Analyze The Walt Disney Company by segment The Walt Disney Company (DIS) is a leading worldwide entertainment company. Disney operates four business segments. These segments and some of their larger businesses are: • Media Networks: ABC Network, ESPN, Disney Channel, and A&E • Parks and Resorts: Walt Disney World Resort, Disneyland, and International Disney Resorts • Studio Entertainment: Walt Disney Pictures, Pixar, Marvel, and Lucasfilm Consumer Products and Interactive Media: Licensing of Disney characters, publishing, and retail stores Recent comparative revenues for the four segments are as follows (in millions): Segment Year 3 Year 1 Media Networks $23,689 $21,152 Parks and Resorts 16,974 15,099 Studio Entertainment 7,278 9,441 Consumer Products and Interactive Media 5,528 5,284 $55,632 $48,813 Total a. Prepare a vertical analysis of the segment sales to total sales for Year 1 and Year 3. Round percentages to nearest whole percent. Note: Due to rounding, your totals may exceed 100 percent. Year 3 Segment Year 3 Percentage Year 1 Year 1 Percentage % $21,152 Media Networks $23,689 Parks and Resorts 16,974 15,099 Studio Entertainment 9,441 7,278 Consumer Products & Interactive Media 5,528 5,284 % $48,813 Total $55,632 b. The revenues of Parks and Resorts and Consumer Products & Interactive Media segments as a percentage of total revenue has from Year 1 to Year 3. The offsetting gains came from two-percentage point gains from from Year 1 to Year 3. Thus, there was slight adjustment in the relative segment sales between Year 1 and Year 3. C. Prepare a horizontal analysis of the segment sales between Year 1 and Year 3. Round percentages to nearest whole percent. Amount Change % Change Segment Year 3 Year 1 Media Networks $23,689 $21,152 Parks and Resorts 16,974 15,099 Studio Entertainment 9,441 7,278 Consumer Products & Interactive Media 5,528 5,284 $55,632 $48,813 Total d. Which segment showed the largest growth? Which segment showed the smallest growth? %24

Analyze The Walt Disney Company by segment The Walt Disney Company (DIS) is a leading worldwide entertainment company. Disney operates four business segments. These segments and some of their larger businesses are: • Media Networks: ABC Network, ESPN, Disney Channel, and A&E • Parks and Resorts: Walt Disney World Resort, Disneyland, and International Disney Resorts • Studio Entertainment: Walt Disney Pictures, Pixar, Marvel, and Lucasfilm Consumer Products and Interactive Media: Licensing of Disney characters, publishing, and retail stores Recent comparative revenues for the four segments are as follows (in millions): Segment Year 3 Year 1 Media Networks $23,689 $21,152 Parks and Resorts 16,974 15,099 Studio Entertainment 7,278 9,441 Consumer Products and Interactive Media 5,528 5,284 $55,632 $48,813 Total a. Prepare a vertical analysis of the segment sales to total sales for Year 1 and Year 3. Round percentages to nearest whole percent. Note: Due to rounding, your totals may exceed 100 percent. Year 3 Segment Year 3 Percentage Year 1 Year 1 Percentage % $21,152 Media Networks $23,689 Parks and Resorts 16,974 15,099 Studio Entertainment 9,441 7,278 Consumer Products & Interactive Media 5,528 5,284 % $48,813 Total $55,632 b. The revenues of Parks and Resorts and Consumer Products & Interactive Media segments as a percentage of total revenue has from Year 1 to Year 3. The offsetting gains came from two-percentage point gains from from Year 1 to Year 3. Thus, there was slight adjustment in the relative segment sales between Year 1 and Year 3. C. Prepare a horizontal analysis of the segment sales between Year 1 and Year 3. Round percentages to nearest whole percent. Amount Change % Change Segment Year 3 Year 1 Media Networks $23,689 $21,152 Parks and Resorts 16,974 15,099 Studio Entertainment 9,441 7,278 Consumer Products & Interactive Media 5,528 5,284 $55,632 $48,813 Total d. Which segment showed the largest growth? Which segment showed the smallest growth? %24

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter7: Variable Costing For Management

analysis

Section: Chapter Questions

Problem 3MAD

Related questions

Question

100%

Analyze The Walt Disney Company by segment

The Walt Disney Company (DIS) is a leading worldwide entertainment company. Disney operates four business segments. These segments and some of their larger businesses are:

- Media Networks: ABC Network, ESPN, Disney Channel, and A&E

- Parks and Resorts: Walt Disney World Resort, Disneyland, and International Disney Resorts

- Studio Entertainment: Walt Disney Pictures, Pixar, Marvel, and Lucasfilm

- Consumer Products and Interactive Media: Licensing of Disney characters, publishing, and retail stores

Recent comparative revenues for the four segments are as follows (in millions):

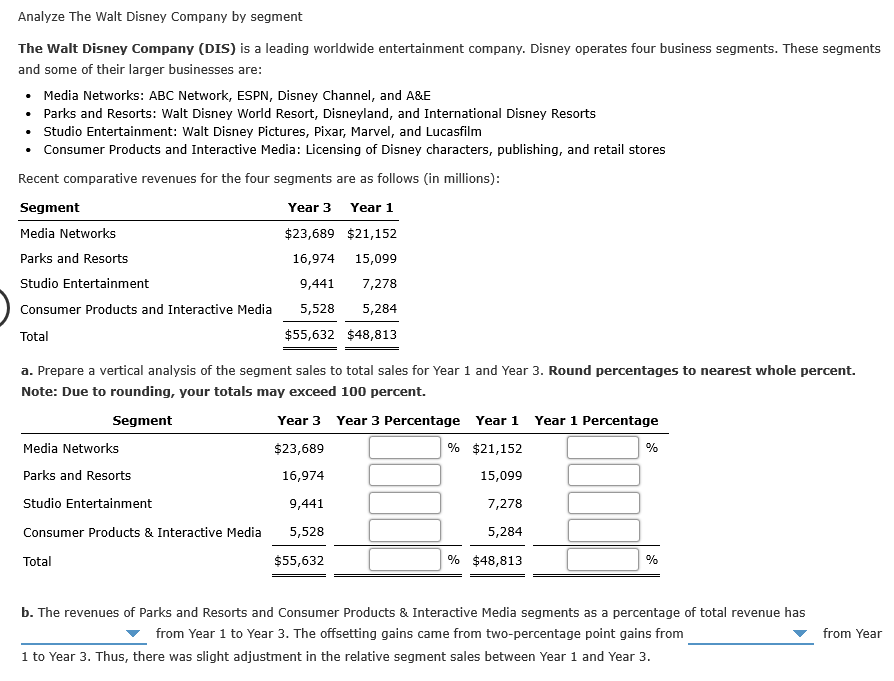

Transcribed Image Text:Analyze The Walt Disney Company by segment

The Walt Disney Company (DIS) is a leading worldwide entertainment company. Disney operates four business segments. These segments

and some of their larger businesses are:

• Media Networks: ABC Network, ESPN, Disney Channel, and A&E

• Parks and Resorts: Walt Disney World Resort, Disneyland, and International Disney Resorts

• Studio Entertainment: Walt Disney Pictures, Pixar, Marvel, and Lucasfilm

Consumer Products and Interactive Media: Licensing of Disney characters, publishing, and retail stores

Recent comparative revenues for the four segments are as follows (in millions):

Segment

Year 3

Year 1

Media Networks

$23,689 $21,152

Parks and Resorts

16,974

15,099

Studio Entertainment

7,278

9,441

Consumer Products and Interactive Media

5,528

5,284

$55,632 $48,813

Total

a. Prepare a vertical analysis of the segment sales to total sales for Year 1 and Year 3. Round percentages to nearest whole percent.

Note: Due to rounding, your totals may exceed 100 percent.

Year 3

Segment

Year 3 Percentage Year 1 Year 1 Percentage

% $21,152

Media Networks

$23,689

Parks and Resorts

16,974

15,099

Studio Entertainment

9,441

7,278

Consumer Products & Interactive Media

5,528

5,284

% $48,813

Total

$55,632

b. The revenues of Parks and Resorts and Consumer Products & Interactive Media segments as a percentage of total revenue has

from Year 1 to Year 3. The offsetting gains came from two-percentage point gains from

from Year

1 to Year 3. Thus, there was slight adjustment in the relative segment sales between Year 1 and Year 3.

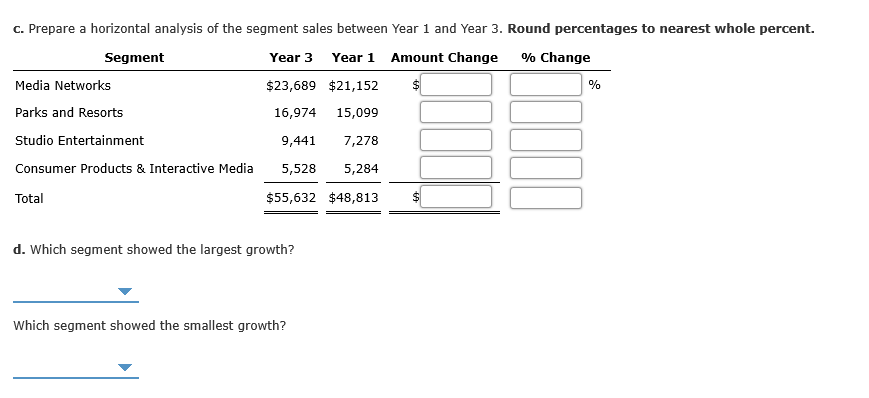

Transcribed Image Text:C. Prepare a horizontal analysis of the segment sales between Year 1 and Year 3. Round percentages to nearest whole percent.

Amount Change

% Change

Segment

Year 3

Year 1

Media Networks

$23,689 $21,152

Parks and Resorts

16,974

15,099

Studio Entertainment

9,441

7,278

Consumer Products & Interactive Media

5,528

5,284

$55,632 $48,813

Total

d. Which segment showed the largest growth?

Which segment showed the smallest growth?

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage