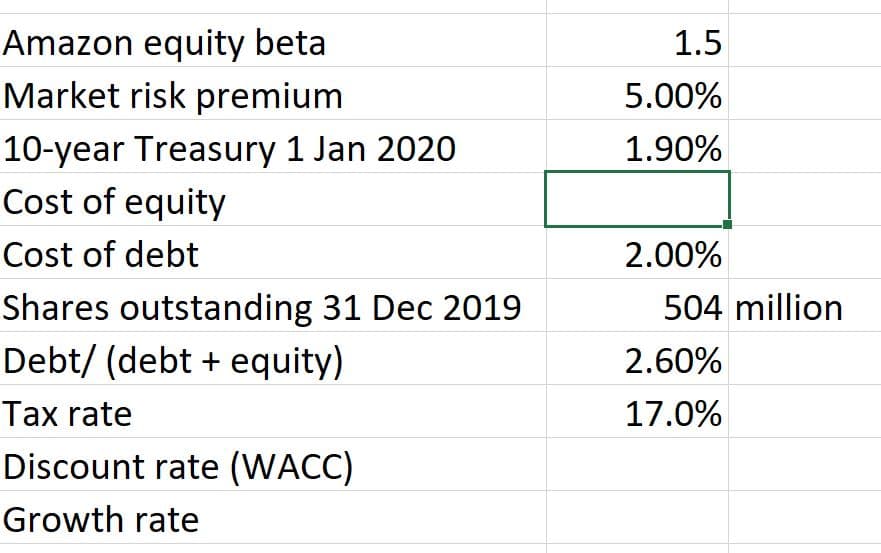

Amazon equity beta Market risk premium 1.5 5.00% 10-year Treasury 1 Jan 2020 Cost of equity 1.90% Cost of debt 2.00% Shares outstanding 31 Dec 2019 504 million Debt/ (debt + equity) 2.60% Tax rate 17.0% Discount rate (WACC) Growth rate

Q: Enterprise stock trade for $52.50 per share. Its expected to pay $2.50 dividend at end of year (D1=…

A: WACC stands for Weighted Average Cost of Capital. It is the cost of capital of the company which is…

Q: Debt: $2,500,000 par value of outstanding bond that pays annually 12% coupon rate with an annual…

A: Preferred shares- These are shares of a company which are paid dividends before common stock…

Q: Using information below, calculate value of one share of company X: 2021 2022 2023 2024…

A: Earning per share (EPS): It is a financial ratio that helps in calculating the earning capacity of…

Q: aux Corp Stock Over the Last 10 years - Beta = 1.1 - Market Risk premium = 10% - Current…

A: The Cost of Equity using Dividend Growth Model (DGM) Cost of equity = Expected Dividend/Current…

Q: At the end of the year 2020 Brown Bear Corporation paid dividends $3.24 per share. The company…

A: Here, Dividend Paid is $3.24 per share Growth Rate in dividend are as follows: 2021- 15% 2022- 15%…

Q: Free Cashflows to Equity. PQ has 1,575,500 shares outstanding. Its projected FCFE for next year is…

A: Free Cash Flow to Equity(FCFE) refers to the cash flow received by the equity shareholders of the…

Q: Stock ABC is currently sold at a price RM4.50 per unit. The dividend of 7 cent per share was…

A: Nominal rate of return: Nominal interest rates include the inflation effect. Nominal interest rate…

Q: 3. Residual Earnings Evaluation: The required return is 9%. The growth rate after 2019 into the…

A: Residual Income valuation model is front loaded model because its formula include the value for…

Q: Number of outstanding shares 100 000 Earnings 300 000 Retention ratio 60% 91-day Treasury bill rate…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Chen Chocolate Company’s EPS in 2020 was $1.80, and in 2015 it was $1.25. The company’s payout ratio…

A:

Q: Quantitative Problem 3: Assume today is December 31, 2019. Imagine Works Inc. just paid a dividend…

A: PRICE OF STOCK = D1/(1+r)^1+D2/(1+r)^2+D3/(1+r)^3+[D4/{(R-g)*(1+r)^4}] Price of stock = Present…

Q: Debt: $2,500,000 par value of outstanding bond that pays annually 12% coupon rate with an annual…

A: The bond price is the present discounted value of the future cash stream generated by a bond. It…

Q: 1. A firm's common stock is currently selling for $50 per share. Its dividend payments and end of…

A: Shares are one of investment option with high return and risk. Share prices fluctuates regularly due…

Q: •1) An analyst forecasts to have expected dividends of $3.15 year 1 (Div1), $3.50 year 2 (Div2),…

A: In this question we requires to calculate Current Stock Price P0 using the Dividend Discount Model:…

Q: TOPIC WEIGHTED AVERAGE What is the company’s WACC if the tax rate is 30%? Debt = 10,000, 6%…

A: WACC: It stands for Weighted Average Cost of Capital. It is the technique used to compute the…

Q: (Valuing common Stock) Assume the following: • The investor’s required rate of return is 15 percent.…

A: Price earning ratio is no. of times a company's share is trading compared to its earning per share.

Q: (Valuing common Stock) Assume the following: • The investor’s required rate of return is 15 percent.…

A: The price-to-earnings ratio is a valuation metric that compares a company's current share price to…

Q: Valuing common Stock) Assume the following: • The investor’s required rate of return is 15 percent.…

A: Given: Required rate of return (Ke) = 15% E1 = $5.00 retention ratio(b) = 50% ROE(r) = 20% Similar…

Q: mmon stocK has (-free rate is 4 percent an market risk prem 7 регcent. EQUIRED Calculate the…

A: Price of common equity can be present value of dividends and present value of terminal value of…

Q: National Co.’s stock sells for P35 that recently paid a P5 dividend. The growth rate will remain the…

A: As per formula Cost of newly issued equity = [D0*(1+g)/(P0-F)]+g Where D0 - Recent dividend i.e. P5…

Q: 2020 reported NOPAT $10,500 million 2020 reported NOA 62,200 million Present value of forecast…

A: Stock Price: A share price, often known as a stock price, is the amount of money it would take to…

Q: 13 - XYZ Co its selected financial statements items are given as following. Total net sales equals…

A: Nominal growth = Increase in sales / initial sales

Q: Debt: $2,500,000 par value of outstanding bond that pays annually 12% coupon rate with an annual…

A: Those shares which are prioritized over common shares at the time of payment of dividends but did…

Q: Debt: $2,500,000 par value of outstanding bond that pays annually 12% coupon rate with an annual…

A: A financial instrument that does not affect the ownership of the common shareholders or management…

Q: Faux Corp Stock Over the Last 10 years - Beta = 1.1 - Market Risk premium = 10% - Current…

A: In this question we need to compute the cost of equity using SML.

Q: What is the approx price per share of Company A today (end of 2015/ beginning of 2016)? Data: end…

A: Treasury Shares refers to self-owned common stocks by a company which that reduces the counts of…

Q: Debt: $3,500,000 par value of outstanding bond that pays annually 10% coupon rate with an…

A: Those shares which are prioritized over common shares at the time of payment of dividends but did…

Q: what growth rate would Abercrombie & Fitch have to provide the investors?

A: Introduction: The term growth rate in dividend refers to the annual rate of growth which a dividend…

Q: Debt: $2,500,000 par value of outstanding bond that pays annually 12% coupon rate with an annual…

A: The weighted average cost of capital (WACC) is also known as the Composite Cost of Capital or…

Q: Quantitative Problem: Barton Industries expects next year's annual dividend, D1, to be $1.70 and it…

A: In this question we require to compute the flotation cost adjustment that must be added to its cost…

Q: Answer Part -3 RAK Ceramic is currently paying dividend Tk. 3.70 per share, which is expected to…

A: We’ll answer the third question since the exact it is specified. Please submit a new question…

Q: HOWing information for Abraccadabra of America Debt $84,000,000 book value outstanding. The debt is…

A: Cost of capital would be the weighted average cost of debt and also weighted cost of equity and that…

Q: Faux Corp Stock Over the Last 10 years - Beta = 1.1 - Market Risk premium = 10% - Current…

A: A stock is a financial instrument that is sold by a corporation to raise equity funds. It shows an…

How do I calculate "

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Assume the risk-free rate on long-term Treasury bonds is 6.04%. Assume also that the average annual return on the Winslow 5000 is 11% as the expected return on the market. Use the SML equation (i.e., CAPM) to calculate the two companies' required returns. Bartman Industries Reynolds Inc. Year Stock Price Dividend Holding period return Stock Price Dividend Holding period return 2020 $17.25 $1.15 $48.75 $3.00 2019 14.75 1.06 52.30 2.90 2018 16.50 1.00 48.75 2.75 2017 10.75 0.95 57.25 2.50 2016 11.37 0.90 60.00 2.25 2015 7.62 55.75Faux Corp Stock Over the Last 10 years - Beta = 1.1 - Market Risk premium = 10% - Current risk-free rate 3% - Last dividend $5 - Current Stock Price $30 Dividend History 2016 - $4.20 2017 - $4.40 2018 - $4.55 2019 - $4.75 2020 - $5.00 1. Calculate the cost of equity using SMLFaux Corp Stock Over the Last 10 years - Beta = 1.1 - Market Risk premium = 10% - Current risk-free rate 3% - Last dividend $5 - Current Stock Price $30 Dividend History 2016 - $4.20 2017 - $4.40 2018 - $4.55 2019 - $4.75 2020 - $5.00 Dividend Growth Rate = 17.83% 1. Calculate the Cost of Equity using DGM

- Joe Corps Stock Over the Last 10 years –Beta = 1.1 –Market risk premium = 10% –Current risk-free rate = 3% –Last dividend = $5 –Current stock price =$30 - Dividend History 2016 $4.20 2017 4.40 2018 4.55 2019 4.75 2020 5.00 Cost of equity = 14% Cost of equity = 3% + 1.1 * 10% Cost of equity = 3% + 11% Which of the two models are correct? Cost of equity under DGM: 37.46% Cost of equity = ((5.89 / 30) + .1783) .3746 = 37.46% Cost of equity under DGM: 37.46% 1. Which of the two models are correct?Roundall dollar answers to 2 decimal places and record all interest rate, coupon rate and growth rate answers as a percentrounded to one decimal place. 26. The historical stock returns for GAF, Inc. are listed below: Year -Annual Stock Return2013 -12%2014 14%2015 35%2016 2%2017 -16%2018 8%2019 0%2020 34%2021 12%2022 6% What is the standard deviation of returns for GAF, Inc. stock over the 10-year time period? (Compute the standard deviation assuming this is a population of returns, not a sample – that is, use the procedure describedin the textbook for calculating the standard deviation of a series of stock returns).27. The end of year stock price and the dividend paid each year for Maxwell, Inc. stock for years 0 through 6 arelisted in the table below: Year -End of Year Stock Price- Dividend0 $12.00 $ 01 $14.86 $1.802 $7.95 $1.883 $8.00…Q18 Financial analysts forecast Safeco Corp.’s (SAF) growth rate for the future to be 8 percent. Safeco’s recent dividend was $0.88.What is the value of Safeco stock when the required return is 12 percent? (Round your answer to 2 decimal places.) VALUE OF STOCK

- number of outstanding shares100 000Earnings300 000Retention ratio60%91-day Treasury bill rate6%Market risk premium8%UFSK Beta1.2Dividend growth rate stable phase5%Bonds outstanding5 000Par value per bond1000Semi-annual coupon rate on bonds6%Bond yield to maturity8%Bond years remaining to maturity4Corporate tax rate30%Additional informationUFSK limited recently paid a dividendUFSK recently signed a deal and expects a super normal growth in earnings. The company expects earnings to grow by 8% for the first two years then decline by 2% in the following year, there after a stable growth of 5% is expected into the future.Required:. Determine the fair value of UFSK limited bondnumber of outstanding shares100 000Earnings300 000Retention ratio60%91-day Treasury bill rate6%Market risk premium8%UFSK Beta1.2Dividend growth rate stable phase5%Bonds outstanding5 000Par value per bond1000Semi-annual coupon rate on bonds6%Bond yield to maturity8%Bond years remaining to maturity4Corporate tax rate30%Additional informationUFSK limited recently paid a dividendUFSK recently signed a deal and expects a super normal growth in earnings. The company expects earnings to grow by 8% for the first two years then decline by 2% in the following year, there after a stable growth of 5% is expected into the future.Required:Ascertain the market value of UFSK limited equity.number of outstanding shares100 000Earnings300 000Retention ratio60%91-day Treasury bill rate6%Market risk premium8%UFSK Beta1.2Dividend growth rate stable phase5%Bonds outstanding5 000Par value per bond1000Semi-annual coupon rate on bonds6%Bond yield to maturity8%Bond years remaining to maturity4Corporate tax rate30%Additional informationUFSK limited recently paid a dividendUFSK recently signed a deal and expects a super normal growth in earnings. The company expects earnings to grow by 8% for the first two years then decline by 2% in the following year, there after a stable growth of 5% is expected into the future.Required:Determine the total value of the company’s debt

- number of outstanding shares100 000Earnings300 000Retention ratio60%91-day Treasury bill rate6%Market risk premium8%UFSK Beta1.2Dividend growth rate stable phase5%Bonds outstanding5 000Par value per bond1000Semi-annual coupon rate on bonds6%Bond yield to maturity8%Bond years remaining to maturity4Corporate tax rate30%Additional informationUFSK limited recently paid a dividendUFSK recently signed a deal and expects a super normal growth in earnings. The company expects earnings to grow by 8% for the first two years then decline by 2% in the following year, there after a stable growth of 5% is expected into the future.Required:As an investment analyst advise your client how much must she expect to pay for UFSK limited stock.Faux Corp Stock Over the Last 10 years - Beta = 1.1 - Market Risk premium = 10% - Current risk-free rate 3% - Last dividend $5 - Current Stock Price $30 Dividend History 2016 - $4.20 2017 - $4.40 2018 - $4.55 2019 - $4.75 2020 - $5.00 1. Calculate the dividend growth rateQUESTION: Find WACC (discount rate) Additional Info: Analysts expect the firm’s revenues, earnings, capital expenditures, and depreciation to grow at 9.9% a year from 2019 to 2021, after which time the growth rate is expected to drop to 3%. The depreciation expense for 2019 is $5.182 billion. Capital spending is expected to offset depreciation in the stable state period. The yield on 30-year treasury bonds is 2% and the equity market risk premium is 6.2%. The shares outstanding as of 12/31/2019 were 3,516,000,000 and the stock price was $60 per share. The average price of the company’s long-term corporate Bonds was 123.95 with an average yield to maturity of 4.16%. The company’s long-term bonds have a bond rating of AA. Shares Outstanding 3,516,000,000 Stock Price $60 Yield (30Y Treasury) 2% Equity Market Risk Prem. 6.2% Avg. Price LT Corp. Bond 123.95 Avg. YTM 4.16% Depreciation Expense (2019) 5,182,000,000 Current Stock Price 54.58…