As the manager of Margarita Mexican Restaurant, you must deal with a variety of business transactions. Provide an explanation for the following transactions: Transaction Explanation a. Debit Equipment and credit Cash. b. Debit Dividends and credit Cash. c. Debit Wages Payable and credit Cash. d. Debit Equipment and credit Common Stock. e. Debit Cash and credit Unearned Revenue. F. Debit Advertising Expense and credit Cash. . Debit Cash and credit Service Revenue. Paid cash dividends to stockholders. Paid for advertising with cash. Paid wages owed to employees, previously recorded. Performed services and were paid by the customer. Purchased equipment with cash.

As the manager of Margarita Mexican Restaurant, you must deal with a variety of business transactions. Provide an explanation for the following transactions: Transaction Explanation a. Debit Equipment and credit Cash. b. Debit Dividends and credit Cash. c. Debit Wages Payable and credit Cash. d. Debit Equipment and credit Common Stock. e. Debit Cash and credit Unearned Revenue. F. Debit Advertising Expense and credit Cash. . Debit Cash and credit Service Revenue. Paid cash dividends to stockholders. Paid for advertising with cash. Paid wages owed to employees, previously recorded. Performed services and were paid by the customer. Purchased equipment with cash.

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter2: Analyzing Transactions Into Debit And Credit Parts

Section2.1: Using T Accounts

Problem 1OYO

Related questions

Question

I need help with understanding this problem.

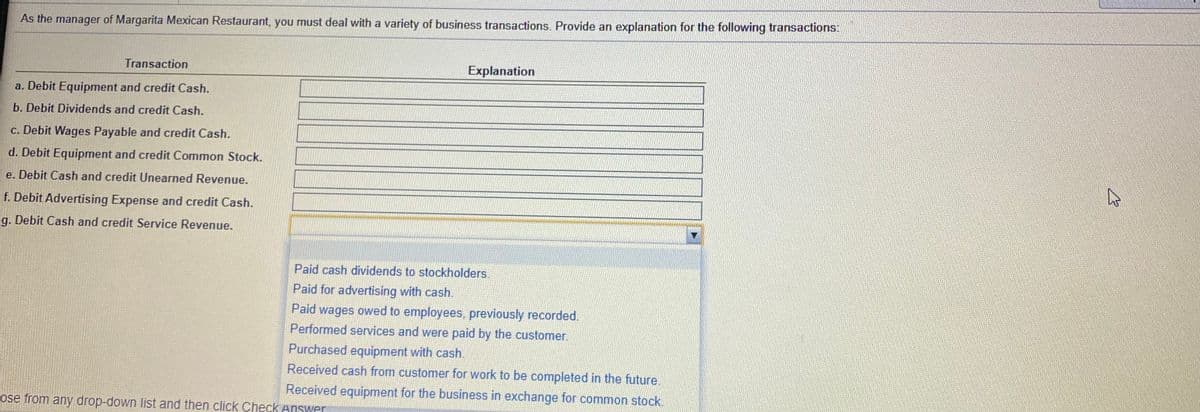

Transcribed Image Text:As the manager of Margarita Mexican Restaurant, you must deal with a variety of business transactions. Provide an explanation for the following transactions:

Transaction

Explanation

a. Debit Equipment and credit Cash.

b. Debit Dividends and credit Cash.

c. Debit Wages Payable and credit Cash.

d. Debit Equipment and credit Common Stock.

e. Debit Cash and credit Unearned Revenue.

f. Debit Advertising Expense and credit Cash.

g. Debit Cash and credit Service Revenue.

Paid cash dividends to stockholders.

Paid for advertising with cash.

Paid wages owed to employees, previously recorded.

Performed services and were paid by the customer.

Purchased equipment with cash.

Received cash from customer for work to be completed in the future.

Received equipment for the business in exchange for common stock.

ose from any drop-down list and then click Check Answer

Expert Solution

Step 1

Transaction: It is an event between a buyer and seller which involves money. It is an exchange of goods or services between a buyer and seller for a consideration.

Journal entry: It is also called as book of original entry. All financial transactions occurred in a business are recorded using the journal entry. The journal entry is recorded in the order in which a financial transaction happens and for every entry a debit and a credit for an equal amount is recorded.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College