Alternative Accounting Treatments a. Estimate the amount of liability and record. b. Do not record as a liability but disclose in a footnote to the financial statements. c. Neither record as a liability nor disclose in a footnote to the financial statements. Required: Match the appropriate alternative accounting treatment with each of the potential contingent liabilities listed below. Potential Contingent Liabilities 1. Income taxes related to revenue included in net income this year but taxable in a future year. 2. Potential costs in future periods associated with performing warranty services on products sold this period. 3. Estimated cost of future services under a product warranty related to past sales. 4. Estimated cost of future services under a product warranty related to future sales. 5. Estimated cost of pension benefits related to past employee services that has yet to be funded. 6. Potential loss on environmental cleanup suit against company; a court judgment against the company is considered less than probable but more than remotely likely. 7. Potential loss under class-action suit by a group of customers; during the current year, the likelihood of a judgment against the company has increased from remote to possible but less than probable.

Alternative Accounting Treatments a. Estimate the amount of liability and record. b. Do not record as a liability but disclose in a footnote to the financial statements. c. Neither record as a liability nor disclose in a footnote to the financial statements. Required: Match the appropriate alternative accounting treatment with each of the potential contingent liabilities listed below. Potential Contingent Liabilities 1. Income taxes related to revenue included in net income this year but taxable in a future year. 2. Potential costs in future periods associated with performing warranty services on products sold this period. 3. Estimated cost of future services under a product warranty related to past sales. 4. Estimated cost of future services under a product warranty related to future sales. 5. Estimated cost of pension benefits related to past employee services that has yet to be funded. 6. Potential loss on environmental cleanup suit against company; a court judgment against the company is considered less than probable but more than remotely likely. 7. Potential loss under class-action suit by a group of customers; during the current year, the likelihood of a judgment against the company has increased from remote to possible but less than probable.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 70E

Related questions

Question

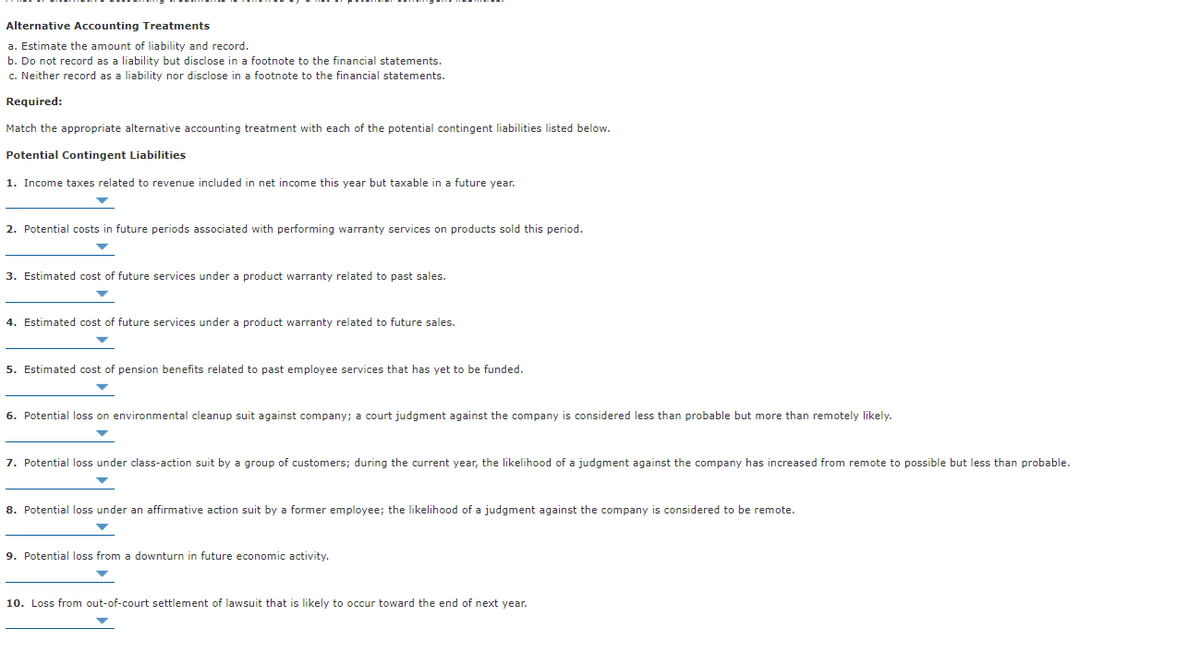

Transcribed Image Text:Alternative Accounting Treatments

a. Estimate the amount of liability and record.

b. Do not record as a liability but disclose in a footnote to the financial statements.

c. Neither record as a liability nor disclose in a footnote to the financial statements.

Required:

Match the appropriate alternative accounting treatment with each of the potential contingent liabilities listed below.

Potential Contingent Liabilities

1. Income taxes related to revenue included in net income this year but taxable in a future year.

2. Potential costs in future periods associated with performing warranty services on products sold this period.

3. Estimated cost of future services under a product warranty related to past sales.

4. Estimated cost of future services under a product warranty related to future sales.

5. Estimated cost of pension benefits related to past employee services that has yet to be funded.

6. Potential loss on environmental cleanup suit against company; a court judgment against the company is considered less than probable but more than remotely likely.

7. Potential loss under class-action suit by a group of customers; during the current year, the likelihood of a judgment against the company has increased from remote to possible but less than probable.

8. Potential loss under an affirmative action suit by a former employee; the likelihood of a judgment against the company is considered to be remote.

9. Potential loss from a downturn in future economic activity.

10. Loss from out-of-court settlement of lawsuit that is likely to occur toward the end of next year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College