1 2 m 4n 07 9. White 9 A Talk S Aint Ia O ENG 10 O Annota S Annota SAnnota M Recibic I Downl ssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false 台☆* + Facebook 6 Student Center Bb Blackboard WhatsApp Ggrammarly unemployment > |国Readi Maps Zoom Mark Turney owns Creative Corners. He does his banking at United Federal Bank (UFB) in Tucson, Arizona. The amounts in his general ledger for payroll taxes and the employee's withholding of Social Security, Medicare, and federal income tax as of April 15 of the current year show the following: Social Security tax payable (employer and employee), $3,020; Medicare tax payable (employer and employee), $734; FUTA tax payable, $84; SSUTA tax payable, $414; and Employees income tax payable, $4,622. Journalize the payment of the Form 941 deposit to UFB and the payment of the SUTA tax to the State of Arizona as of April 15, 20--. If an amount box does not require an entry, leave it blank. Page: POST. DATE DESCRIPTION DEBIT CREDIT REF. 1 Apr. 15 2 3 3. Deposit of employee income tax and Social Security and Medicare taxes 7 Apr. 15 8. 8. Paid SUTA tax 6. 11 Apr. 15 11 12 12 13 Paid FUTA tax 8 13 6:52 PM N 12/16/2021 61 12

1 2 m 4n 07 9. White 9 A Talk S Aint Ia O ENG 10 O Annota S Annota SAnnota M Recibic I Downl ssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false 台☆* + Facebook 6 Student Center Bb Blackboard WhatsApp Ggrammarly unemployment > |国Readi Maps Zoom Mark Turney owns Creative Corners. He does his banking at United Federal Bank (UFB) in Tucson, Arizona. The amounts in his general ledger for payroll taxes and the employee's withholding of Social Security, Medicare, and federal income tax as of April 15 of the current year show the following: Social Security tax payable (employer and employee), $3,020; Medicare tax payable (employer and employee), $734; FUTA tax payable, $84; SSUTA tax payable, $414; and Employees income tax payable, $4,622. Journalize the payment of the Form 941 deposit to UFB and the payment of the SUTA tax to the State of Arizona as of April 15, 20--. If an amount box does not require an entry, leave it blank. Page: POST. DATE DESCRIPTION DEBIT CREDIT REF. 1 Apr. 15 2 3 3. Deposit of employee income tax and Social Security and Medicare taxes 7 Apr. 15 8. 8. Paid SUTA tax 6. 11 Apr. 15 11 12 12 13 Paid FUTA tax 8 13 6:52 PM N 12/16/2021 61 12

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:1 2 m 4n 07

9.

White

9 A Talk

S Aint Ia

O ENG 10 O Annota

S Annota

SAnnota M Recibic

I Downl

ssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false

台☆*

+ Facebook

6 Student Center

Bb Blackboard

WhatsApp

Ggrammarly

unemployment

> |国Readi

Maps

Zoom

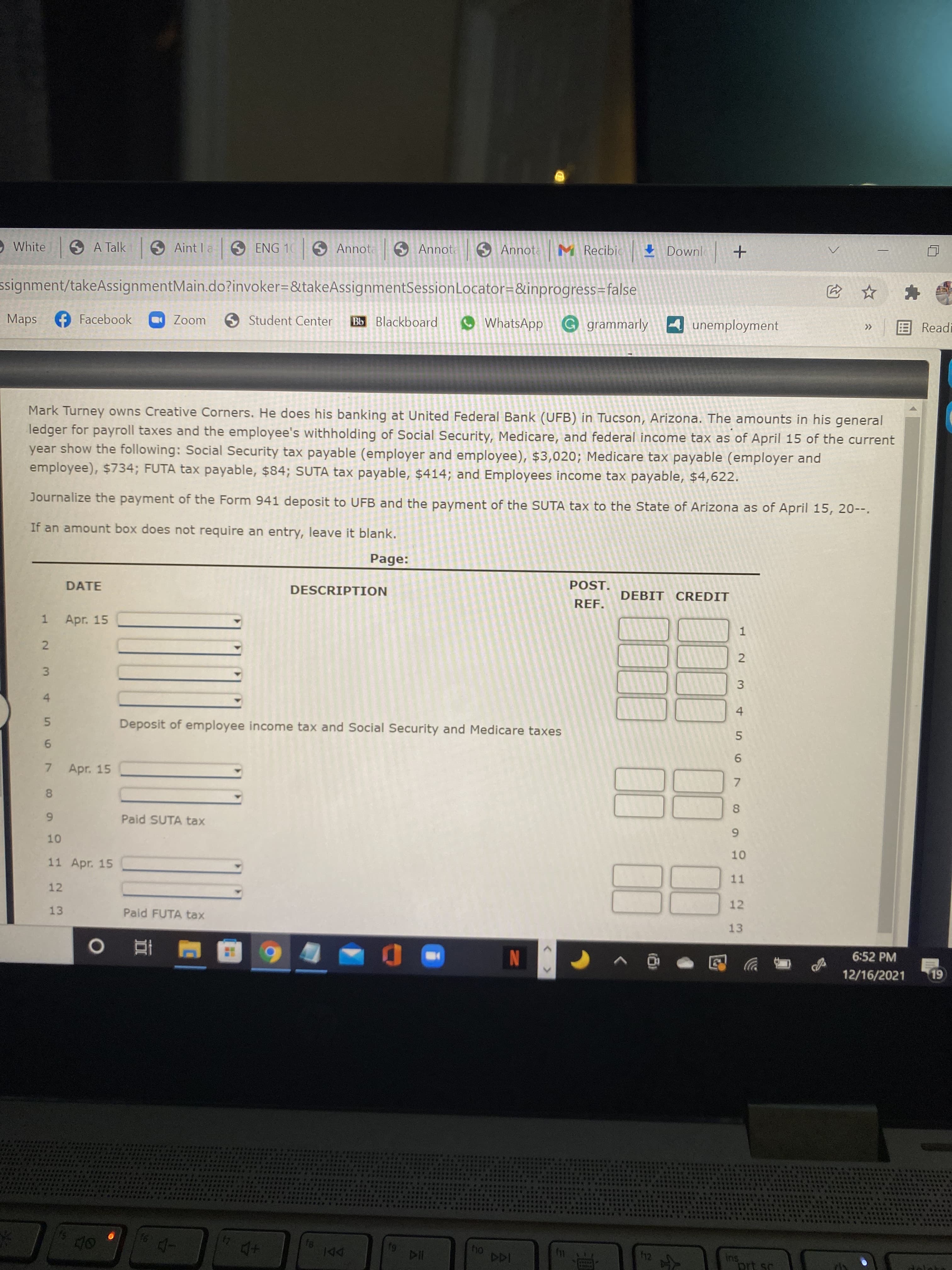

Mark Turney owns Creative Corners. He does his banking at United Federal Bank (UFB) in Tucson, Arizona. The amounts in his general

ledger for payroll taxes and the employee's withholding of Social Security, Medicare, and federal income tax as of April 15 of the current

year show the following: Social Security tax payable (employer and employee), $3,020; Medicare tax payable (employer and

employee), $734; FUTA tax payable, $84; SSUTA tax payable, $414; and Employees income tax payable, $4,622.

Journalize the payment of the Form 941 deposit to UFB and the payment of the SUTA tax to the State of Arizona as of April 15, 20--.

If an amount box does not require an entry, leave it blank.

Page:

POST.

DATE

DESCRIPTION

DEBIT CREDIT

REF.

1 Apr. 15

2

3

3.

Deposit of employee income tax and Social Security and Medicare taxes

7 Apr. 15

8.

8.

Paid SUTA tax

6.

11 Apr. 15

11

12

12

13

Paid FUTA tax

8

13

6:52 PM

N

12/16/2021

61

12

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education