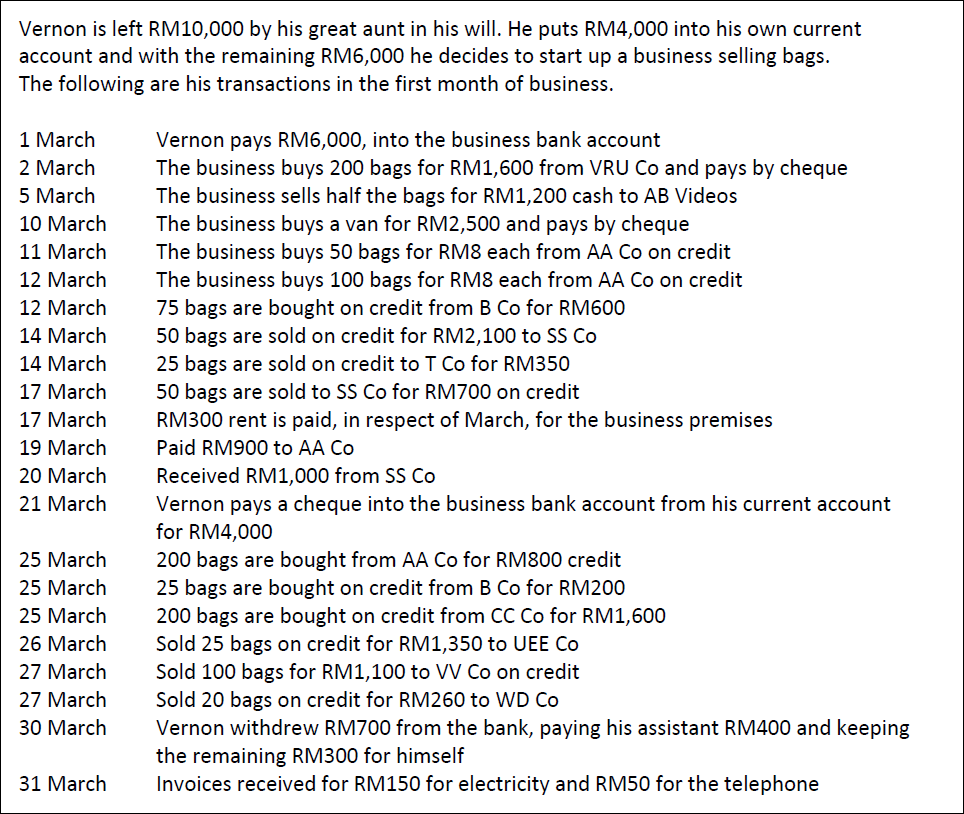

Vernon is left RM10,000 by his great aunt in his will. He puts RM4,000 into his own current account and with the remaining RM6,000 he decides to start up a business selling bags. The following are his transactions in the first month of business. 1 March Vernon pays RM6,000, into the business bank account The business buys 200 bags for RM1,600 from VRU Co and pays by cheque The business sells half the bags for RM1,200 cash to AB Videos 2 March 5 March The business buys a van for RM2,500 and pays by cheque The business buys 50 bags for RM8 each from AA Co on credit 10 March 11 March 12 March The business buys 100 bags for RM8 each from AA Co on credit 75 bags are bought on credit from B Co for RM600 50 bags are sold on credit for RM2,100 to SS Co 25 bags are sold on credit to T Co for RM350 50 bags are sold to SS Co for RM700 on credit 12 March 14 March 14 March 17 March RM300 rent is paid, in respect of March, for the business premises Paid RM900 to AA Co 17 March 19 March 20 March Received RM1,000 from SS Co Vernon pays a cheque into the business bank account from his current account for RM4,000 21 March 200 bags are bought from AA Co for RM800 credit 25 bags are bought on credit from B Co for RM200 200 bags are bought on credit from CC Co for RM1,600 25 March 25 March 25 March 26 March Sold 25 bags on credit for RM1,350 to UEE Co Sold 100 bags for RM1,100 to VV Co on credit Sold 20 bags on credit for RM260 to WD Co 27 March 27 March 30 March Vernon withdrew RM700 from the bank, paying his assistant RM400 and keeping the remaining RM300 for himself Invoices received for RM150 for electricity and RM50 for the telephone 31 March

Vernon is left RM10,000 by his great aunt in his will. He puts RM4,000 into his own current account and with the remaining RM6,000 he decides to start up a business selling bags. The following are his transactions in the first month of business. 1 March Vernon pays RM6,000, into the business bank account The business buys 200 bags for RM1,600 from VRU Co and pays by cheque The business sells half the bags for RM1,200 cash to AB Videos 2 March 5 March The business buys a van for RM2,500 and pays by cheque The business buys 50 bags for RM8 each from AA Co on credit 10 March 11 March 12 March The business buys 100 bags for RM8 each from AA Co on credit 75 bags are bought on credit from B Co for RM600 50 bags are sold on credit for RM2,100 to SS Co 25 bags are sold on credit to T Co for RM350 50 bags are sold to SS Co for RM700 on credit 12 March 14 March 14 March 17 March RM300 rent is paid, in respect of March, for the business premises Paid RM900 to AA Co 17 March 19 March 20 March Received RM1,000 from SS Co Vernon pays a cheque into the business bank account from his current account for RM4,000 21 March 200 bags are bought from AA Co for RM800 credit 25 bags are bought on credit from B Co for RM200 200 bags are bought on credit from CC Co for RM1,600 25 March 25 March 25 March 26 March Sold 25 bags on credit for RM1,350 to UEE Co Sold 100 bags for RM1,100 to VV Co on credit Sold 20 bags on credit for RM260 to WD Co 27 March 27 March 30 March Vernon withdrew RM700 from the bank, paying his assistant RM400 and keeping the remaining RM300 for himself Invoices received for RM150 for electricity and RM50 for the telephone 31 March

Chapter15: Taxing Business Income

Section: Chapter Questions

Problem 3DQ

Related questions

Question

Prepare the ledger accounts for the following transactions

Transcribed Image Text:Vernon is left RM10,000 by his great aunt in his will. He puts RM4,000 into his own current

account and with the remaining RM6,000 he decides to start up a business selling bags.

The following are his transactions in the first month of business.

1 March

Vernon pays RM6,000, into the business bank account

The business buys 200 bags for RM1,600 from VRU Co and pays by cheque

The business sells half the bags for RM1,200 cash to AB Videos

2 March

5 March

The business buys a van for RM2,500 and pays by cheque

The business buys 50 bags for RM8 each from AA Co on credit

10 March

11 March

12 March

The business buys 100 bags for RM8 each from AA Co on credit

75 bags are bought on credit from B Co for RM600

50 bags are sold on credit for RM2,100 to SS Co

25 bags are sold on credit to T Co for RM350

50 bags are sold to SS Co for RM700 on credit

12 March

14 March

14 March

17 March

RM300 rent is paid, in respect of March, for the business premises

Paid RM900 to AA Co

17 March

19 March

20 March

Received RM1,000 from SS Co

Vernon pays a cheque into the business bank account from his current account

for RM4,000

21 March

200 bags are bought from AA Co for RM800 credit

25 bags are bought on credit from B Co for RM200

200 bags are bought on credit from CC Co for RM1,600

25 March

25 March

25 March

26 March

Sold 25 bags on credit for RM1,350 to UEE Co

Sold 100 bags for RM1,100 to VV Co on credit

Sold 20 bags on credit for RM260 to WD Co

27 March

27 March

30 March

Vernon withdrew RM700 from the bank, paying his assistant RM400 and keeping

the remaining RM300 for himself

Invoices received for RM150 for electricity and RM50 for the telephone

31 March

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT