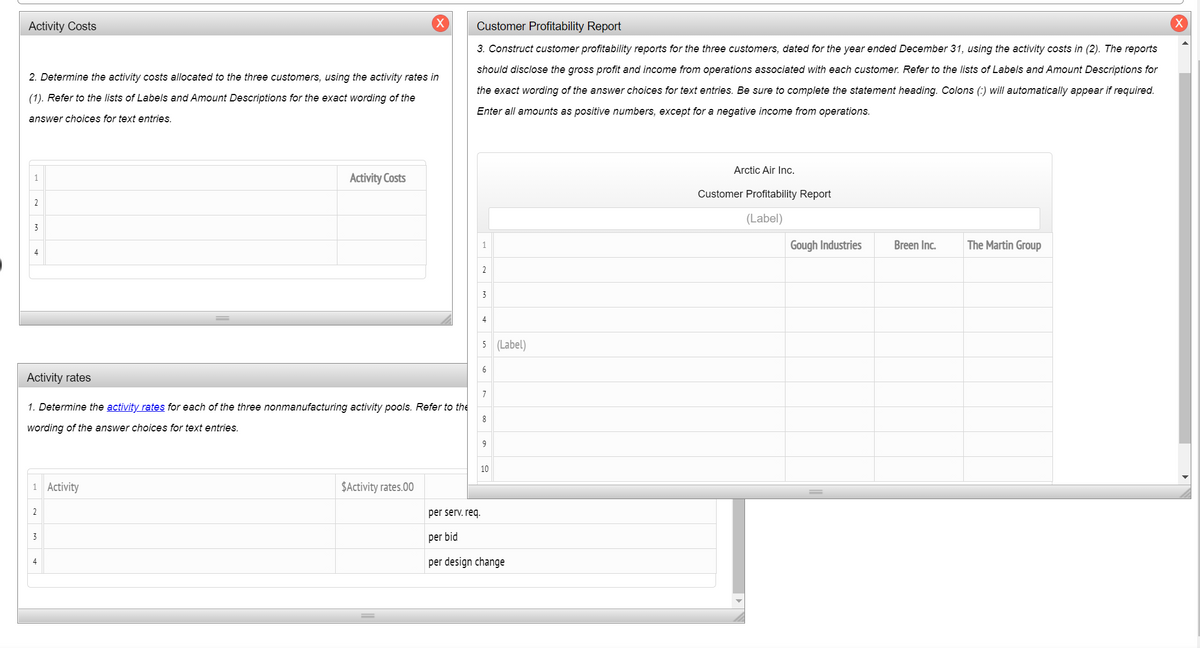

Activity Costs Customer Profitability Report 3. Construct customer profitability reports for the three customers, dated for the year ended December 31, using the activity costs in (2). The reports should disclose the gross profit and income from operations associated with each customer. Refer to the lists of Labels and Amount Descriptions for 2. Determine the activity costs allocated to the three customers, using the activity rates in the exact wording of the answer choices for text entries. Be sure to complete the statement heading. Colons (:) will automatically appear if required. (1). Refer to the lists of Labels and Amount Descriptions for the exact wording of the Enter all amounts as positive numbers, except for a negative income from operations. answer choices for text entries. Arctic Air Inc. Activity Costs Customer Profitability Report (Label) 3 Gough Industries Breen Inc. The Martin Group 2 3 5 (Label) Activity rates 1. Determine the activity rates for each of the three nonmanufacturing activity pools. Refer to the wording of the answer choices for text entries. 10 1 Activity $Activity rates.00 2 per serv. req. per bid per design change

Activity Costs Customer Profitability Report 3. Construct customer profitability reports for the three customers, dated for the year ended December 31, using the activity costs in (2). The reports should disclose the gross profit and income from operations associated with each customer. Refer to the lists of Labels and Amount Descriptions for 2. Determine the activity costs allocated to the three customers, using the activity rates in the exact wording of the answer choices for text entries. Be sure to complete the statement heading. Colons (:) will automatically appear if required. (1). Refer to the lists of Labels and Amount Descriptions for the exact wording of the Enter all amounts as positive numbers, except for a negative income from operations. answer choices for text entries. Arctic Air Inc. Activity Costs Customer Profitability Report (Label) 3 Gough Industries Breen Inc. The Martin Group 2 3 5 (Label) Activity rates 1. Determine the activity rates for each of the three nonmanufacturing activity pools. Refer to the wording of the answer choices for text entries. 10 1 Activity $Activity rates.00 2 per serv. req. per bid per design change

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter4: Activity-based Costing

Section: Chapter Questions

Problem 5PA: Allocating selling and administrative expenses using activity-based costing Arctic Air Inc....

Related questions

Question

Arctic Air Inc. manufactures cooling units for commercial buildings.

Activity-base usage and unit volume information for the three customers is as follows:

|

|

Gough Industries

|

Breen Inc.

|

The Martin

|

|

|

Group

|

Total

|

|||

| Number of service requests | 65 | 47 | 202 | 314 |

| Number of bids | 34 | 20 | 45 | 99 |

| Number of customer design changes | 41 | 27 | 156 | 224 |

| Unit volume | 21 | 15 | 6 | 42 |

Transcribed Image Text:Activity Costs

Customer Profitability Report

3. Construct customer profitability reports for the three customers, dated for the year ended December 31, using the activity costs in (2). The reports

should disclose the gross profit and income from operations associated with each customer. Refer to the lists of Labels and Amount Descriptions for

2. Determine the activity costs allocated to the three customers, using the activity rates in

the exact wording of the answer choices for text entries. Be sure to complete the statement heading. Colons (:) will automatically appear if required.

(1). Refer to the lists of Labels and Amount Descriptions for the exact wording of the

Enter all amounts as positive numbers, except for a negative income from operations.

answer choices for text entries.

Arctic Air Inc.

1

Activity Costs

Customer Profitability Report

2

(Label)

3

Gough Industries

Breen Inc.

The Martin Group

4

2

3

4

5 (Label)

6

Activity rates

1. Determine the activity rates for each of the three nonmanufacturing activity pools. Refer to the

8

wording of the answer choices for text entries.

9

10

1 Activity

$Activity rates.00

2

per serv. req.

3

per bid

per design change

4

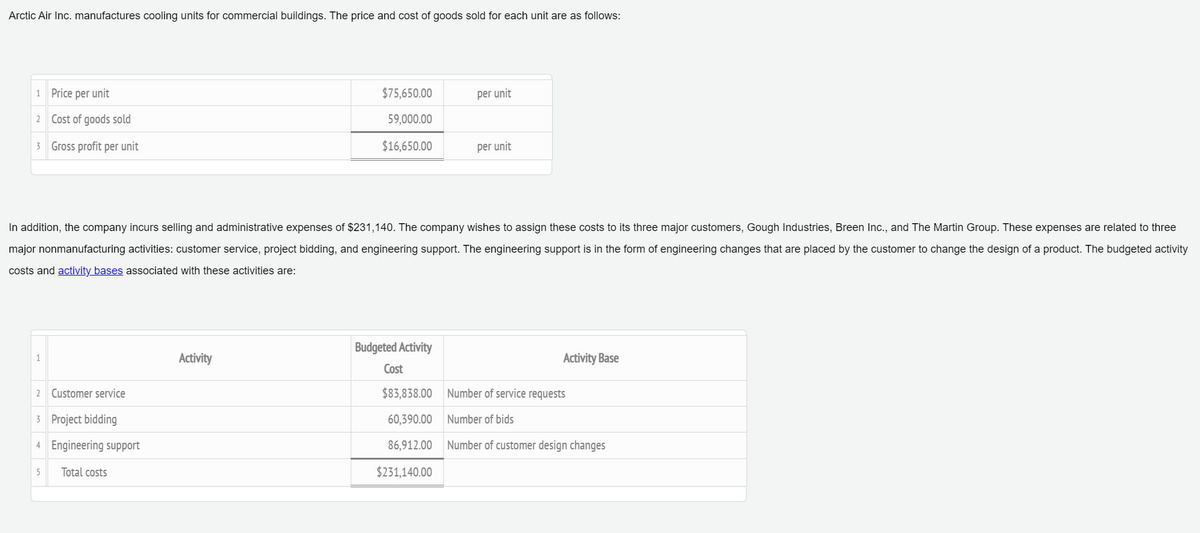

Transcribed Image Text:Arctic Air Inc. manufactures cooling units for commercial buildings. The price and cost of goods sold for each unit are as follows:

1 Price per unit

$75,650.00

per unit

2 Cost of goods sold

59,000.00

3 Gross profit per unit

$16,650.00

per unit

In addition, the company incurs selling and administrative expenses of $231,140. The company wishes to assign these costs to its three major customers, Gough Industries, Breen Inc., and The Martin Group. These expenses are related to three

major nonmanufacturing activities: customer service, project bidding, and engineering support. The engineering support is in the form of engineering changes that are placed by the customer to change the design of a product. The budgeted activity

costs and activity bases associated with these activities are:

Budgeted Activity

Activity

Activity Base

1

Cost

2 Customer service

$83,838.00

Number of service requests

3 Project bidding

60,390.00

Number of bids

4 Engineering support

86,912.00

Number of customer design changes

Total costs

$231,140.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning