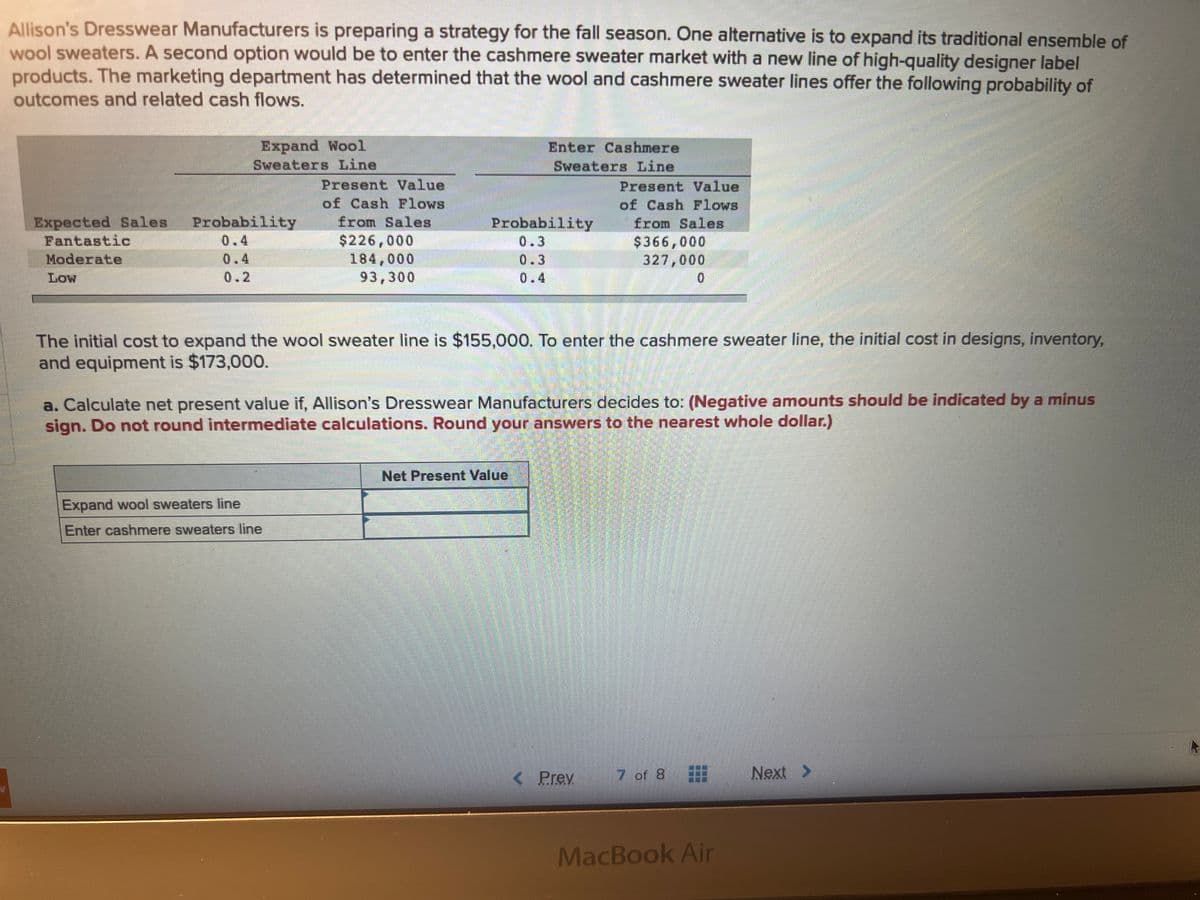

Allison's Dresswear Manufacturers is preparing a strategy for the fall season. One alternative is to expand its traditional ensemble of wool sweaters. A second option would be to enter the cashmere sweater market with a new line of high-quality designer label products. The marketing department has determined that the wool and cashmere sweater lines offer the following probability of outcomes and related cash flows. Expand Wool Sweaters Line Expected Sales Probability 0.4 0.4 0.2 Fantastic Moderate Low Present Value of Cash Flows from Sales $226,000 184,000 93,300 Expand wool sweaters line Enter cashmere sweaters line Enter Cashmere Sweaters Line Probability 0.3 0.3 0.4 Present Value of Cash Flows from Sales $366,000 327,000 The initial cost to expand the wool sweater line is $155,000. To enter the cashmere sweater line, the initial cost in designs, inventory, and equipment is $173,000. Net Present Value 0 a. Calculate net present value if, Allison's Dresswear Manufacturers decides to: (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest whole dollar.)

Allison's Dresswear Manufacturers is preparing a strategy for the fall season. One alternative is to expand its traditional ensemble of wool sweaters. A second option would be to enter the cashmere sweater market with a new line of high-quality designer label products. The marketing department has determined that the wool and cashmere sweater lines offer the following probability of outcomes and related cash flows. Expand Wool Sweaters Line Expected Sales Probability 0.4 0.4 0.2 Fantastic Moderate Low Present Value of Cash Flows from Sales $226,000 184,000 93,300 Expand wool sweaters line Enter cashmere sweaters line Enter Cashmere Sweaters Line Probability 0.3 0.3 0.4 Present Value of Cash Flows from Sales $366,000 327,000 The initial cost to expand the wool sweater line is $155,000. To enter the cashmere sweater line, the initial cost in designs, inventory, and equipment is $173,000. Net Present Value 0 a. Calculate net present value if, Allison's Dresswear Manufacturers decides to: (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest whole dollar.)

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter12: Integer Linear Optimization_models

Section: Chapter Questions

Problem 3P: Spencer Enterprises is attempting to choose among a series of new investment alternatives. The...

Related questions

Question

Transcribed Image Text:Allison's Dresswear Manufacturers is preparing a strategy for the fall season. One alternative is to expand its traditional ensemble of

wool sweaters. A second option would be to enter the cashmere sweater market with a new line of high-quality designer label

products. The marketing department has determined that the wool and cashmere sweater lines offer the following probability of

outcomes and related cash flows.

Expand Wool

Sweaters Line

Expected Sales Probability

Fantastic

Moderate

Low

0.2

Present Value

of Cash Flows

from Sales

$226,000

184,000

93,300

Expand wool sweaters line

Enter cashmere sweaters line

Enter Cashmere

Sweaters Line

Probability

0.3

0.3

0.4

The initial cost to expand the wool sweater line is $155,000. To enter the cashmere sweater line, the initial cost in designs, inventory,

and equipment is $173,000.

Net Present Value

Present Value

of Cash Flows

from Sales

$366,000

327,000

a. Calculate net present value if, Allison's Dresswear Manufacturers decides to: (Negative amounts should be indicated by a minus

sign. Do not round intermediate calculations. Round your answers to the nearest whole dollar.)

< Prev

0

7 of 8

MacBook Air

Next >

R

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College