Annual Average Number of Orders Selling Price per Order If Average Manufacturing Cycle Time per Order Is Less Than Variable Cost per Order Inventory Carrying Cost per Order per Hour More Than 200 Hours Manufacturing Time Required 40 hours 50 hours Customer 200 Hours Peterbilt 100 10 $14,000 $13,400 11,960 $9,000 $0.50 0.45 Kenworth 12,500 8,000 1. Calculate the average manufacturing cycle times per order (a) if DJ manufactures only Peterbilt and (b) if DJ manufactures both Peterbilt and Kenworth. 2. Even though Kenworth has a positive contribution margin, DJ's managers are evaluating whether DJ should (a) make and sell only Peterbilt or (b) make and sell both Peterbilt and Kenworth. Which alterna- tive will maximize DJ's operating income? Show your calculations. 3. What other factors should DJ consider in choosing between the alternatives in requirement 2? Required

Annual Average Number of Orders Selling Price per Order If Average Manufacturing Cycle Time per Order Is Less Than Variable Cost per Order Inventory Carrying Cost per Order per Hour More Than 200 Hours Manufacturing Time Required 40 hours 50 hours Customer 200 Hours Peterbilt 100 10 $14,000 $13,400 11,960 $9,000 $0.50 0.45 Kenworth 12,500 8,000 1. Calculate the average manufacturing cycle times per order (a) if DJ manufactures only Peterbilt and (b) if DJ manufactures both Peterbilt and Kenworth. 2. Even though Kenworth has a positive contribution margin, DJ's managers are evaluating whether DJ should (a) make and sell only Peterbilt or (b) make and sell both Peterbilt and Kenworth. Which alterna- tive will maximize DJ's operating income? Show your calculations. 3. What other factors should DJ consider in choosing between the alternatives in requirement 2? Required

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

100%

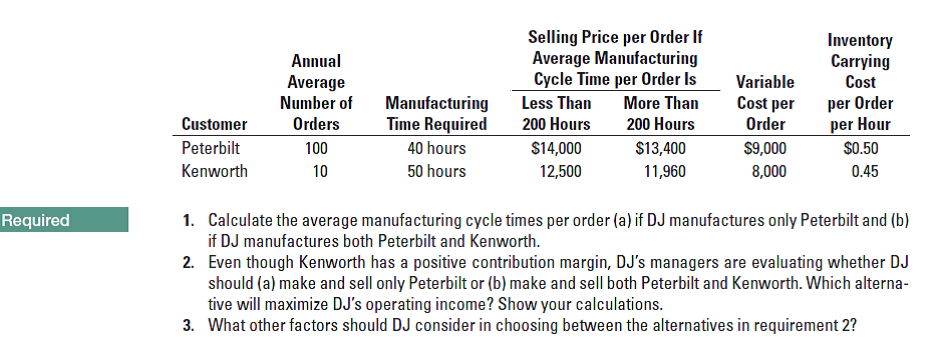

Manufacturing cycle times, relevant revenues, and relevant costs. The DJ Corporation makes custom specied wire harnesses for the trucking industry only upon receiving rm orders from its customers. DJ has recently purchased a new machine to make two types of wire harnesses, one for Peterbilt and the other for Kenworth. The annual capacity of the new machine is 5,000 hours. The following information is available for next year:

Transcribed Image Text:Annual

Average

Number of

Orders

Selling Price per Order If

Average Manufacturing

Cycle Time per Order Is

Less Than

Variable

Cost per

Order

Inventory

Carrying

Cost

per Order

per Hour

More Than

200 Hours

Manufacturing

Time Required

40 hours

50 hours

Customer

200 Hours

Peterbilt

100

10

$14,000

$13,400

11,960

$9,000

$0.50

0.45

Kenworth

12,500

8,000

1. Calculate the average manufacturing cycle times per order (a) if DJ manufactures only Peterbilt and (b)

if DJ manufactures both Peterbilt and Kenworth.

2. Even though Kenworth has a positive contribution margin, DJ's managers are evaluating whether DJ

should (a) make and sell only Peterbilt or (b) make and sell both Peterbilt and Kenworth. Which alterna-

tive will maximize DJ's operating income? Show your calculations.

3. What other factors should DJ consider in choosing between the alternatives in requirement 2?

Required

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 23 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education