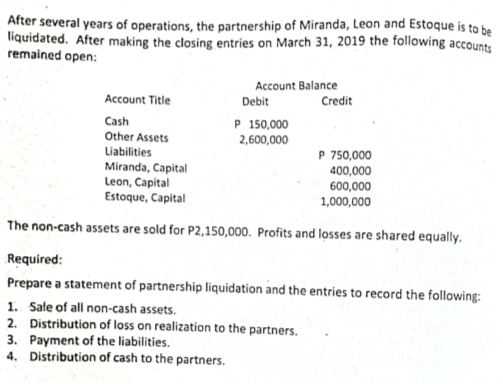

After several years of operations, the partnership of Miranda, Leon and Estoque is to be liquidated. After making the closing entries on March 31, 2019 the following accounts remained open: Account Balance Credit Account Title Debit P 150,000 Cash Other Assets Liabilities Miranda, Capital Leon, Capital Estoque, Capital 2,600,000 P 750,000 400,000 600,000 1,000,000 The non-cash assets are sold for P2,150,000. Profits and losses are shared equally. Required: Prepare a statement of partnership liquidation and the entries to record the following: 1. Sale of all non-cash assets. 2. Distribution of loss on realization to the partners. 3. Payment of the liabilities

After several years of operations, the partnership of Miranda, Leon and Estoque is to be liquidated. After making the closing entries on March 31, 2019 the following accounts remained open: Account Balance Credit Account Title Debit P 150,000 Cash Other Assets Liabilities Miranda, Capital Leon, Capital Estoque, Capital 2,600,000 P 750,000 400,000 600,000 1,000,000 The non-cash assets are sold for P2,150,000. Profits and losses are shared equally. Required: Prepare a statement of partnership liquidation and the entries to record the following: 1. Sale of all non-cash assets. 2. Distribution of loss on realization to the partners. 3. Payment of the liabilities

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter19: Accounting For Partnerships

Section: Chapter Questions

Problem 10SPB: STATEMENT OF PARTNER SHIP LIQUIDATION WITH LOSS After several years of operations, the partnership...

Related questions

Question

100%

Lump-Sum Liquidation with Loss on Realization

Transcribed Image Text:After several years of operations, the partnership of Miranda, Leon and Estoque is to be

liquidated. After making the closing entries on March 31, 2019 the following accounts

remained open:

Account Balance

Account Title

Debit

Credit

Cash

P 150,000

Other Assets

2,600,000

P 750,000

Liabilities

Miranda, Capital

Leon, Capital

Estoque, Capital

400,000

600,000

1,000,000

The non-cash assets are sold for P2,150,000. Profits and losses are shared equally.

Required:

Prepare a statement of partnership liquidation and the entries to record the following:

1. Sale of all non-cash assets.

2. Distribution of loss on realization to the partners.

3. Payment of the liabilities.

4. Distribution of cash to the partners.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning