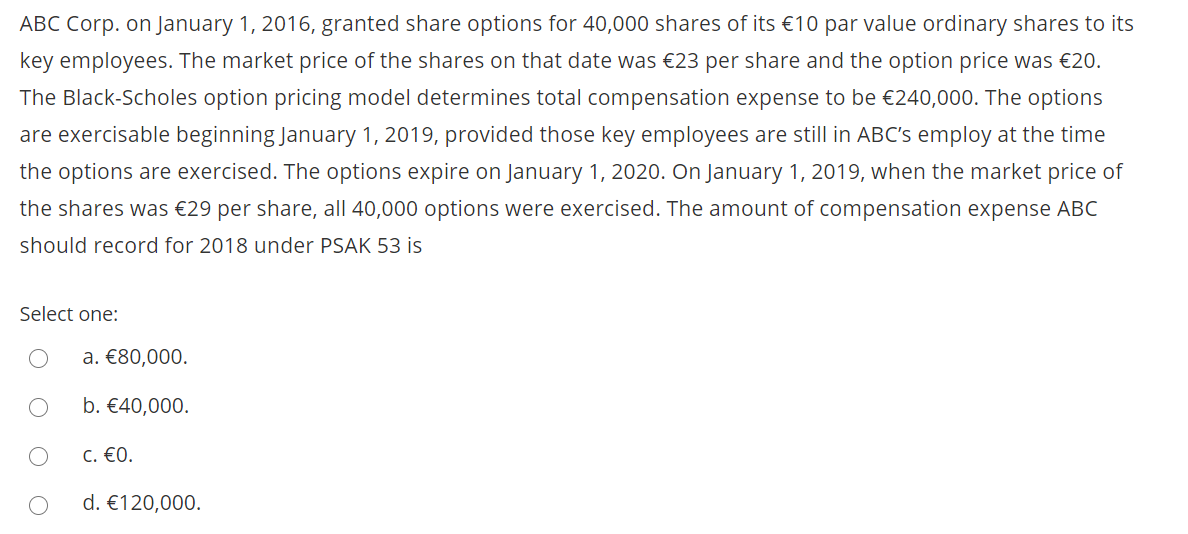

ABC Corp. on January 1, 2016, granted share options for 40,000 shares of its €10 par value ordinary shares to its key employees. The market price of the shares on that date was €23 per share and the option price was €20. The Black-Scholes option pricing model determines total compensation expense to be €240,000. The options are exercisable beginning January 1, 2019, provided those key employees are still in ABC's employ at the time the options are exercised. The options expire on January 1, 2020. On January 1, 2019, when the market price of the shares was €29 per share, all 40,000 options were exercised. The amount of compensation expense ABC should record for 2018 under PSAK 53 is Select one: a. €80,000. b. €40,000. C. €0. d. €120,000.

ABC Corp. on January 1, 2016, granted share options for 40,000 shares of its €10 par value ordinary shares to its key employees. The market price of the shares on that date was €23 per share and the option price was €20. The Black-Scholes option pricing model determines total compensation expense to be €240,000. The options are exercisable beginning January 1, 2019, provided those key employees are still in ABC's employ at the time the options are exercised. The options expire on January 1, 2020. On January 1, 2019, when the market price of the shares was €29 per share, all 40,000 options were exercised. The amount of compensation expense ABC should record for 2018 under PSAK 53 is Select one: a. €80,000. b. €40,000. C. €0. d. €120,000.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter15: Shareholders’ Equity: Capital Contributions And Distributions

Section: Chapter Questions

Problem 17E

Related questions

Question

Transcribed Image Text:ABC Corp. on January 1, 2016, granted share options for 40,000 shares of its €10 par value ordinary shares to its

key employees. The market price of the shares on that date was €23 per share and the option price was €20.

The Black-Scholes option pricing model determines total compensation expense to be €240,000. The options

are exercisable beginning January 1, 2019, provided those key employees are still in ABC's employ at the time

the options are exercised. The options expire on January 1, 2020. On January 1, 2019, when the market price of

the shares was €29 per share, all 40,000 options were exercised. The amount of compensation expense ABC

should record for 2018 under PSAK 53 is

Select one:

a. €80,000.

b. €40,000.

C. €0.

d. €120,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT