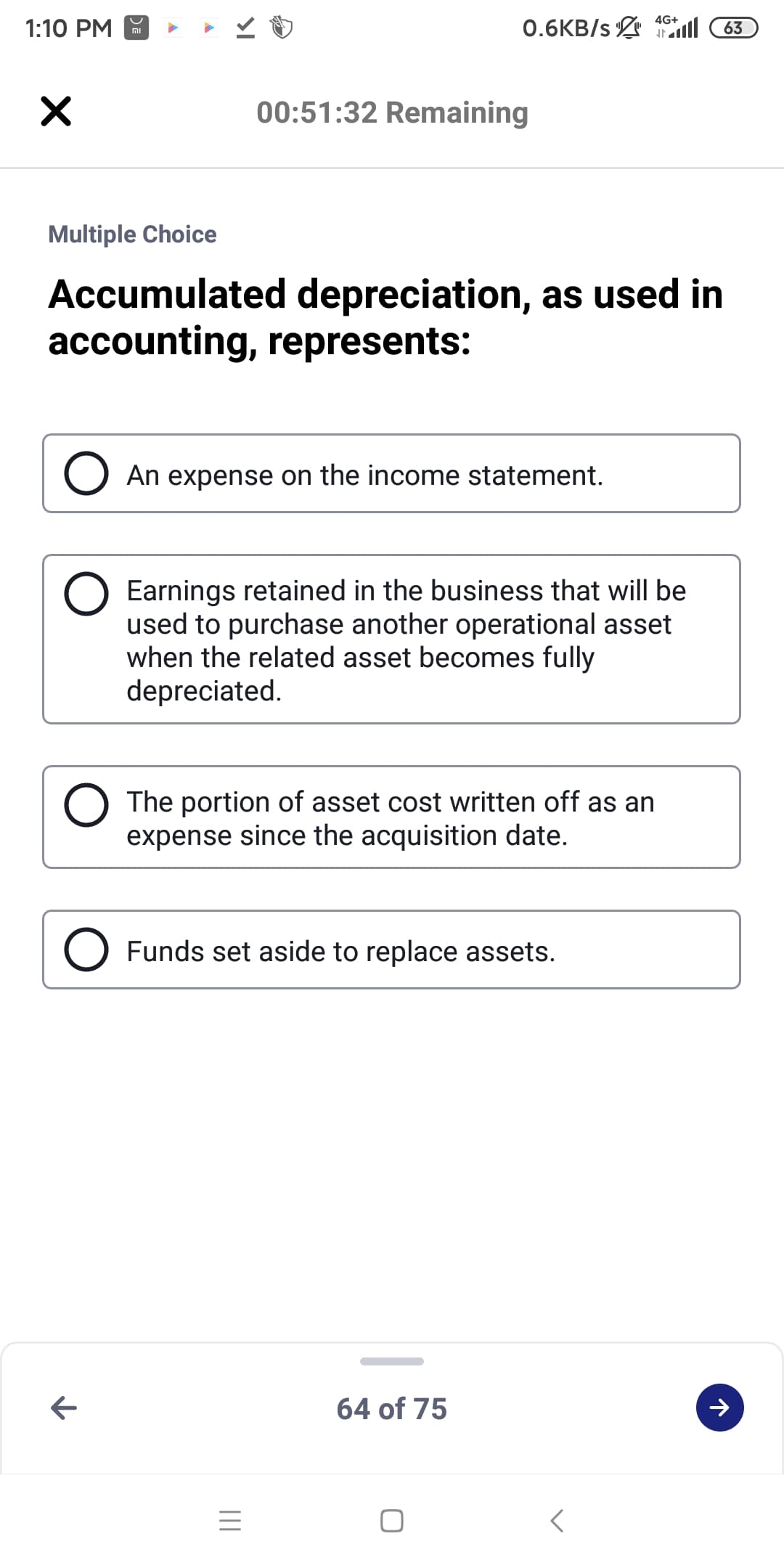

Accumulated depreciation, as used in accounting, represents: O An expense on the income statement. Earnings retained in the business that will be used to purchase another operational asset when the related asset becomes fully depreciated. The portion of asset cost written off as an expense since the acquisition date. O Funds set aside to replace assets.

Accumulated depreciation, as used in accounting, represents: O An expense on the income statement. Earnings retained in the business that will be used to purchase another operational asset when the related asset becomes fully depreciated. The portion of asset cost written off as an expense since the acquisition date. O Funds set aside to replace assets.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter7: Fixed Assets, Natural Resources, And Intangible Assets

Section: Chapter Questions

Problem 7.4MBA

Related questions

Question

100%

Transcribed Image Text:4G+

1:10 PM M

0.6KB/s ill

63

00:51:32 Remaining

Multiple Choice

Accumulated depreciation, as used in

accounting, represents:

An expense on the income statement.

O Earnings retained in the business that will be

used to purchase another operational asset

when the related asset becomes fully

depreciated.

The portion of asset cost written off as an

expense since the acquisition date.

Funds set aside to replace assets.

64 of 75

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning