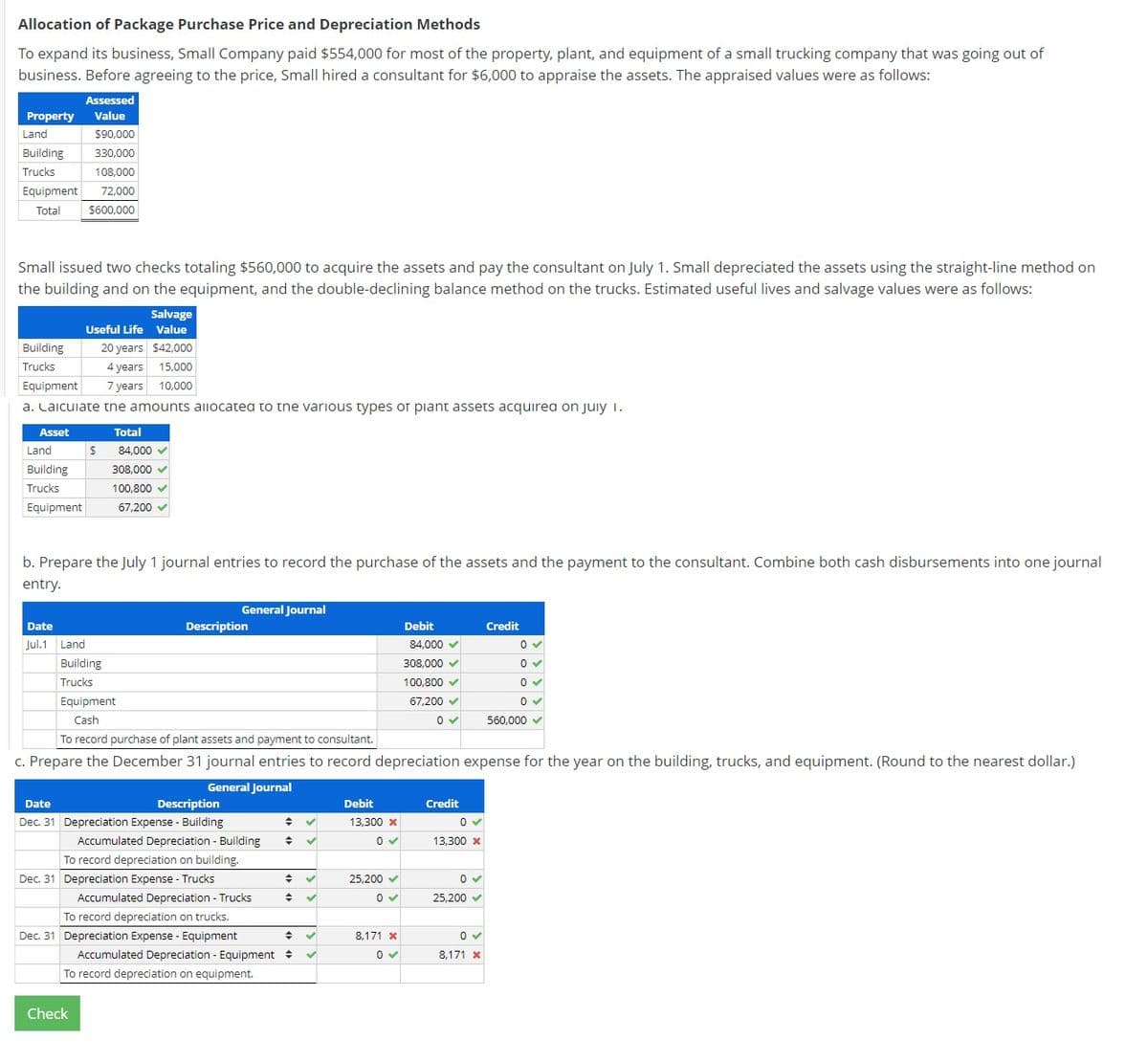

Allocation of Package Purchase Price and Depreciation Methods To expand its business, Small Company paid $554,000 for most of the property, plant, and equipment of a small trucking company that was going out of business. Before agreeing to the price, Small hired a consultant for $6,000 to appraise the assets. The appraised values were as follows: Assessed Property Value Land $90,000 Building 330,000 Trucks 108,000 Equipment 72,000 Total $600,000 Small issued two checks totaling $560,000 to acquire the assets and pay the consultant on July 1. Small depreciated the assets using the straight-line method on the building and on the equipment, and the double-declining balance method on the trucks. Estimated useful lives and salvage values were as follows: Salvage Useful Life Value Building 20 years $42,.000 4 years 15,000 7 years 10,000 Trucks Equipment a. Caicuiate tne amounts allocatea to tne various types or piant assets acquirea on juiy i. Asset Total Land S 84,000 v Building 308,000 v Trucks 100,800 v Equipment 67,200 v b. Prepare the July 1 journal entries to record the purchase of the assets and the payment to the consultant. Combine both cash disbursements into one journal entry. General Journal Date Description Debit Credit Jul.1 Land 84,000 v Building 308,000 v Trucks 100,800 v Equipment 67,200 v Cash 560,000 v To record purchase of plant assets and payment to consultant. c. Prepare the December 31 journal entries to record depreciation expense for the year on the building, trucks, and equipment. (Round to the nearest dollar.) General Journal Date Description Debit Credit Dec. 31 Depreciation Expense - Building 수 13,300 x Accumulated Depreciation - Building 13,300 x To record depreciation on building. Dec. 31 Depreciation Expense - Trucks 25.200 v Accumulated Depreciation - Trucks 25,200 v To record depreciation on trucks. Dec. 31 Depreciation Expense - Equipment 8,171 x Accumulated Depreciation - Equipment + 8,171 x To record depreciation on equipment. Check

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Please help me with part c in the general ledger for the

Trending now

This is a popular solution!

Step by step

Solved in 2 steps