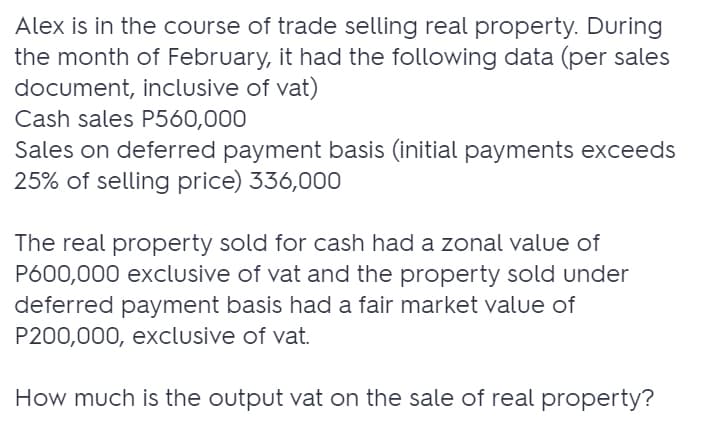

Alex is in the course of trade selling real property. During the month of February, it had the following data (per sales document, inclusive of vat) Cash sales P560,000 Sales on deferred payment basis (initial payments exceeds 25% of selling price) 336,000 The real property sold for cash had a zonal value of P600,000 exclusive of vat and the property sold under deferred payment basis had a fair market value of P200,000, exclusive of vat. How much is the output vat on the sale of real property?

Alex is in the course of trade selling real property. During the month of February, it had the following data (per sales document, inclusive of vat) Cash sales P560,000 Sales on deferred payment basis (initial payments exceeds 25% of selling price) 336,000 The real property sold for cash had a zonal value of P600,000 exclusive of vat and the property sold under deferred payment basis had a fair market value of P200,000, exclusive of vat. How much is the output vat on the sale of real property?

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 53P

Related questions

Question

P84,000

P96,000

P108,000

P112,320

Transcribed Image Text:Alex is in the course of trade selling real property. During

the month of February, it had the following data (per sales

document, inclusive of vat)

Cash sales P560,000

Sales on deferred payment basis (initial payments exceeds

25% of selling price) 336,000

The real property sold for cash had a zonal value of

P600,000 exclusive of vat and the property sold under

deferred payment basis had a fair market value of

P200,000, exclusive of vat.

How much is the output vat on the sale of real property?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning