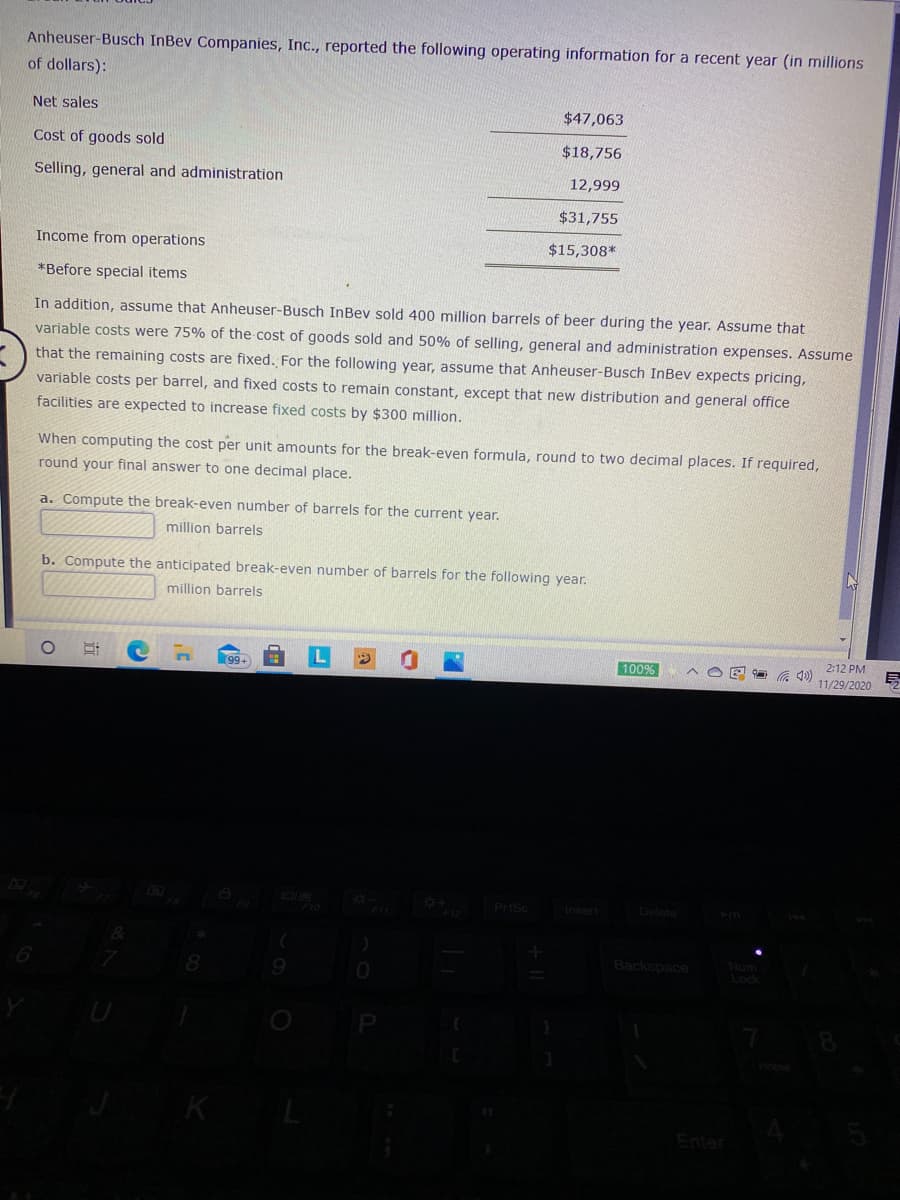

Anheuser-Busch InBev Companies, Inc., reported the following operating information for a recent year (in millions of dollars): Net sales $47,063 Cost of goods sold $18,756 Selling, general and administration 12,999 $31,755 Income from operations $15,308* *Before special items In addition, assume that Anheuser-Busch InBev sold 400 million barrels of beer during the year. Assume that variable costs were 75% of the cost of goods sold and 50% of selling, general and administration expenses. Assume that the remaining costs are fixed. For the following year, assume that Anheuser-Busch InBev expects pricing, variable costs per barrel, and fixed costs to remain constant, except that new distribution and general office facilities are expected to increase fixed costs by $300 million. When computing the cost per unit amounts for the break-even formula, round to two decimal places. If required, round your final answer to one decimal place. a. Compute the break-even number of barrels for the current year. million barrels b. Compute the anticipated break-even number of barrels for the following year. million barrels

Anheuser-Busch InBev Companies, Inc., reported the following operating information for a recent year (in millions of dollars): Net sales $47,063 Cost of goods sold $18,756 Selling, general and administration 12,999 $31,755 Income from operations $15,308* *Before special items In addition, assume that Anheuser-Busch InBev sold 400 million barrels of beer during the year. Assume that variable costs were 75% of the cost of goods sold and 50% of selling, general and administration expenses. Assume that the remaining costs are fixed. For the following year, assume that Anheuser-Busch InBev expects pricing, variable costs per barrel, and fixed costs to remain constant, except that new distribution and general office facilities are expected to increase fixed costs by $300 million. When computing the cost per unit amounts for the break-even formula, round to two decimal places. If required, round your final answer to one decimal place. a. Compute the break-even number of barrels for the current year. million barrels b. Compute the anticipated break-even number of barrels for the following year. million barrels

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.2.1P

Related questions

Question

100%

Please answer all questions with explanations. Thx

Transcribed Image Text:Anheuser-Busch InBev Companies, Inc., reported the following operating information for a recent year (in millions

of dollars):

Net sales

$47,063

Cost of goods sold

$18,756

Selling, general and administration

12,999

$31,755

Income from operations

$15,308*

*Before special items

In addition, assume that Anheuser-Busch InBev sold 400 million barrels of beer during the year. Assume that

variable costs were 75% of the cost of goods sold and 50% of selling, general and administration expenses. Assume

that the remaining costs are fixed. For the following year, assume that Anheuser-Busch InBev expects pricing,

variable costs per barrel, and fixed costs to remain constant, except that new distribution and general office

facilities are expected to increase fixed costs by $300 million.

When computing the cost per unit amounts for the break-even formula, round to two decimal

aces. If required,

round your final answer to one decimal place.

a. Compute the break-even number of barrels for the current year.

million barrels

b. Compute the anticipated break-even number of barrels for the following year.

million barrels

100%

2:12 PM

99+

11/29/2020

Prisc

Insert Delete

F10

Num

Lock

Backspace

Enter

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College