materials and labor costs for servicing machine tools by 5%; (b) working with suppliers to reduce materials-procurement and inspection costs by 20% and materials-handling costs by 30%; and (c) increasing preventive-maintenance costs by 70% to reduce breakdown-maintenance costs by 50%. Calculate the effect of programs (a), (b), and (c) on value-added costs, non-value-added costs, and total costs. Comment briefly.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter11: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 11.2E: Identify cost graphs The following cost graphs illustrate various types of cost behavior: For each...

Related questions

Question

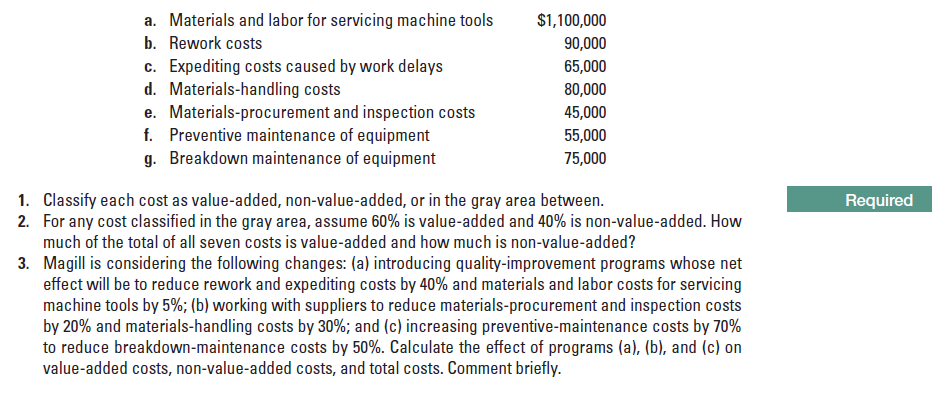

Value-added, non-value-added costs. The Magill Repair Shop repairs and services machine tools. A summary of its costs (by activity) for 2017 is as follows:

Transcribed Image Text:a. Materials and labor for servicing machine tools

b. Rework costs

$1,100,000

90,000

c. Expediting costs caused by work delays

d. Materials-handling costs

e. Materials-procurement and inspection costs

f. Preventive maintenance of equipment

g. Breakdown maintenance of equipment

65,000

80,000

45,000

55,000

75,000

Classify each cost as value-added, non-value-added, or in the gray area between.

For any cost classified in the gray area, assume 60% is value-added and 40% is non-value-added. How

much of the total of all seven costs is value-added and how much is non-value-added?

1.

Required

2.

3. Magill is considering the following changes: (a) introducing quality-improvement programs whose net

effect will be to reduce rework and expediting costs by 40% and materials and labor costs for servicing

machine tools by 5%; (b) working with suppliers to reduce materials-procurement and inspection costs

by 20% and materials-handling costs by 30%; and (c) increasing preventive-maintenance costs by 70%

to reduce breakdown-maintenance costs by 50%. Calculate the effect of programs (a), (b), and (c) on

value-added costs, non-value-added costs, and total costs. Comment briefly.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning