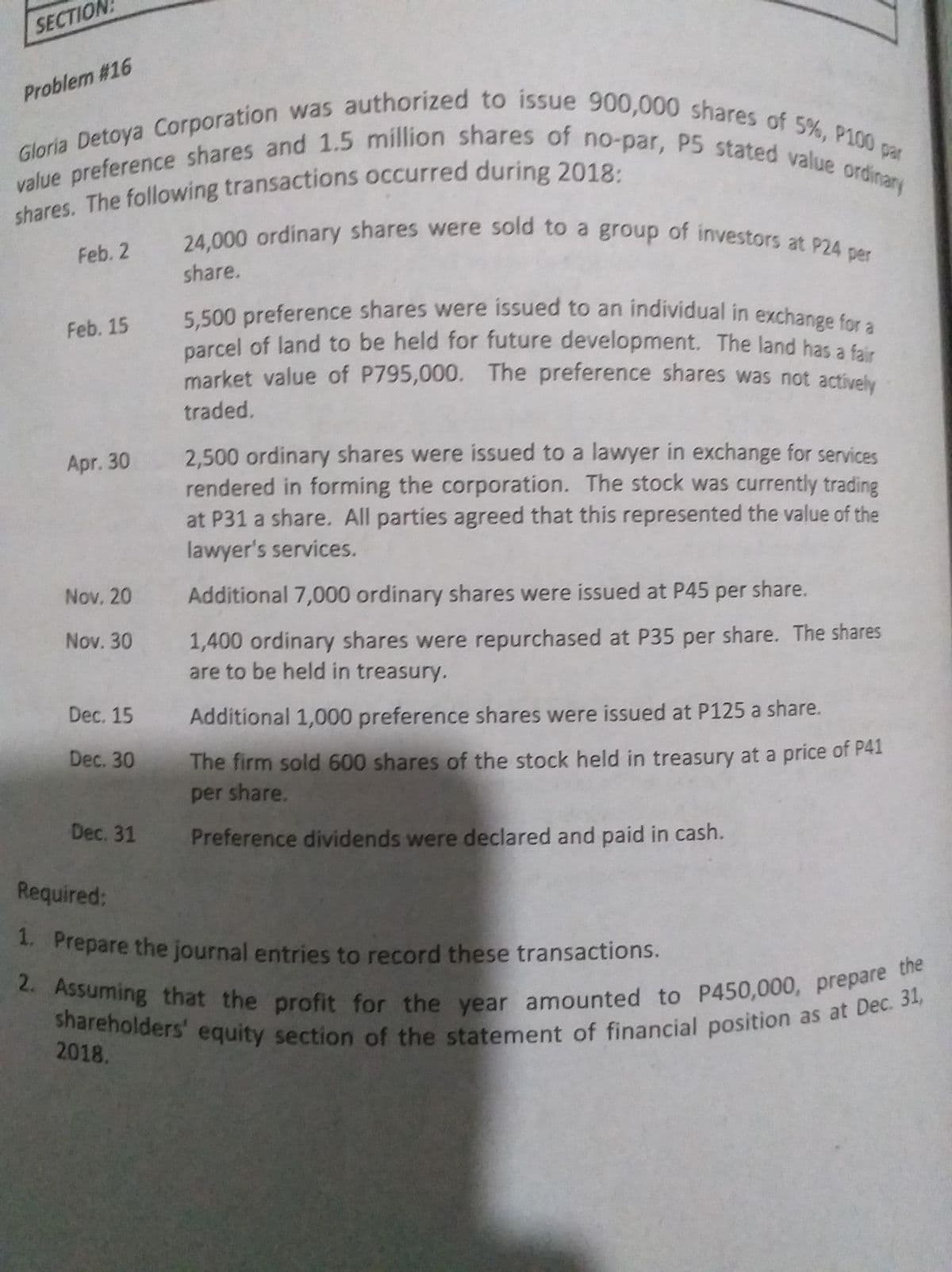

a. Prepare journal entries b. Assuming that the profit for the year amounted to P450,000, prepare the shareholders' equity section of the statement of financial position as at Dec. 31, 2018. Gloria Detoya Corporation was authorized to issue 900,000 shares of 5%, $100 par value preference shares and 1.5 million shares of no- par, $5 stated value ordinary shares. The ff. transactions occurred during 2018: Feb. 2) 24,000 ordinary shares were sold to a group of investors at $24 per share. Feb 15) 5,500 preference share were issued to an individual in exchange for a parcel of land to be held for future development. The land has a fair market value of $795,000. The preference shares was not actively traded. Apr. 30) 2,500 ordinary shares were issued to a lawyer in exchange for services rendered in forming the corporation. The stock was currently trading at $31 a share. All parties agreed that this represented the value of the lawyer's services. Nov. 20) Additionally 7,000 ordinary share were issued at $45 per share. Nov. 30) 1,400 ordinary shares were repurchased at $35 per share. The shares are to be held in treasury. Dec. 15) Additionally 1,000 preference share were issued at $125 a share. Dec. 30) The firm sold 600 shares of stock held in treasury at a price of $41 per share. Dec. 31) Preference dividends were declared and paid in cash. URGENT HELP!

a. Prepare journal entries

b. Assuming that the profit for the year amounted to P450,000, prepare the shareholders' equity section of the statement of financial position as at Dec. 31, 2018.

Gloria Detoya Corporation was authorized to issue 900,000 shares of 5%, $100 par value preference shares and 1.5 million shares of no- par, $5 stated value ordinary shares. The ff. transactions occurred during 2018:

Feb. 2) 24,000 ordinary shares were sold to a group of investors at $24 per share.

Feb 15) 5,500

Apr. 30) 2,500 ordinary shares were issued to a lawyer in exchange for services rendered in forming the corporation. The stock was currently trading at $31 a share. All parties agreed that this represented the value of the lawyer's services.

Nov. 20) Additionally 7,000 ordinary share were issued at $45 per share.

Nov. 30) 1,400 ordinary shares were repurchased at $35 per share. The shares are to be held in treasury.

Dec. 15) Additionally 1,000 preference share were issued at $125 a share.

Dec. 30) The firm sold 600 shares of stock held in treasury at a price of $41 per share.

Dec. 31) Preference dividends were declared and paid in cash.

URGENT HELP!

Step by step

Solved in 2 steps with 4 images