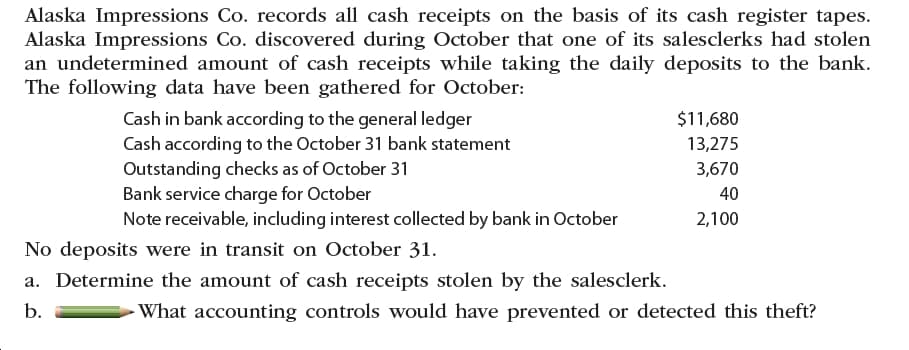

Alaska Impressions Co. records all cash receipts on the basis of its cash register tapes. Alaska Impressions Co. discovered during October that one of its salesclerks had stolen an undetermined amount of cash receipts while taking the daily deposits to the bank. The following data have been gathered for October: Cash in bank according to the general ledger Cash according to the October 31 bank statement Outstanding checks as of October 31 Bank service charge for October Note receivable, including interest collected by bank in October $11,680 13,275 3,670 40 2,100 No deposits were in transit on October 31. a. Determine the amount of cash receipts stolen by the salesclerk. b. -What accounting controls would have prevented or detected this theft?

Alaska Impressions Co. records all cash receipts on the basis of its cash register tapes. Alaska Impressions Co. discovered during October that one of its salesclerks had stolen an undetermined amount of cash receipts while taking the daily deposits to the bank. The following data have been gathered for October: Cash in bank according to the general ledger Cash according to the October 31 bank statement Outstanding checks as of October 31 Bank service charge for October Note receivable, including interest collected by bank in October $11,680 13,275 3,670 40 2,100 No deposits were in transit on October 31. a. Determine the amount of cash receipts stolen by the salesclerk. b. -What accounting controls would have prevented or detected this theft?

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter5: Bank Reconciliation (bankrec)

Section: Chapter Questions

Problem 3R

Related questions

Question

Transcribed Image Text:Alaska Impressions Co. records all cash receipts on the basis of its cash register tapes.

Alaska Impressions Co. discovered during October that one of its salesclerks had stolen

an undetermined amount of cash receipts while taking the daily deposits to the bank.

The following data have been gathered for October:

Cash in bank according to the general ledger

Cash according to the October 31 bank statement

Outstanding checks as of October 31

Bank service charge for October

Note receivable, including interest collected by bank in October

$11,680

13,275

3,670

40

2,100

No deposits were in transit on October 31.

a. Determine the amount of cash receipts stolen by the salesclerk.

b.

-What accounting controls would have prevented or detected this theft?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning