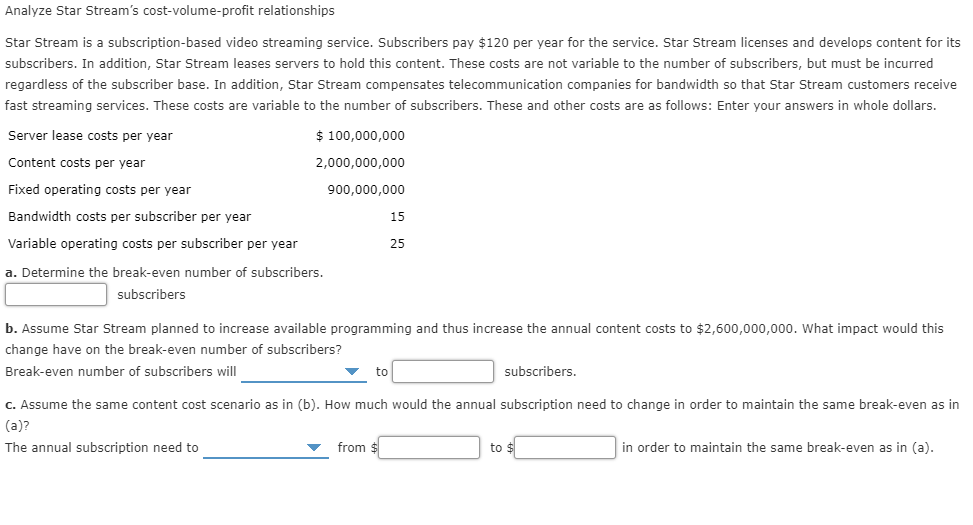

Analyze Star Stream's cost-vol ume-profit relationships Star Stream is a subscription-based video streaming service. Subscribers pay $120 per year for the service. Star Stream licenses and develops content for its subscribers. In addition, Star Stream leases servers to hold this content. These costs are not variable to the number of subscribers, but must be incurred regardless of the subscriber base. In addition, Star Stream compensates telecommunication companies for bandwidth so that Star Stream customers receive fast streaming services. These costs are variable to the number of subscribers. These and other costs are as follows: Enter your answers in whole dollars. Server lease costs per year $100,000,000 Content costs per year 2,000,000,000 Fixed operating costs per year 900.000,000 Bandwidth costs per subscriber per year 15 Variable operating costs per subscriber per year 25 a. Determine the break-even number of subscribers. subscribers b. Assume Star Stream planned to increase available programming and thus increase the annual content costs to $2,600,000,000. What impact would this change have on the break-even number of subscribers? Break-even number of subscribers will subscribers. to c. Assume the same content cost scenario as in (b). How much would the annual subscription need to change in order to maintain the same break-even as in (a)? from $ in order to maintain the same break-even as in (a) to $ The annual subscription need to

Analyze Star Stream's cost-vol ume-profit relationships Star Stream is a subscription-based video streaming service. Subscribers pay $120 per year for the service. Star Stream licenses and develops content for its subscribers. In addition, Star Stream leases servers to hold this content. These costs are not variable to the number of subscribers, but must be incurred regardless of the subscriber base. In addition, Star Stream compensates telecommunication companies for bandwidth so that Star Stream customers receive fast streaming services. These costs are variable to the number of subscribers. These and other costs are as follows: Enter your answers in whole dollars. Server lease costs per year $100,000,000 Content costs per year 2,000,000,000 Fixed operating costs per year 900.000,000 Bandwidth costs per subscriber per year 15 Variable operating costs per subscriber per year 25 a. Determine the break-even number of subscribers. subscribers b. Assume Star Stream planned to increase available programming and thus increase the annual content costs to $2,600,000,000. What impact would this change have on the break-even number of subscribers? Break-even number of subscribers will subscribers. to c. Assume the same content cost scenario as in (b). How much would the annual subscription need to change in order to maintain the same break-even as in (a)? from $ in order to maintain the same break-even as in (a) to $ The annual subscription need to

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter6: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 3MAD

Related questions

Question

Transcribed Image Text:Analyze Star Stream's cost-vol ume-profit relationships

Star Stream is a subscription-based video streaming service. Subscribers pay $120 per year for the service. Star Stream licenses and develops content for its

subscribers. In addition, Star Stream leases servers to hold this content. These costs are not variable to the number of subscribers, but must be incurred

regardless of the subscriber base. In addition, Star Stream compensates telecommunication companies for bandwidth so that Star Stream customers receive

fast streaming services. These costs are variable to the number of subscribers. These and other costs are as follows: Enter your answers in whole dollars.

Server lease costs per year

$100,000,000

Content costs per year

2,000,000,000

Fixed operating costs per year

900.000,000

Bandwidth costs per subscriber per year

15

Variable operating costs per subscriber per year

25

a. Determine the break-even number of subscribers.

subscribers

b. Assume Star Stream planned to increase available programming and thus increase the annual content costs to $2,600,000,000. What impact would this

change have on the break-even number of subscribers?

Break-even number of subscribers will

subscribers.

to

c. Assume the same content cost scenario as in (b). How much would the annual subscription need to change in order to maintain the same break-even as in

(a)?

from $

in order to maintain the same break-even as in (a)

to $

The annual subscription need to

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT