Admitting a New LLC Member With Bonus Alert Medical, LLC, consists of two doctors, Abrams and Lipscomb, who share in all income and losses according to a 2:3 income- sharing ratio. Dr. Lin has been asked to join the LLC. Prior to admitting Lin, the assets of Alert Medical were revalued to reflect their current market values. The revaluation resulted in medical equipment being increased by $33,000. Prior to the revaluation, the equity balances for Abrams and Lipscomb were $317,000 and $363,000, respectively. a. Provide the journal entry for the asset revaluation. For a compound transaction, if an amount box does not require an entry, leave it blank. b. Provide the journal entry for the bonus under the following independent situations: 1. Lin purchased a 30% interest in Alert Medical, LLC, for $406,000. For a compound transaction, if an amount box does not require an entry, leave it blank. 2. Lin purchased a 25% interest in Alert Medical, LLC, for $207,000. For a compound transaction, if an amount box does not require an entry, leave it blank.

Admitting a New LLC Member With Bonus Alert Medical, LLC, consists of two doctors, Abrams and Lipscomb, who share in all income and losses according to a 2:3 income- sharing ratio. Dr. Lin has been asked to join the LLC. Prior to admitting Lin, the assets of Alert Medical were revalued to reflect their current market values. The revaluation resulted in medical equipment being increased by $33,000. Prior to the revaluation, the equity balances for Abrams and Lipscomb were $317,000 and $363,000, respectively. a. Provide the journal entry for the asset revaluation. For a compound transaction, if an amount box does not require an entry, leave it blank. b. Provide the journal entry for the bonus under the following independent situations: 1. Lin purchased a 30% interest in Alert Medical, LLC, for $406,000. For a compound transaction, if an amount box does not require an entry, leave it blank. 2. Lin purchased a 25% interest in Alert Medical, LLC, for $207,000. For a compound transaction, if an amount box does not require an entry, leave it blank.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter18: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 1BD

Related questions

Question

Transcribed Image Text:eBook

Print Item

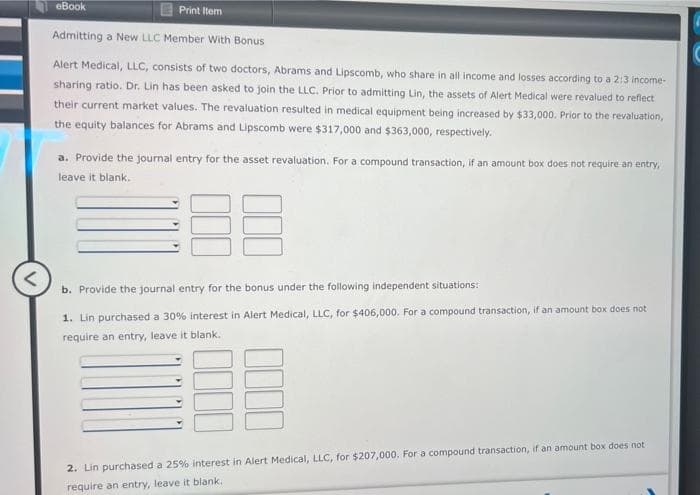

Admitting a New LLC Member With Bonus

Alert Medical, LLC, consists of two doctors, Abrams and Lipscomb, who share in all income and losses according to a 2:3 income-

sharing ratio. Dr. Lin has been asked to join the LLC. Prior to admitting Lin, the assets of Alert Medical were revalued to reflect

their current market values. The revaluation resulted in medical equipment being increased by $33,000. Prior to the revaluation,

the equity balances for Abrams and Lipscomb were $317,000 and $363,000, respectively.

a. Provide the journal entry for the asset revaluation. For a compound transaction, if an amount box does not require an entry,

leave it blank.

b. Provide the journal entry for the bonus under the following independent situations:

1. Lin purchased a 30% interest in Alert Medical, LLC, for $406,000. For a compound transaction, if an amount box does not

require an entry, leave it blank.

2. Lin purchased a 25% interest in Alert Medical, LLC, for $207,000. For a compound transaction, if an amount box does not

require an entry, leave it blank.

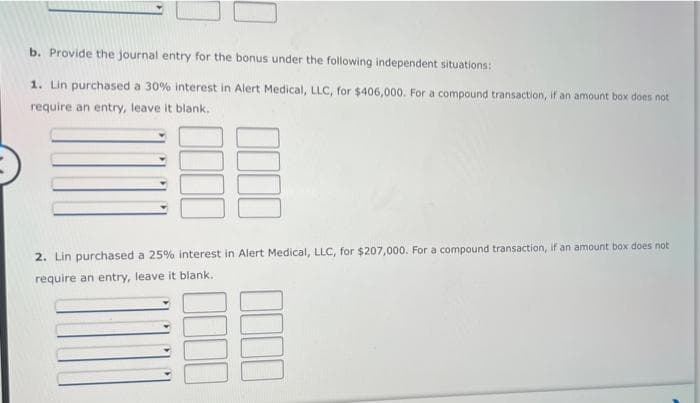

Transcribed Image Text:b. Provide the journal entry for the bonus under the following independent situations:

1. Lin purchased a 30% interest in Alert Medical, LLC, for $406,000. For a compound transaction, if an amount box does not

require an entry, leave it blank.

2. Lin purchased a 25% interest in Alert Medical, LLC, for $207,000. For a compound transaction, if an amount box does not

require an entry, leave it blank.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning