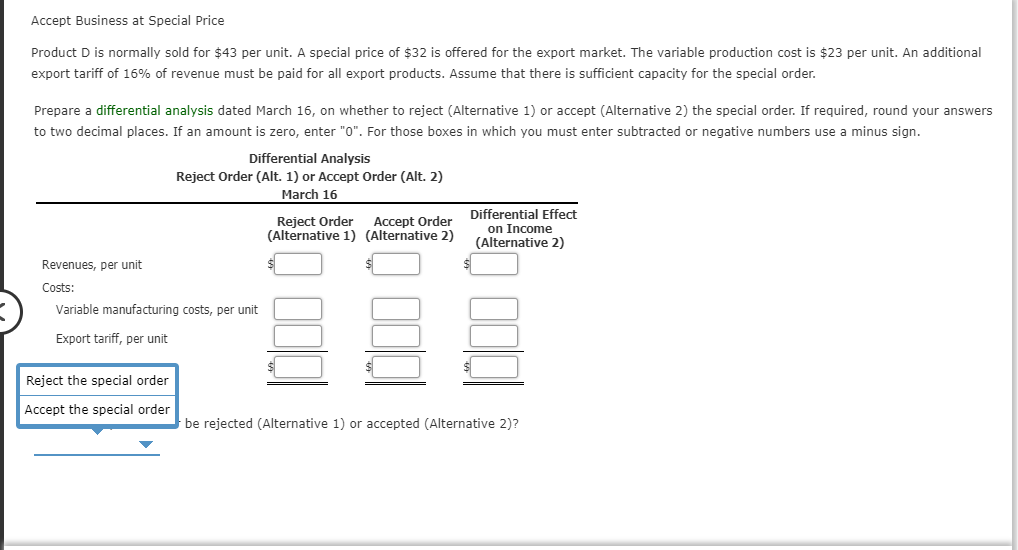

Accept Business at Special Price Product D is normally sold for $43 per unit. A special price of $32 is offered for the export market. The variable production cost is $23 per unit. An additional export tariff of 16% of revenue must be paid for all export products. Assume that there is sufficient capacity for the special order. Prepare a differential analysis dated March 16, on whether to reject (Alternative 1) or accept (Alternative 2) the special order. If required, round your answers to two decimal places. If an amount is zero, enter "0". For those boxes in which you must enter subtracted or negative numbers use a minus sign. Differential Analysis Reject Order (Alt. 1) or Accept Order (Alt. 2) March 16 Differential Effect on Income (Alternative 2) Reject Order (Alternative 1) (Alternative 2) Accept Order Revenues, per unit Costs: Variable manufacturing costs, per unit Export tariff, per unit Reject the special order Accept the special order be rejected (Alternative 1) or accepted (Alternative 2)?

Accept Business at Special Price Product D is normally sold for $43 per unit. A special price of $32 is offered for the export market. The variable production cost is $23 per unit. An additional export tariff of 16% of revenue must be paid for all export products. Assume that there is sufficient capacity for the special order. Prepare a differential analysis dated March 16, on whether to reject (Alternative 1) or accept (Alternative 2) the special order. If required, round your answers to two decimal places. If an amount is zero, enter "0". For those boxes in which you must enter subtracted or negative numbers use a minus sign. Differential Analysis Reject Order (Alt. 1) or Accept Order (Alt. 2) March 16 Differential Effect on Income (Alternative 2) Reject Order (Alternative 1) (Alternative 2) Accept Order Revenues, per unit Costs: Variable manufacturing costs, per unit Export tariff, per unit Reject the special order Accept the special order be rejected (Alternative 1) or accepted (Alternative 2)?

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter11: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 6BE

Related questions

Question

100%

Transcribed Image Text:Accept Business at Special Price

Product D is normally sold for $43 per unit. A special price of $32 is offered for the export market. The variable production cost is $23 per unit. An additional

export tariff of 16% of revenue must be paid for all export products. Assume that there is sufficient capacity for the special order.

Prepare a differential analysis dated March 16, on whether to reject (Alternative 1) or accept (Alternative 2) the special order. If required, round your answers

to two decimal places. If an amount is zero, enter "0". For those boxes in which you must enter subtracted or negative numbers use a minus sign.

Differential Analysis

Reject Order (Alt. 1) or Accept Order (Alt. 2)

March 16

Differential Effect

on Income

(Alternative 2)

Reject Order

(Alternative 1) (Alternative 2)

Accept Order

Revenues, per unit

Costs:

Variable manufacturing costs, per unit

Export tariff, per unit

Reject the special order

Accept the special order

be rejected (Alternative 1) or accepted (Alternative 2)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College