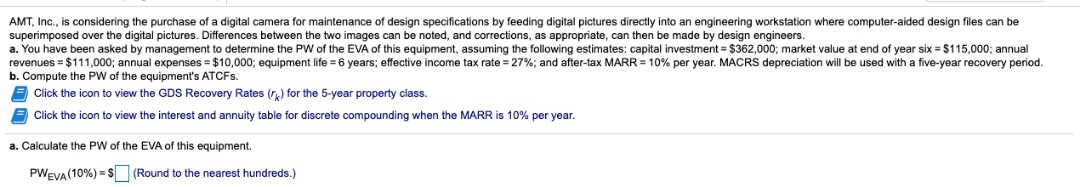

AMT, Inc., is considering the purchase of a digital camera for maintenance of design specifications by feeding digital pictures directly into an engineering workstation where computer-aided design files can be superimposed over the digital pictures. Differences between the two images can be noted, and corrections, as appropriate, can then be made by design engineers. a. You have been asked by management to determine the PW of the EVA of this equipment, assuming the following estimates: capital investment = $362,000; market value at end of year six = $115,000; annual revenues = $111,000; annual expenses = $10,000; equipment life = 6 years; effective income tax rate = 27%; and after-tax MARR = 10% per year. MACRS depreciation will be used with a five-year recovery period. b. Compute the PW of the equipment's ATCFS. Click the icon to view the GDS Recovery Rates (r.) for the 5-year property class. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 10% per year. a. Calculate the PW of the EVA of this equipment. PWEVA (10%) =S (Round to the nearest hundreds.)

AMT, Inc., is considering the purchase of a digital camera for maintenance of design specifications by feeding digital pictures directly into an engineering workstation where computer-aided design files can be superimposed over the digital pictures. Differences between the two images can be noted, and corrections, as appropriate, can then be made by design engineers. a. You have been asked by management to determine the PW of the EVA of this equipment, assuming the following estimates: capital investment = $362,000; market value at end of year six = $115,000; annual revenues = $111,000; annual expenses = $10,000; equipment life = 6 years; effective income tax rate = 27%; and after-tax MARR = 10% per year. MACRS depreciation will be used with a five-year recovery period. b. Compute the PW of the equipment's ATCFS. Click the icon to view the GDS Recovery Rates (r.) for the 5-year property class. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 10% per year. a. Calculate the PW of the EVA of this equipment. PWEVA (10%) =S (Round to the nearest hundreds.)

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter15: Decision Analysis

Section: Chapter Questions

Problem 5P: Hudson Corporation is considering three options for managing its data warehouse: continuing with its...

Related questions

Question

Transcribed Image Text:AMT, Inc., is considering the purchase of a digital camera for maintenance of design specifications by feeding digital pictures directly into an engineering workstation where computer-aided design files can be

superimposed over the digital pictures. Differences between the two images can be noted, and corrections, as appropriate, can then be made by design engineers

a. You have been asked by management to determine the PW of the EVA of this equipment, assuming the following estimates: capital investment = $362,000; market value at end of year six = $115,000; annual

revenues = $111,000; annual expenses = $10,000; equipment life = 6 years; effective income tax rate = 27%; and after-tax MARR = 10% per year. MACRS depreciation will be used with a five-year recovery period.

b. Compute the PW of the equipment's ATCFS.

Click the icon to view the GDS Recovery Rates (r,) for the 5-year property class.

E Click the icon to view the interest and annuity table for discrete compounding when the MARR is 10% per year.

a. Calculate the PW of the EVA of this equipment.

PWEVA (10%) =S (Round to the nearest hundreds.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning