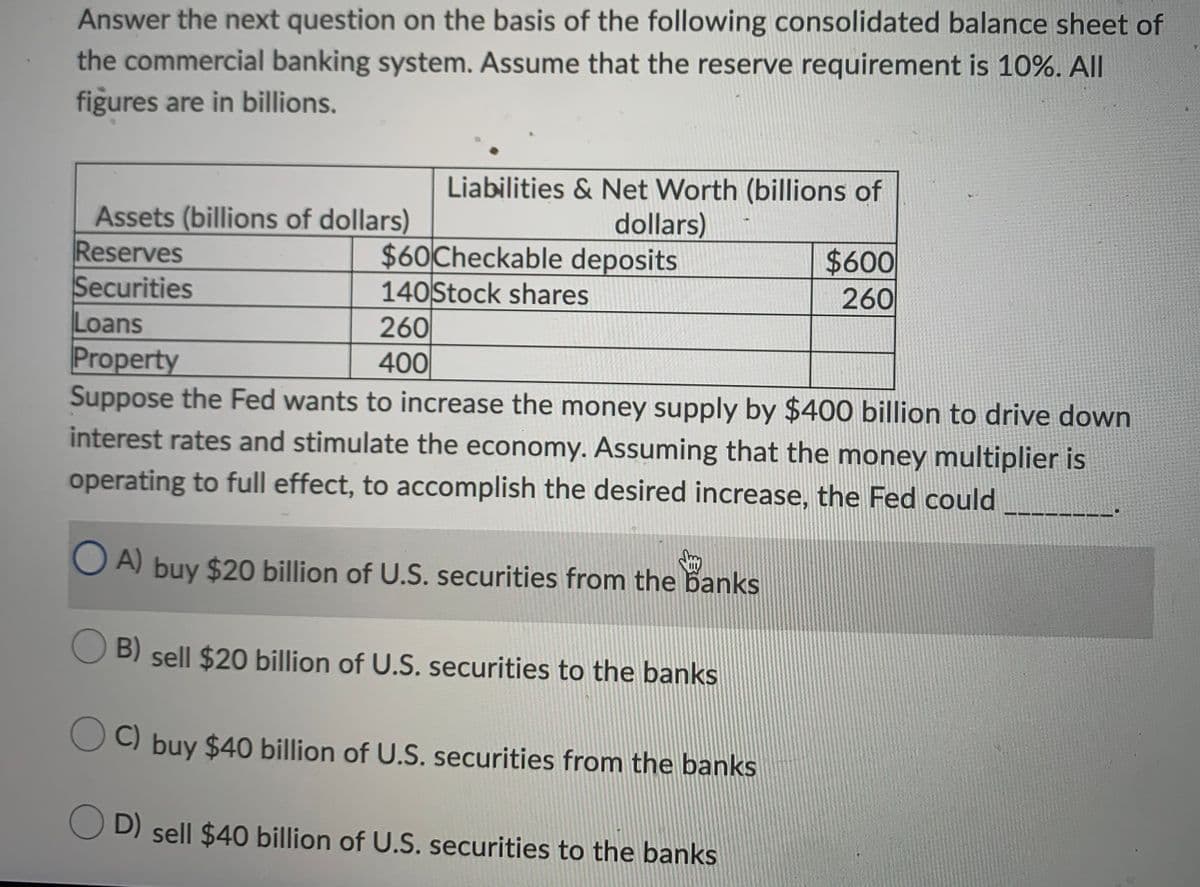

Answer the next question on the basis of the following consolidated balance sheet the commercial banking system. Assume that the reserve requirement is 10%. All figures are in billions. Liabilities & Net Worth (billions of Assets (billions of dollars) Reserves Securities dollars) $60 Checkable deposits 140 Stock shares 260 400 $600 260 Loans Property Suppose the Fed wants to increase the money supply by $400 billion to drive down interest rates and stimulate the economy. Assuming that the money multiplier is operating to full effect, to accomplish the desired increase, the Fed could O A) buy $20 billion of U.S. securities from the banks B) sell $20 billion of U.S. securities to the banks C) buy $40 billion of U.S. securities from the banks D) sell $40 billion of U.S. securities to the banks

Answer the next question on the basis of the following consolidated balance sheet the commercial banking system. Assume that the reserve requirement is 10%. All figures are in billions. Liabilities & Net Worth (billions of Assets (billions of dollars) Reserves Securities dollars) $60 Checkable deposits 140 Stock shares 260 400 $600 260 Loans Property Suppose the Fed wants to increase the money supply by $400 billion to drive down interest rates and stimulate the economy. Assuming that the money multiplier is operating to full effect, to accomplish the desired increase, the Fed could O A) buy $20 billion of U.S. securities from the banks B) sell $20 billion of U.S. securities to the banks C) buy $40 billion of U.S. securities from the banks D) sell $40 billion of U.S. securities to the banks

Brief Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter11: The Monetary System

Section: Chapter Questions

Problem 2PA

Related questions

Question

see image

thank you

Transcribed Image Text:Answer the next question on the basis of the following consolidated balance sheet of

the commercial banking system. Assume that the reserve requirement is 10%. All

figures are in billions.

Liabilities & Net Worth (billions of

Assets (billions of dollars)

Reserves

Securities

Loans

Property

Suppose the Fed wants to increase the money supply by $400 billion to drive down

interest rates and stimulate the economy. Assuming that the money multiplier is

dollars)

$60 Checkable deposits

140 Stock shares

$600

260

260

400

operating to full effect, to accomplish the desired increase, the Fed could

O A) buy $20 billion of U.S. securities from the banks

O B) sell $20 billion of U.S. securities to the banks

B)

C) buy $40 billion of U.S. securities from the banks

D) sell $40 billion of U.S. securities to the banks

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning