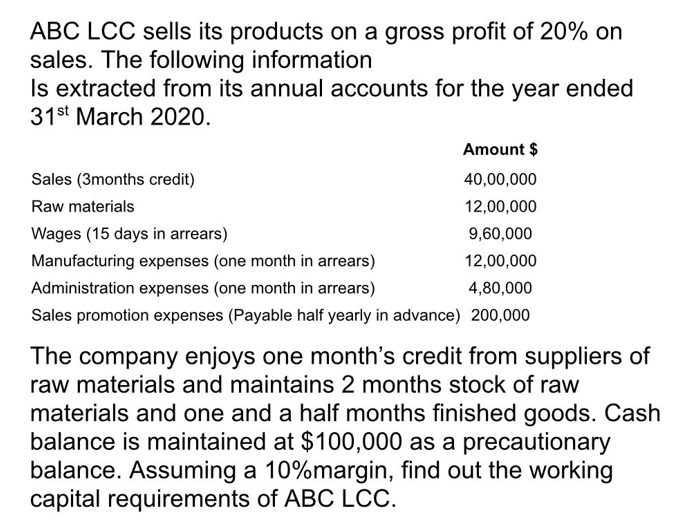

ABC LCC sells its products on a gross profit of 20% on sales. The following information Is extracted from its annual accounts for the year ended 31st March 2020. Sales (3months credit) Raw materials Wages (15 days in arrears) Manufacturing expenses (one month in arrears) Administration expenses (one month in arrears) Amount $ 40,00,000 12,00,000 9,60,000 12,00,000 480.000

ABC LCC sells its products on a gross profit of 20% on sales. The following information Is extracted from its annual accounts for the year ended 31st March 2020. Sales (3months credit) Raw materials Wages (15 days in arrears) Manufacturing expenses (one month in arrears) Administration expenses (one month in arrears) Amount $ 40,00,000 12,00,000 9,60,000 12,00,000 480.000

Chapter5: Introduction To Business Expenses

Section: Chapter Questions

Problem 63P

Related questions

Question

Transcribed Image Text:ABC LCC sells its products on a gross profit of 20% on

sales. The following information

Is extracted from its annual accounts for the year ended

31st March 2020.

Amount $

40,00,000

12,00,000

9,60,000

12,00,000

Manufacturing expenses (one month in arrears)

Administration expenses (one month in arrears)

4,80,000

Sales promotion expenses (Payable half yearly in advance) 200,000

Sales (3months credit)

Raw materials

Wages (15 days in arrears)

The company enjoys one month's credit from suppliers of

raw materials and maintains 2 months stock of raw

materials and one and a half months finished goods. Cash

balance is maintained at $100,000 as a precautionary

balance. Assuming a 10%margin, find out the working

capital requirements of ABC LCC.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning