use the adjusted trial balance? Journalizing and posting adjustments to the four-column accounts anc preparing an adjusted trial balance unadjusted trial balance of Guthrie Inn Company at December 31, 2018, and the needed for the adjustments follow. GUTHRIE INN COMPANY Unadjusted Trial Balance December 31, 2018 Balan Account Title

use the adjusted trial balance? Journalizing and posting adjustments to the four-column accounts anc preparing an adjusted trial balance unadjusted trial balance of Guthrie Inn Company at December 31, 2018, and the needed for the adjustments follow. GUTHRIE INN COMPANY Unadjusted Trial Balance December 31, 2018 Balan Account Title

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 2MC

Related questions

Question

Horngren's 12th edition P3-35A page 167

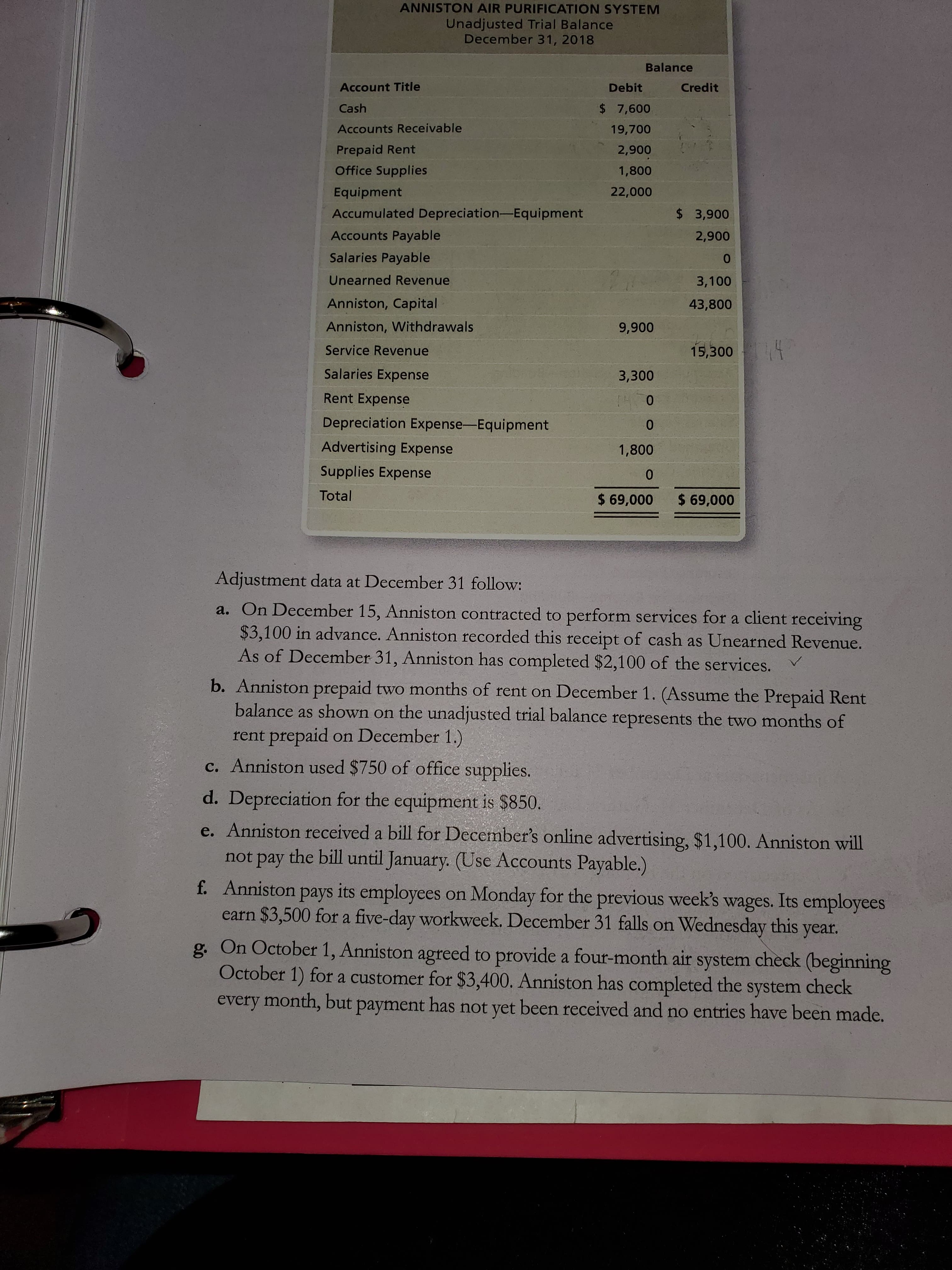

Transcribed Image Text:ANNISTON AIR PURIFICATION SYSTEM

Unadjusted Trial Balance

December 31, 2018

Balance

Account Title

Debit

Credit

Cash

$ 7,600

Accounts Receivable

19,700

Prepaid Rent

2,900

Office Supplies

1,800

Equipment

22,000

Accumulated Depreciation-Equipment

$ 3,900

Accounts Payable

2,900

Salaries Payable

Unearned Revenue

3,100

Anniston, Capital

43,800

Anniston, Withdrawals

9,900

Service Revenue

15,300

Salaries Expense

3,300

Rent Expense

Depreciation Expense-Equipment

Advertising Expense

1,800

Supplies Expense

Total

$ 69,000

$ 69,000

Adjustment data at December 31 follow:

a. On December 15, Anniston contracted to perform services for a client receiving

$3,100 in advance. Anniston recorded this receipt of cash as Unearned Revenue.

As of December 31, Anniston has completed $2,100 of the services.

b. Anniston prepaid two months of rent on December 1. (Assume the Prepaid Rent

balance as shown on the unadjusted trial balance represents the two months of

rent prepaid on December 1.)

c. Anniston used $750 of office supplies.

d. Depreciation for the equipment is $850.

e. Anniston received a bill for December's online advertising, $1,100. Anniston will

not pay the bill until January. (Use Accounts Payable.)

f. Anniston pays its employees on Monday for the previous week's wages. Its employees

earn $3,500 for a five-day workweek. December 31 falls on Wednesday this

g. On October 1, Anniston agreed to provide a four-month air system check (beginning

October 1) for a customer for $3,400. Anniston has completed the system check

every month, but payment has not yet been received and no entries have been made.

year.

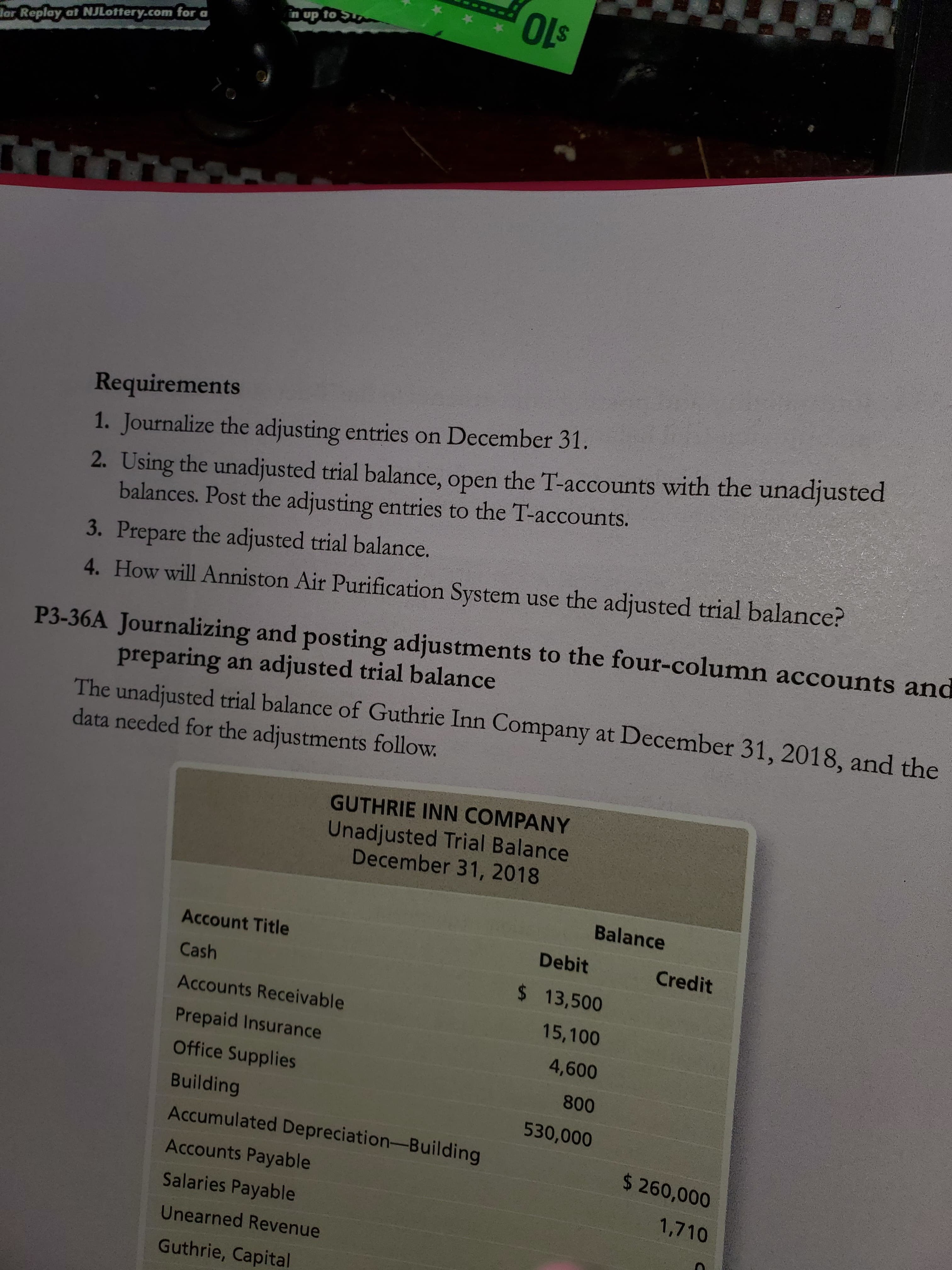

Transcribed Image Text:use the adjusted trial balance?

Journalizing and posting adjustments to the four-column accounts anc

preparing an adjusted trial balance

unadjusted trial balance of Guthrie Inn Company at December 31, 2018, and the

needed for the adjustments follow.

GUTHRIE INN COMPANY

Unadjusted Trial Balance

December 31, 2018

Balan

Account Title

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning