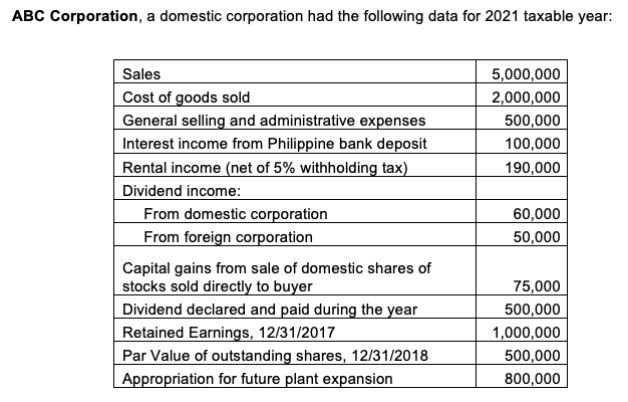

ABC Corporation, a domestic corporation had the following data for 2021 taxable year: 5,000,000 2,000,000 500,000 Sales Cost of goods sold General selling and administrative expenses Interest income from Philippine bank deposit Rental income (net of 5% withholding tax) Dividend income: From domestic corporation From foreign corporation 100,000 190,000 60,000 50,000 Capital gains from sale of domestic shares of stocks sold directly to buyer Dividend declared and paid during the year Retained Earnings, 12/31/2017 Par Value of outstanding shares, 12/31/2018 Appropriation for future plant expansion 75,000 500,000 1,000,000 500,000 800,000

ABC Corporation, a domestic corporation had the following data for 2021 taxable year: 5,000,000 2,000,000 500,000 Sales Cost of goods sold General selling and administrative expenses Interest income from Philippine bank deposit Rental income (net of 5% withholding tax) Dividend income: From domestic corporation From foreign corporation 100,000 190,000 60,000 50,000 Capital gains from sale of domestic shares of stocks sold directly to buyer Dividend declared and paid during the year Retained Earnings, 12/31/2017 Par Value of outstanding shares, 12/31/2018 Appropriation for future plant expansion 75,000 500,000 1,000,000 500,000 800,000

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter2: Financial Statements, Cash Flow,and Taxes

Section: Chapter Questions

Problem 10MC

Related questions

Question

(Philippine domestic corporation)

Questions:

| 1. The income tax due is | |||

| 2. The income tax payable is | |||

| 3. The improperly |

Transcribed Image Text:ABC Corporation, a domestic corporation had the following data for 2021 taxable year:

5,000,000

2,000,000

500,000

Sales

Cost of goods sold

General selling and administrative expenses

Interest income from Philippine bank deposit

Rental income (net of 5% withholding tax)

Dividend income:

From domestic corporation

From foreign corporation

100,000

190,000

60,000

50,000

Capital gains from sale of domestic shares of

stocks sold directly to buyer

Dividend declared and paid during the year

Retained Earnings, 12/31/2017

Par Value of outstanding shares, 12/31/2018

Appropriation for future plant expansion

75,000

500,000

1,000,000

500,000

800,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you