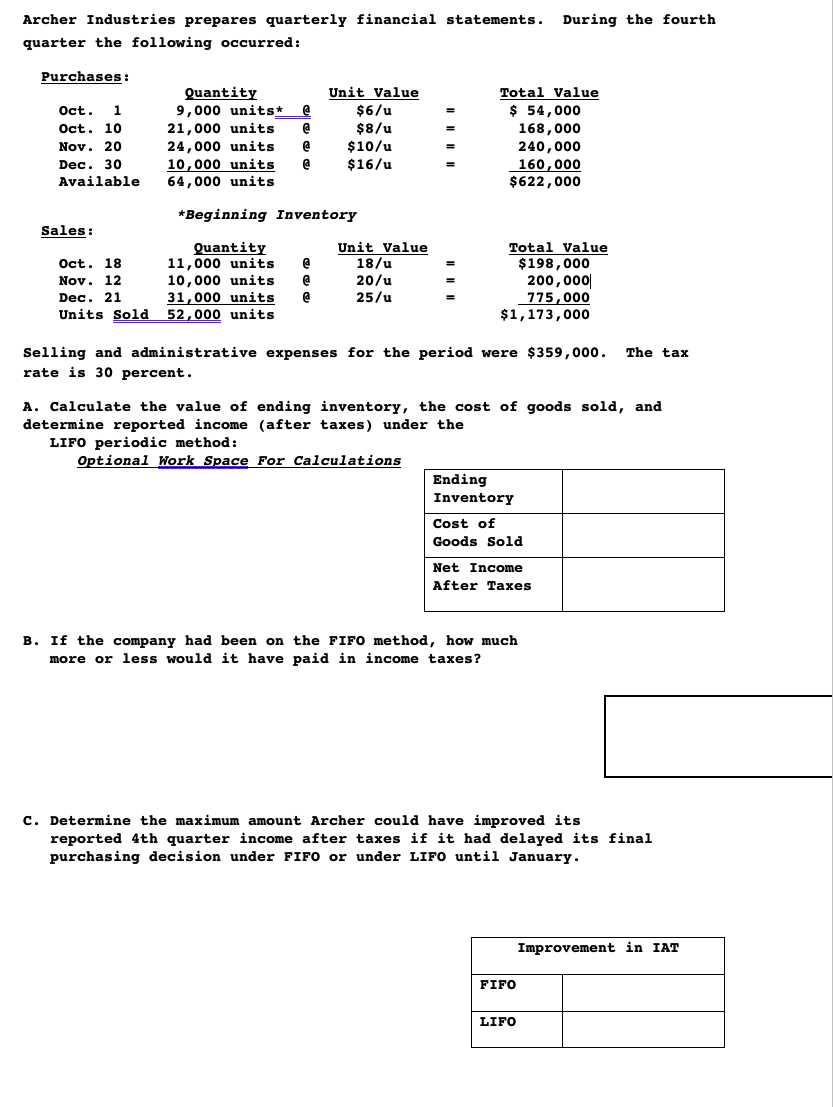

Archer Industries prepares quarterly financial statements. During the fourth quarter the following occurred: Purchases: Unit Value $6/u $8/u $10/u $16/u Total Value $ 54,000 Quantity 9,000 units* @ 21,000 units 24,000 units 10,000 units 64,000 units Oct. 1 Oct. 10 168,000 240,000 160,000 $622,000 Nov. 20 Dec. 30 Available *Beginning Inventory Sales: Unit Value 18/u Quantity 11,000 units 10,000 units 31,000 units Units Sold 52,000 units Total Value $198,000 200,000| 775,000 $1,173,000 Oct. 18 Nov. 12 Dec. 21 20/u 25/u Selling and administrative expenses for the period were $359,000. The tax rate is 30 percent. A. Calculate the value of ending inventory, the cost of goods sold, and determine reported income (after taxes) under the LIFO periodic method: Optional Work Space For Calculations Ending Inventory Cost of Goods Sold Net Income After Taxes B. If the company had been on the FIFO method, how much more or less would it have paid in income taxes? c. Determine the maximum amount Archer could have improved its reported 4th quarter income after taxes if it had delayed its final purchasing decision under FIFO or under LIFO until January.

Archer Industries prepares quarterly financial statements. During the fourth quarter the following occurred: Purchases: Unit Value $6/u $8/u $10/u $16/u Total Value $ 54,000 Quantity 9,000 units* @ 21,000 units 24,000 units 10,000 units 64,000 units Oct. 1 Oct. 10 168,000 240,000 160,000 $622,000 Nov. 20 Dec. 30 Available *Beginning Inventory Sales: Unit Value 18/u Quantity 11,000 units 10,000 units 31,000 units Units Sold 52,000 units Total Value $198,000 200,000| 775,000 $1,173,000 Oct. 18 Nov. 12 Dec. 21 20/u 25/u Selling and administrative expenses for the period were $359,000. The tax rate is 30 percent. A. Calculate the value of ending inventory, the cost of goods sold, and determine reported income (after taxes) under the LIFO periodic method: Optional Work Space For Calculations Ending Inventory Cost of Goods Sold Net Income After Taxes B. If the company had been on the FIFO method, how much more or less would it have paid in income taxes? c. Determine the maximum amount Archer could have improved its reported 4th quarter income after taxes if it had delayed its final purchasing decision under FIFO or under LIFO until January.

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 67P

Related questions

Question

Transcribed Image Text:Archer Industries prepares quarterly financial statements.

During the fourth

quarter the following occurred:

Purchases:

Quantity

9,000 units*

21,000 units

24,000 units

10,000 units

64,000 units

Unit Value

Total Value

$ 54,000

168,000

240,000

160,000

$622,000

$6/u

$8/u

Oct.

1.

Oct. 10

Nov. 20

$10/u

Dec. 30

$16/u

Available

*Beginning Inventory

Sales:

Unit Value

Quantity

11,000 units

10,000 units

31,000 units

52,000 units

Total Value

Oct. 18

Nov. 12

Dec. 21

Units Sold

18/u

$198,000

200,000|

775,000

$1,173,000

20/u

25/u

The tax

Selling and administrative expenses for the period were $359, 000.

rate is 30 percent.

A. Calculate the value of ending inventory, the cost of goods sold, and

determine reported income (after taxes) under the

LIFO periodic method:

Optional Work Space For Calculations

Ending

Inventory

Cost of

Goods Sold

Net Income

After Taxes

B. If the company had been on the FIFO method, how much

more or less would it have paid in income taxes?

C. Determine the maximum amount Archer could have improved its

reported 4th quarter income after taxes if it had delayed its final

purchasing decision under FIFO or under LIFO until January.

Improvement in IAT

FIFO

LIFO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage