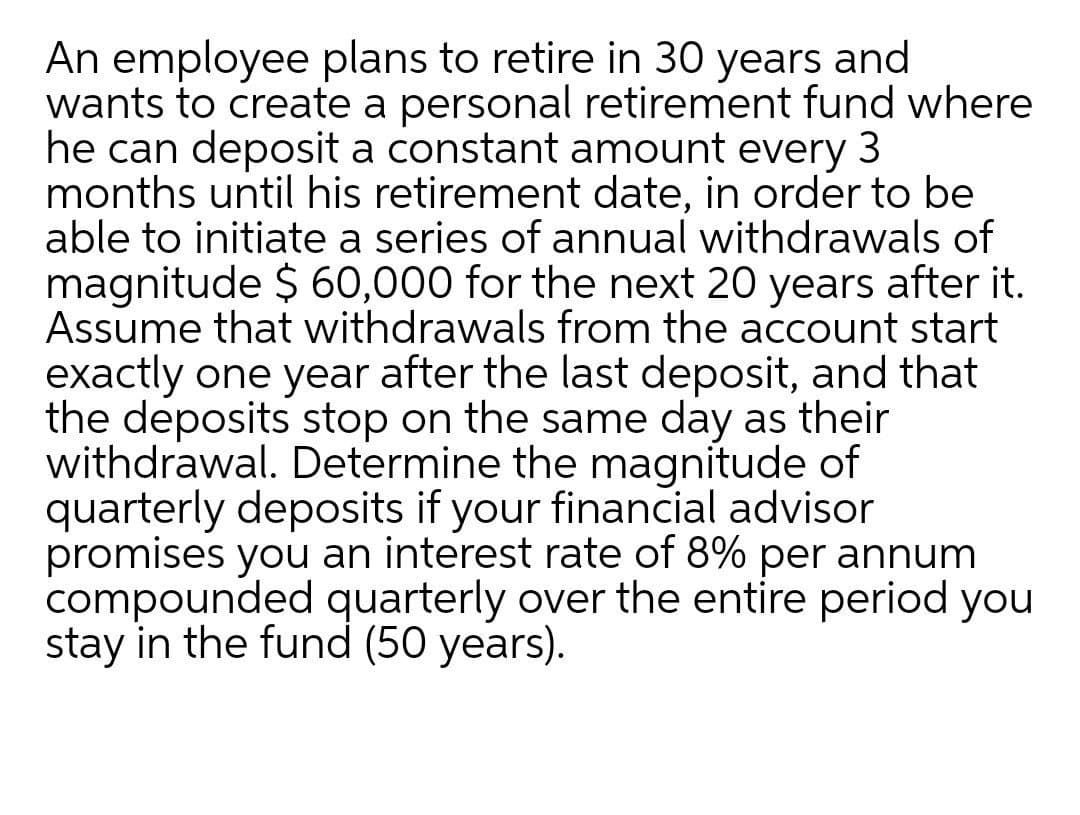

An employee plans to retire in 30 years and wants to create a personal retirement fund where he can deposit a constant amount every 3 months until his retirement date, in order to be able to initiate a series of annual withdrawals of magnitude $ 60,000 for the next 20 years after it. Assume that withdrawals from the account start exactly one year after the last deposit, and that the deposits stop on the same day as their ithdra wal Detormine themagnit

An employee plans to retire in 30 years and wants to create a personal retirement fund where he can deposit a constant amount every 3 months until his retirement date, in order to be able to initiate a series of annual withdrawals of magnitude $ 60,000 for the next 20 years after it. Assume that withdrawals from the account start exactly one year after the last deposit, and that the deposits stop on the same day as their ithdra wal Detormine themagnit

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 39P

Related questions

Question

Help

Transcribed Image Text:An employee plans to retire in 30 years and

wants to create a personal retirement fund where

he can deposit a constant amount every 3

months until his retirement date, in order to be

able to initiate a series of annual withdrawals of

magnitude $ 60,000 for the next 20 years after it.

Assume that withdrawals from the account start

exactly one year after the last deposit, and that

the deposits stop on the same day as their

withdrawal. Determine the magnitude of

quarterly deposits if your financial advisor

promises you an interest rate of 8% per annum

compounded quarterly over the entire period you

stay in the fund (50 years).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning