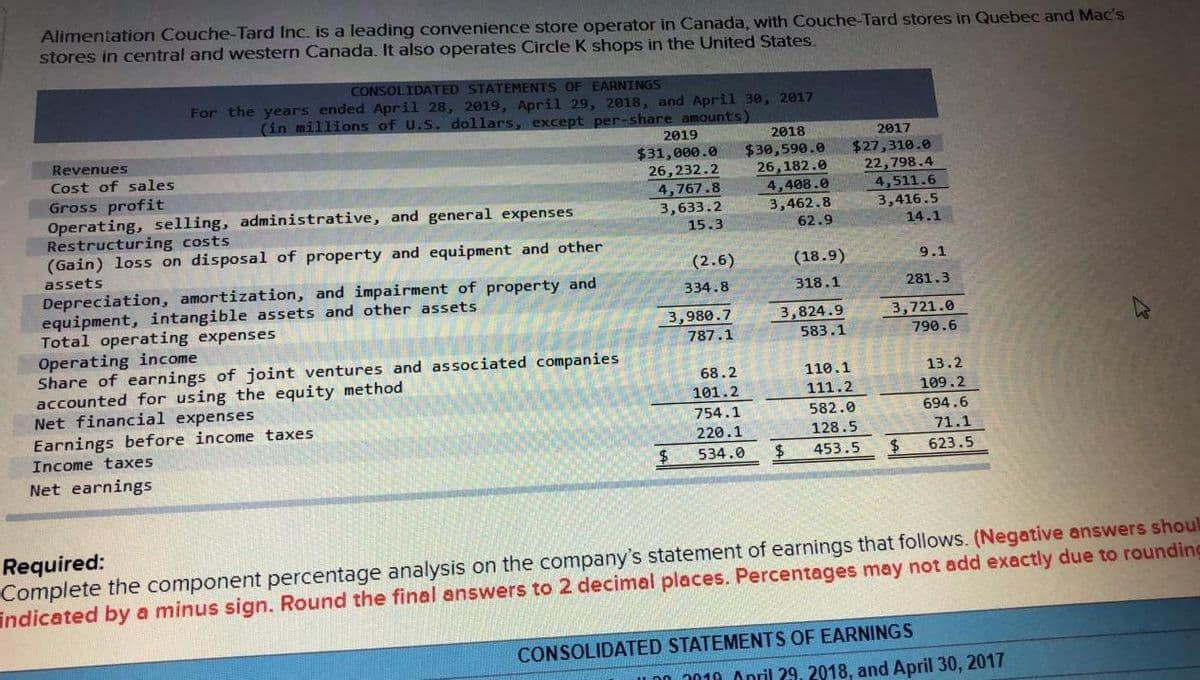

Alimentation Couche-Tard Inc. is a leading convenience store operator in Canada, with Couche-Talu stores in central and western Canada. It also operates Circle K shops in the United States. CONSOLIDATED STATEMENTS OF EARNINGS For the years ended April 28, 2019, April 29, 2018, and April 30, 2017 (in millions of U.S. dollars, except per-share amounts) 2019 2018 2017 $27,310.0 22,798.4 Revenues $31,000.0 26,232.2 4,767.8 $30,590.0 26,182.0 4,408.0 3,462.8 62.9 Cost of sales Gross profit Operating, selling, administrative, and general expenses Restructuring costs (Gain) loss on disposal of property and equipment and other 4,511.6 3,633.2 15.3 3,416.5 14.1 assets (2.6) (18.9) 9.1 Depreciation, amortization, and impairment of property and equipment, intangible assets and other assets Total operating expenses Operating income Share of earnings of joint ventures and associated companies accounted for using the equity method Net financial expenses 334.8 318.1 281.3 3,980.7 787.1 3,824.9 3,721.0 583.1 790.6 68.2 101.2 110.1 13.2 109.2 694.6 111.2 754.1 582.0 Earnings before income taxes Income taxes 220.1 128.5 71.1 24 534.0 24 453.5 623.5 Net earnings Required: Complete the component percentage analysis on the company's statement of earnings that follows. (Negative answers shou' ndicated by a minus sign. Round the final answers to 2 decimal places. Percentages may not add exactly due to roundins CONSOLIDATED STATEMENTS OF EARNINGS

Alimentation Couche-Tard Inc. is a leading convenience store operator in Canada, with Couche-Talu stores in central and western Canada. It also operates Circle K shops in the United States. CONSOLIDATED STATEMENTS OF EARNINGS For the years ended April 28, 2019, April 29, 2018, and April 30, 2017 (in millions of U.S. dollars, except per-share amounts) 2019 2018 2017 $27,310.0 22,798.4 Revenues $31,000.0 26,232.2 4,767.8 $30,590.0 26,182.0 4,408.0 3,462.8 62.9 Cost of sales Gross profit Operating, selling, administrative, and general expenses Restructuring costs (Gain) loss on disposal of property and equipment and other 4,511.6 3,633.2 15.3 3,416.5 14.1 assets (2.6) (18.9) 9.1 Depreciation, amortization, and impairment of property and equipment, intangible assets and other assets Total operating expenses Operating income Share of earnings of joint ventures and associated companies accounted for using the equity method Net financial expenses 334.8 318.1 281.3 3,980.7 787.1 3,824.9 3,721.0 583.1 790.6 68.2 101.2 110.1 13.2 109.2 694.6 111.2 754.1 582.0 Earnings before income taxes Income taxes 220.1 128.5 71.1 24 534.0 24 453.5 623.5 Net earnings Required: Complete the component percentage analysis on the company's statement of earnings that follows. (Negative answers shou' ndicated by a minus sign. Round the final answers to 2 decimal places. Percentages may not add exactly due to roundins CONSOLIDATED STATEMENTS OF EARNINGS

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.4C

Related questions

Question

Transcribed Image Text:Alimentation Couche-Tard Inc. is a leading convenience store operator in Canada, with Couche-Tard stores in Quebec and Mac's

stores in central and western Canada. It also operates Circle K shops in the United States.

CONSOLIDATED STATEMENTS OF EARNINGS

For the years ended April 28, 2019, April 29, 2018, and April 30, 2017

(in millions of U.S. dollars, except per-share amounts)

2019

2018

$30,590.0

26,182.0

4,408.0

3,462.8

2017

$27,310.0

22,798.4

Revenues

$31,000.0

Cost of sales

26,232.2

Gross profit

Operating, selling, administrative, and general expenses

Restructuring costs

(Gain) loss on disposal of property and equipment and other

4,767.8

3,633.2

4,511.6

3,416.5

15.3

62.9

14.1

assets

(2.6)

(18.9)

9.1

Depreciation, amortization, and impairment of property and

equipment, intangible assets and other assets

Total operating expenses

Operating income

Share of earnings of joint ventures and associated companies

accounted for using the equity method

Net financial expenses

Earnings before income taxes

Income taxes

334.8

318.1

281.3

3,721.0

790.6

3,980.7

3,824.9

583.1

787.1

110.1

111.2

13.2

109.2

68.2

101.2

754.1

582.0

694.6

220.1

534.0

128.5

71.1

453.5

$4

623.5

Net earnings

Required:

Complete the component percentage analysis on the company's statement of earnings that follows. (Negative answers shoul

indicated by a minus sign. Round the final answers to 2 decimal places. Percentages may not add exactly due to rounding

CONSOLIDATED STATEMENTS OF EARNINGS

uD0 2010 April 29, 2018. and April 30, 2017

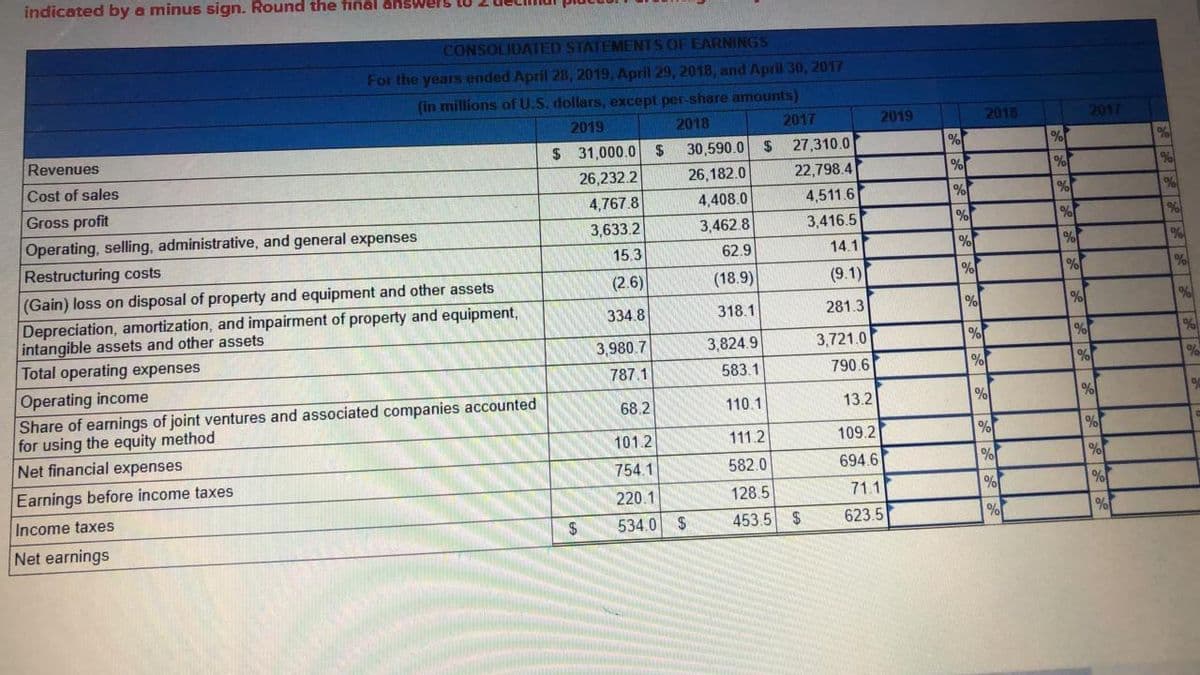

Transcribed Image Text:indicated by a minus sign. Round the final ansWers to

CONSOLIDATED STATEMENTS OF EARNINGS

For the years ended April 28, 2019, April 29, 2018, and April 30, 2017

(in millions ofU.S. dollars, except per-share amounts)

2019

2018

2017

2019

2018

2017

Revenues

$ 27,310.0

22,798.4

$ 31,000.0 $

30,590.0

Cost of sales

26,232.2

26, 182.0

%

Gross profit

4,767.8

4,408.0

4,511.6

%

Operating, selling, administrative, and general expenses

3,633.2

3,462.8

3,416.5

%

Restructuring costs

15.3

62.9

14.1

%

%

(2.6)

(18.9)

(9.1)

%

%

(Gain) loss on disposal of property and equipment and other assets

Depreciation, amortization, and impairment of property and equipment,

intangible assets and other assets

Total operating expenses

334.8

318.1

281.3

%

3,980.7

3,824.9

3,721.0

%

787.1

583.1

790.6

Operating income

Share of earnings of joint ventures and associated companies accounted

for using the equity method

Net financial expenses

68.2

110.1

13.2

%

101.2

111.2

109.2

%

754.1

582.0

694.6

%

Earnings before income taxes

220.1

128.5

71.1

Income taxes

$

534.0

24

453.5

2$

623.5

Net earnings

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College