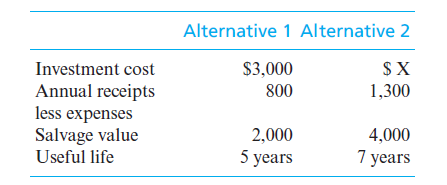

Alternative 1 Alternative 2 Investment cost $3,000 $X Annual receipts less expenses Salvage value Useful life 800 1,300 2,000 4,000 5 years 7 years

Q: 2. The following are the relevant data of two alternative machines are shown in the table below.…

A: Capital budgeting is used by the business firms to determines the gains from different capital…

Q: Compare the two following alternatives in terms of present worth using MARR = 8% for a study period…

A: Computation:

Q: June Co. is evaluating a project requiring a capital expenditure of $620,000. The project has an…

A: Capital expenditure = 620,000 Salvage Value = 0 N = 4 Depreciation per year = Capital expenditure /…

Q: A new city truck can be purchased for $2,400,000. Its expected useful life is six years, at which…

A: Present Value: The present value (PV) is the present sum of a series of fixed payments. The series…

Q: Moore Science uses a discount rate of 15% to evaluate projects. Should the following project be…

A: Given information is: Moore Science uses a discount rate of 15% to evaluate projects. Life is 10…

Q: Consider the financial data for a project given in the table below. Initial investment $70,000…

A: Internal Rate of Return is the rate at which the Net Present Value of a project becomes zero. It can…

Q: Alternative X has a first cost of 19000 an annual operating cost of 3500 , and a salvage value of…

A: The Present worth analysis is used by discounting their cash flow at a single of point of time at…

Q: The expected average rate of return for a proposed investment of $639,000 in a fixed asset, with a…

A: b. 52.43%

Q: Tiberius Manufacturing is considering two alternative investment proposals with the following data:…

A: Given, Investment = $500,000 Useful life = 5 years Annual net cash flows = $105,000 First,…

Q: The value of CC for the alternative (B) -at an interest rate of 10% per year is closest to:…

A: Capitalized cost is the present value of the future payments of the project, if the project is done…

Q: A challenger asset with a maximum useful life of 6 years has a first cost of $43,000 and an…

A: Equivalent uniform annual cost comprise of annual equivalent uniform of first cost less annual…

Q: Compare the alternatives below using AW and i = 10% per year C D First Cost, $ -50,000 -250,000…

A: Operating Cost Operating costs are the day-to-day costs of running a firm. COGS (cost of goods…

Q: Osler Company is considering an investment with the following data: Initial cost $200,000…

A: Initial cost = $ 200,000 Annual cash inflow = $ 25000 Years = 10 Years Required rate of return = 4%…

Q: 1.Gillespie Gold Products, Inc., is considering the purchase of new smelting equipment. The new…

A: Thanks for the Question Bartleby's Guideline: “Since you have asked multiple question, we will solve…

Q: The expected average rate of return for a proposed investment of $702,100 in a fixed asset with a…

A: Formula: Average total income = Expected total income / 4 years

Q: June Co. is evaluating a project requiring a capital expenditure of $620,000. The project has an…

A: (a) Average rate of return = Average net income/Average investment x 100 = 37,500/310,000…

Q: Two mutually exclusive alternatives are being considered for the environmental protection equipment…

A: Annual Worth: It is the equivalent uniform yearly worth of all estimated receipts and costs…

Q: 2. Compare the following alternatives, using (i) the Net Present Value method . The MARR is 13.32%…

A: Net present value shows how much of the present value of cash inflows exceeds over those of present…

Q: The expected average rate of return for a proposed investment of $589,600 in a fixed asset with a…

A: Average net income = $237,920 / 4 = $59,480 Initial investment = $589,600

Q: The expected average rate of return for a proposed investment of $800,000 in a fixed asset with a…

A: Return on Investment = Average Annual Income / Average Investment

Q: If interest is 8%, what is the present worth of cost of 12 years of Machine X?

A: Time value of money (TVM) refers to the method or technique which is used to measure the amount of…

Q: Compare the two following alternatives in terms of present worth using MARR = 4% for a study period…

A: Present worth is the sum of present value of cash flows.

Q: A proposed 4-year project has an initial cost of $236,000, projected sales of 4,500 units a year, a…

A: Calculations are done on excel so there is no intermediate rounding. Hence, values calculated are…

Q: Xavier Co. wants to purchase a machine for $37,400 with a four-year life and a $1,100 salvage value.…

A: The difference between the present value of cash inflows and present value of cash outflows is net…

Q: An analyst offers three investment alternatives with the A= $200,000; B= $300,000 and C= $100,00O.…

A: Solved using Financial Calculator Option A CF Mode: Press CF C0 = +/- 200,000 C1 = 40,000 F1 = 10…

Q: Assume that two pieces of equipment have the following characteristics: Expected life (years)…

A: Equivalent annual cost is used when two or more projects are compared having unequal lives. Under…

Q: the end of each year. The company uses the straight-line method of depreciation with no mid-year…

A: 1. The project payback is given as, = Initial investment / Annual cash inflows = $450000/$90000 = 5…

Q: Problem 1 Two options need to be analyzed using internal rate of return with a MARR of 9% to…

A:

Q: The purchase of a used pickup truck for $9,000 is being considered. Fuel and maintenance $1,980 per…

A: EUAC is the is equivalent uniform annual cost which is necessary to cover all cost involved in that…

Q: Given the following information, what is the financial break-even point? Initial investment =…

A: Given that: Fixed cost=$58000 price=$130 variable cost per unit=$95 Thus formula of financial break…

Q: GIVEN: Project C requires $800,000 net initial investment for new machinery with a 8-year life and a…

A: Initial Investment on machine = $800,000 Salvage Value = $40,000 Useful Life = 8 Years Straight Line…

Q: A company must invest in one of two alternatives. Alternative Alternative B A Initial Cost $774,542…

A: Here, MARR is 5.80% Investment Period is 4 years

Q: Compare the alternatives C and D on the basis of a present worth analysis using an in rate of 10%…

A: Alternate C Year Cash flow PVF @10% PVCF 1 11,000.0 0.9091 10,000.00 2…

Q: 7. A company considering two alternatives with regards to an equipment which it needs. The…

A: In order to determine the usage of the purchased equipment that is equivalent to rental equipment,…

Q: Compare two alternatives, A and B, on the basis of a present worth evaluation using i = 10% per year…

A: Calculation of present worth of alternative A: Excel spreadsheet:

Q: years, proje arry same risk. sidering the current economic situation Batelco Inc. has set a maximum…

A: Net present value is the difference between the present value of cash flow and initial investment of…

Q: TransITRI is a transportation company with a recent need of a new construction equipment at a first…

A: The machine has a economic life of 8 years.The function given for cash flow before tax can be used…

Q: A new machine can be purchased for $50,000. It is expected useful life is 9 years, with a salvage…

A: The annual worth analysis is a useful technique to determine the equivalent uniform annual worth of…

Q: Which altenative in the table below should be selected when the MARR = 4% per year? The life of each…

A: MARR = 4% Time Period = 10 Years Increment Considered Δ(A-DN) Δ(B-A) Δ(C-B) Δ(D-C) Δ Investment…

Q: 1. An elective project is currently under review. An initial investment of $116,000 would be…

A: Here, Initial Investment is $116,000 Annual Revenue is $38,000 Annual Expenses is $10,000 Therefore,…

Q: Given the following information, what is the financial break-even point? Initial investment =…

A: The financial break-even point is the level of earnings where earnings per share are zero. In other…

Q: As an Engineer, you are asked to consider two building proposals, which alternative do you deem…

A: Interest Rate = 21.4% Quarterly Compounding Number of compounding periods = 4 Year Cash Flow -…

Q: The expected average rate of return for a proposed investment of $800,000 in a fixed asset with a…

A: Average rate of return = Average annual profit / Average investment where, Average annual profit =…

Q: XYZ company has A piece of new equipment will cost $70,000. The equipment will provide a cost…

A: Net present value is the value of any asset of all future income has been discounted back to present…

Q: please answer number 14:bes 221-engineering economics. please give detailed and correct answers. I…

A: The process of estimating and analyzing an entity's margin of safety based on revenues and related…

Q: Alternative X has a first cost of 36000 an annual operating cost of 6900 , and a salvage value of…

A: A method of capital budgeting that helps to evaluate the present worth of cash flow and a series of…

Q: A project requires an investment cost of P 600 000 with 5 – year useful life, no salvage value, and…

A: To find the net cash inflows, we will have to do the calculations step by step. We will use the…

Q: Two methods can be used to produce expansion anchors. Method A costs $80,000 initially and will have…

A: Company shall select the method B and here is the working Is shown:

Q: A certain power plant is considering two alternatives with regards to a hydraulic equipment which it…

A: The equivalent present value is the present value of the replacement cost of the asset. This…

What is the investment cost of Alternative 2 that will cause it to breakeven with Alternative 1, assuming the MARR = 12% per year. Further assume cotermination at the end of year five. State any other assumptions you make.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

- Q#3 Following in the adjusted trial balance of M/s Rizwan for the year 2020ACCOUNT TITLES DEBIT CREDITCash 150000Inventory 10,000Prepaid rent 50,000Office Supplies 60,000Land 900,000Building 800,000Accumulated Depreciation 40,000Accounts payable 80,000Salaries payable 55,000Long term loan 390,000Purchases 400,000Sales 600,000Purchase returns 18,000Sales returns 14,000Transportation-in 5,000Interest expense 2,000Salaries expense 44,000Depreciation expense 29,000Electricity expense 5,000Interest expense 5,000Interest payable 25,000Commission Income 22,000Capital 1,254,000Drawing 10000Total 2,484,000 2,484,000Inventory Closing Rs. 50,000REQUIRED a) Prepare Income Statement for the year ended December 31, 2020. b) Prepare Balance Sheet in classified account form as of December 31, 2020Q#3 Following in the adjusted trial balance of M/s Rizwan for the year 2020ACCOUNT TITLES DEBIT CREDITCash 150000Inventory 10,000Prepaid rent 50,000Office Supplies 60,000Land 900,000Building 800,000Accumulated Depreciation 40,000Accounts payable 80,000Salaries payable 55,000Long term loan 390,000Purchases 400,000Sales 600,000Purchase returns 18,000Sales returns 14,000Transportation-in 5,000Interest expense 2,000Salaries expense 44,000Depreciation expense 29,000Electricity expense 5,000Interest expense 5,000Interest payable 25,000Commission Income 22,000Capital 1,254,000Drawing 10000Total 2,484,000 2,484,000Inventory Closing Rs. 50,000REQUIRED a) Prepare Income Statement for the year ended December 31, 2020.QUESTION 2 (20) INFORMATION:Vista Limited intends purchasing a new machine and has a choice between the following two machines:Equipment A Equipment BInitial cost R220 000 R240 000Expected useful life 5 years 5 yearsScrap value Nil NilExpected net cash inflows: R REnd of:Year 1 55 000 70 000Year 2 60 000 70 000Year 3 62 000 70 000Year 4 60 000 70 000Year 5 70 000 70 000The company estimates that its cost of capital is 12%.Required:2.1 Calculate the Payback Period of both equipment. (Answers must be expressed in years, months and days). (4)2.2 Calculate the Accounting Rate of Return (on initial investment) for both equipment A and B. (Answers must be expressed to 2 decimal places). (5)2.3 Calculate the Net Present Value of each equipment. (Round off amounts to the nearest Rand. (6)2.4 Calculate the Internal Rate of Return of Equipment B. (5)

- Pls answer number 5 with solutions On January 1, 20x1 WRECK RUIN Co. acquired land by issuing a three-year, 12%, ₱4,000,000 note payable. Principal and all accrued interests are due on December 31, 20x3. How much is the interest expense in 20x2? a. 1,017,600 c. 537,600 b. 960,000 d. 764,213Q 2. Woolard Supplies (a sole proprietorship) has taxable income in 2022 of $240,000 before any depreciation deductions (§179, bonus, or MACRS) and placed some office furniture into service during the year. The furniture does not qualify for bonus depreciation. (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) Note: Do not round intermediate calculations. Round your intermediate calculations and final answers to the nearest whole dollar amount. Asset Placed in Service Basis Office Furniture (used) March 20 $1,194,000 a. If Woolard elects $50,000 of §179, what is Woolard's total depreciation deduction for the year? b. If Woolard elects the maximum amount of §179 for the year, what is the amount of deductible §179 expense for the year? What is the total depreciation that Woolard may deduct in 2022? What is Woolard's §179 carryforward amount to next year, if any? c. Woolard is concerned about future limitations on its §179 expense. How much §179 expense should Woolard…part 3 4 solution needed Year Net cashflows 0 -575,000 1 £125,000 2 £248,000 3 £176,000 4 £146,000

- Question 1.2 I could only attach 2 pictures, the last picture has only 1 column "Cash and cash equivalent alent at the end of the year R36000" Calculate the amount of interest paid for the year ended 31 December 2020PA7. LO 4.3Using the following information: make the December 31 adjusting journal entry for depreciation determine the net book value (NBV) of the asset on December 31 Cost of asset, $250,000 Accumulated depreciation, beginning of year, $80,000 Current year depreciation, $25,000Problem 4–4 Redlands Inc. made the following investments on January 1, 2020, its first year of business: Item Cost Expected Life Cost Allocation Warehouse $100 20 years Straight-line Machine 60 10 years Double-declining Patent 20 5 years Straight-line Invest in stock* 10 Indefinite Not applicable * Rancho’s stock had a fair (market) values of $8 and $7 on December 31, 2020 and December 31, 2021, respectively. Required (A): 1. Present the depreciation, amortization, and losses on the 2020 income statements. 2. Report the book values of the long-term assets on the December 31, 2020 balance sheet. Required (B): 1. Compute the gain or loss on the sale of the warehouse if Redlands sold it for $111 on January 1, 2021. 2. Compute the impairment loss on the machine if Redlands determined it had a fair value of $45 on…

- Exercise 10 – Accrued Expenses Entity D acquired a piece of land on April 1, 2020. The purchase price was reduced by a creditfor the real property taxes accrued during the year. Entity D records real property taxes at eachmonth-end by adjusting the prepaid tax or tax payable account as appropriate. On May 1, 2020,Entity D paid the first of two equal installments of P72,000 for real property taxes. Required:What is the entry to record the payment on May 1?Q.11. Land shown in the books at $600,000 was revalued as 1,000,000. What journal entries will be passed at the time of revaluation and at the end of year. Under what head, gain on revaluation will be shown in the Income statement?PROVIDE COMPUTATION! 5. Cumulative compensation expense at the end of year 1a. P407,000 c. P430,000b. P645,000 d. P82,500 6. Cumulative compensation expense at the end of year 2a. P1,290,000 c. P810,000b. P330,000 d. P822,000 7. Cumulative compensation expense at the end of year 3a. P1,221,000 c. P1,215,000b. P1,290,000 d. P1,500,000