AB Engineering Ltd. belongs to a risk class for which the capitalization rate is 10%. It currently has outstanding 11,000 shares selling at $ 110 each. The firm is contemplating the declaration of a dividend of $ 6/ share at the end of the current financial year. It expects to have a net income of $ 100,000 and has a proposal for making new investments of $ 200,000. CALCULATE the value of the firms when dividends are not paid 129.

AB Engineering Ltd. belongs to a risk class for which the capitalization rate is 10%. It currently has outstanding 11,000 shares selling at $ 110 each. The firm is contemplating the declaration of a dividend of $ 6/ share at the end of the current financial year. It expects to have a net income of $ 100,000 and has a proposal for making new investments of $ 200,000. CALCULATE the value of the firms when dividends are not paid 129.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter16: Capital Structure Decisions

Section: Chapter Questions

Problem 5P: Stock Price after Recapitalization Lee Manufacturings value of operations is equal to 900 million...

Related questions

Question

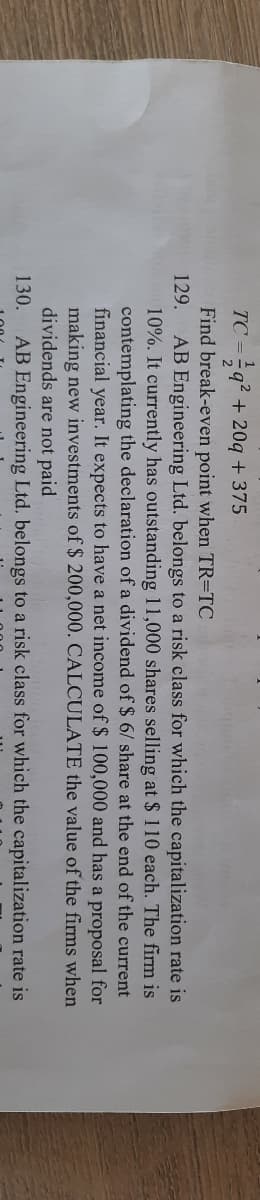

Transcribed Image Text:TC ==q? + 20q + 375

Find break-even point when TR=TC

AB Engineering Ltd. belongs to a risk class for which the capitalization rate is

10%. It currently has outstanding 11,000 shares selling at $ 110 each. The firm is

contemplating the declaration of a dividend of $ 6/ share at the end of the current

Tem 129.

financial year. It expects to have a net income of $ 100,000 and has a proposal for

making new investments of $ 200,000. CALCULATE the value of the firms when

dividends are not paid

AB Engineering Ltd, belongs to a risk class for which the capitalization rate is

130.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning