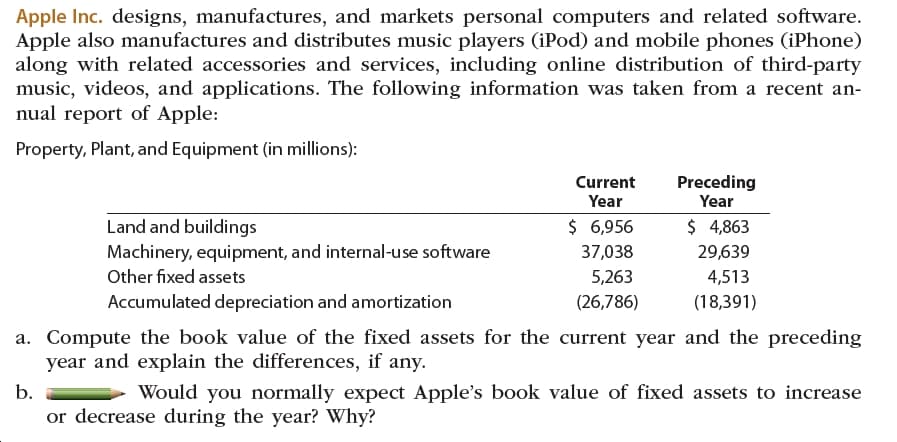

Apple Inc. designs, manufactures, and markets personal computers and related software. Apple also manufactures and distributes music players (iPod) and mobile phones (iPhone) along with related accessories and services, including online distribution of third-party music, videos, and applications. The following information was taken from a recent an- nual report of Apple: Property, Plant, and Equipment (in millions): Preceding Year Current Year Land and buildings $ 6,956 $ 4,863 Machinery, equipment, and internal-use software Other fixed assets 37,038 29,639 5,263 4,513 Accumulated depreciation and amortization (26,786) (18,391) a. Compute the book value of the fixed assets for the current year and the preceding year and explain the differences, if any. Would you normally expect Apple's book value of fixed assets to increase b. or decrease during the year? Why?

Apple Inc. designs, manufactures, and markets personal computers and related software. Apple also manufactures and distributes music players (iPod) and mobile phones (iPhone) along with related accessories and services, including online distribution of third-party music, videos, and applications. The following information was taken from a recent an- nual report of Apple: Property, Plant, and Equipment (in millions): Preceding Year Current Year Land and buildings $ 6,956 $ 4,863 Machinery, equipment, and internal-use software Other fixed assets 37,038 29,639 5,263 4,513 Accumulated depreciation and amortization (26,786) (18,391) a. Compute the book value of the fixed assets for the current year and the preceding year and explain the differences, if any. Would you normally expect Apple's book value of fixed assets to increase b. or decrease during the year? Why?

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter9: Receivables

Section: Chapter Questions

Problem 4CP

Related questions

Question

Transcribed Image Text:Apple Inc. designs, manufactures, and markets personal computers and related software.

Apple also manufactures and distributes music players (iPod) and mobile phones (iPhone)

along with related accessories and services, including online distribution of third-party

music, videos, and applications. The following information was taken from a recent an-

nual report of Apple:

Property, Plant, and Equipment (in millions):

Preceding

Year

Current

Year

Land and buildings

$ 6,956

$ 4,863

Machinery, equipment, and internal-use software

Other fixed assets

37,038

29,639

5,263

4,513

Accumulated depreciation and amortization

(26,786)

(18,391)

a. Compute the book value of the fixed assets for the current year and the preceding

year and explain the differences, if any.

Would you normally expect Apple's book value of fixed assets to increase

b.

or decrease during the year? Why?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning