Activity: Think of at least four users of accounting information. Identify their connection to each other and how they benefited one another through the use of accounting information. NOTE: PLEASE REFER TO THE GIVEN LESSON and answer asap please

Activity: Think of at least four users of accounting information. Identify their connection to each other and how they benefited one another through the use of accounting information. NOTE: PLEASE REFER TO THE GIVEN LESSON and answer asap please

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter1: Introduction To Accounting

Section: Chapter Questions

Problem 1SEA: PURPOSE OF ACCOUNTING Match the following users with the information needed. 1. Ownersa. Whether the...

Related questions

Question

Activity:

Think of at least four users of accounting information. Identify their connection to each other and how they benefited one another through the use of accounting information.

NOTE: PLEASE REFER TO THE GIVEN LESSON and answer asap please

Transcribed Image Text:GOVERNMENT AND THEIR AGENCIES- to investigate

whether the business operation complies to the

promulgated government' s rules and regulation.

8. FINANCIAL ANALYST AND ADVISORS

to determine

the market position of the business in the industry as

well as to give the best advise on how to improve the

profitability level of the company.

7.

9. TRADE ASSOCIATIONS - necessary to report industry

statistics and business comparisons relevant in

economic decisions.

10. PUBLIC to determine if the company has significant

contributions to the economy thru employment and tax

payments.

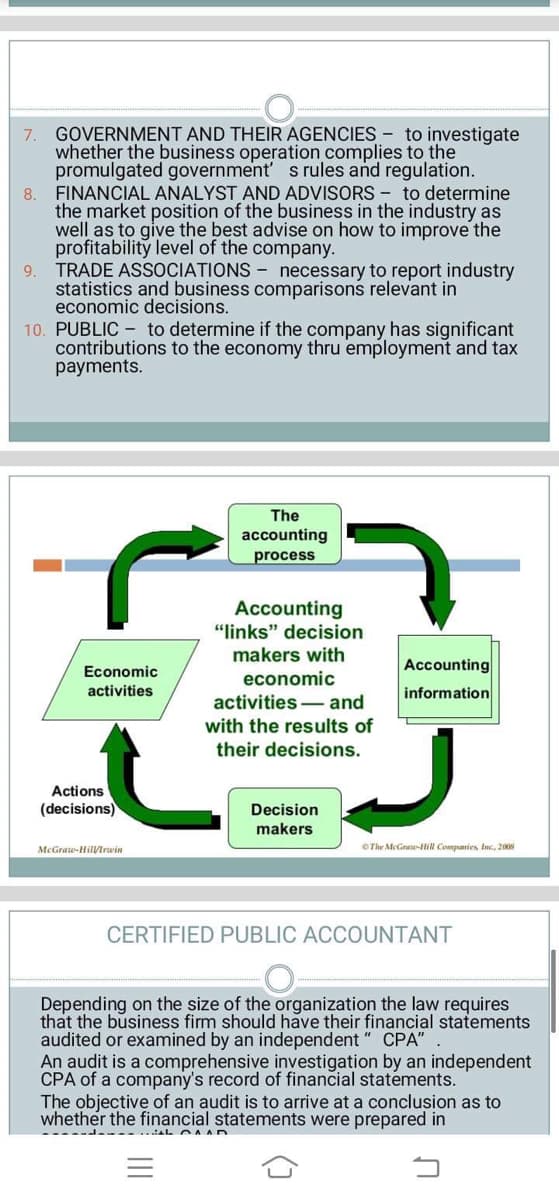

Economic

activities

Actions

(decisions)

McGraw-Hil/Irwin

The

accounting

process

Accounting

"links" decision

makers with

economic

activities

and

with the results of

their decisions.

Decision

makers

|||

Accounting

information

The McGraw-Hill Companies, Inc., 2008

CERTIFIED PUBLIC ACCOUNTANT

Depending on the size of the organization the law requires

that the business firm should have their financial statements

audited or examined by an independent

CPA"

An audit is a comprehensive investigation by an independent

CPA of a company's record of financial statements.

The objective of an audit is to arrive at a conclusion as to

whether the financial statements were prepared in

Transcribed Image Text:USERS OF ACCOUNTING INFORMATION

1. MANAGEMENT - information necessary for

planning and controlling to who will have a

significant impact to the operation of the business.

2. OWNER' S FIRM OR PROSPECTIVE OWNERS -

information necessary to know the progress of the

business and to determine how their money was

being used.

3. INVESTORS- to know how profitable the business

would be and to estimate the rate of return of the

invested money

4. EMPLOYEES- to determine the stability of the

business that will give assurance of security of

employment through good remuneration and

benefits.

5. LENDERS/FINANCIAL INSTITUTIONS - to

determine whether the company can pay the

principal and interest when due.

6. SUPPLIERS/OTHER TRADE CREDITORS - to know

if the company has the capacity to pay the amounts

on the goods and services delivered.

7.

GOVERNMENT AND THEIR AGENCIES to investigate

whether the business operation complies to the

promulgated government' s rules and regulation.

8. FINANCIAL ANALYST AND ADVISORS

to determine

the market position of the business in the industry as

well as to give the best advise on how to improve the

profitability level of the company.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub